Gold and Silver: We failed to form a new higher high

- During the Asian trading session, the price of gold retreated from the $ 1835 price.

- Since the price of silver failed to exceed $ 22.00 yesterday, a pullback followed, which formed a four-day lower low at $ 21.25.

- Investors appear confident that the Federal Reserve will maintain its aggressive tightening policy and raise interest rates faster to curb rising inflation.

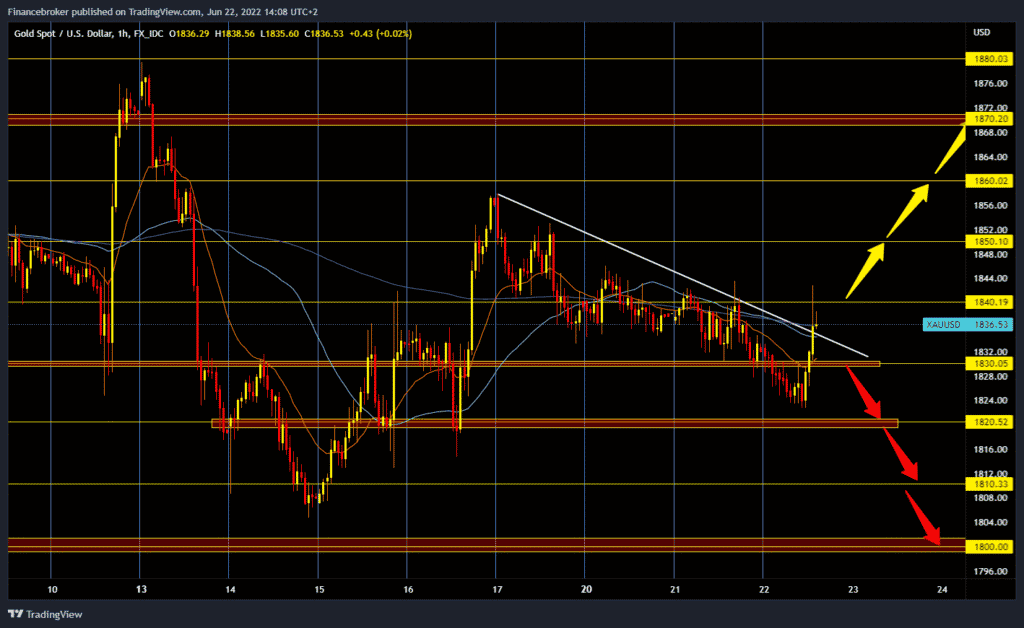

Gold chart analysis

During the Asian trading session, the price of gold retreated from the $ 1835 price. She found support during the European session at the $ 1824 level. After that, there was a quick recovery, and the price jumped above $ 1840 within a few hours. We failed to form a new higher high and see a new pullback to the $ 1836 price tag. Gold made a break above the lower upper resistance line based on that, and with the support of moving averages, we could see a further recovery in the price of the yellow metal. To continue the bullish option, we need a new price break above $ 1840. After that, we could try to climb up to the $ 1850 price tag. If we succeeded, the price of gold would move from the negative zone, which would increase optimism for further continuation. For the bearish option, we need a price withdrawal below $ 1830. After that, we would re-test this morning’s low at $ 1824. A break below would direct us to $ 1810 and $1800 of support.

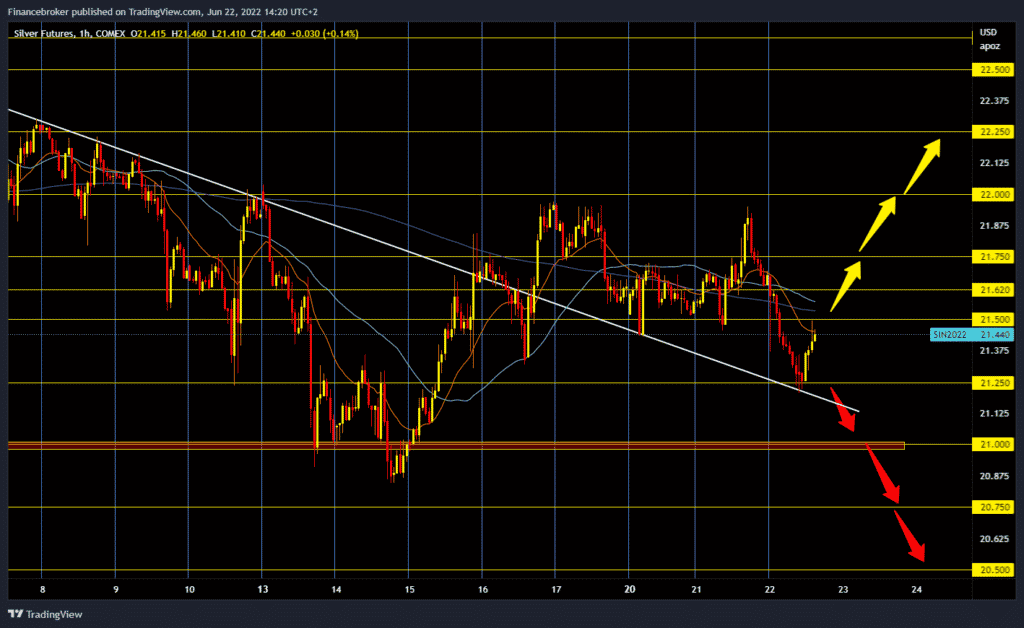

Silver chart analysis

Since the price of silver failed to exceed $ 22.00 yesterday, a pullback followed, which formed a four-day lower low at $ 21.25. Since then, the price of silver has recovered to $ 21.45. We should be at $ 21.50 soon, where we come to moving averages, and we need a break above to return to the positive zone. Our targets are $ 21.60, $ 21.75 and $ 22.00 resistance zone. We need continued negative consolidation and a pullback to this morning’s low for the bearish option. A break in gas prices below this support level would bring us down to the $ 21.00 level, where we would test last week’s low.

Market overview

Investors appear confident that the Federal Reserve will maintain its aggressive tightening policy and raise interest rates faster to curb rising inflation. Markets expect another rate increase of 75 basis points at the next FOMC meeting in July. Hawkish Fed expectations provided some support for the US dollar, undermining the gold demand.

Market sentiment remains fragile amid doubts that major central banks could raise interest rates to curb rising inflation without affecting economic growth. With disruptions in the global supply chain caused by the war between Russia and Ukraine and the recent COVID-19 epidemic in China have continued to fuel fears of a recession. The deteriorating global economic outlook has affected investor sentiment. This triggered a new wave of global trade with risk aversion and led to a sharp decline in capital markets.