Oil and Natural Gas: Critical level

- During Asian trade, the price of crude oil rose.

- During the Asian trading session, the gas price fell to $ 6.00, confirming support at that level.

- On Sunday, Ecuador’s Energy Minister Xavier Vera-Grunauer warned that oil production had reached a critical level and could be completely stopped within 48 hours if protests and roadblocks continue.

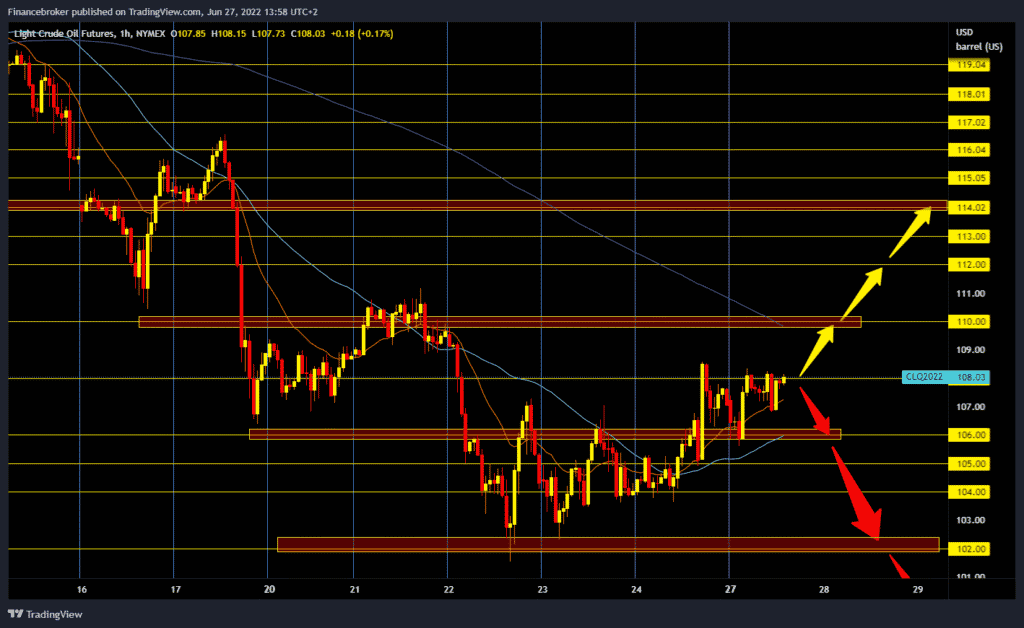

Oil chart analysis

During Asian trade, the price of crude oil rose. Demand is higher than supply in the intense summer driving and flying season. The leaders of the G7 group considered how to reach high energy prices, and one of the options is establishing a price limit for oil. Fear of the recession and the lower demand for oil that goes with it put pressure on the price of the world’s major energy source last week.

Last week’s official government report showed that crude oil stocks in the United States increased by 5.6 million barrels. Crude oil is trading at $ 107.89 a barrel, up 0.25% from the start of trading tonight. A meeting of the OPEC + initiative is being held on Thursday. The oil price found support at $ 106.00 this morning, and soon after that, we saw a strong bullish momentum that raised the price to $ 108.00. We have been in the bullish trend for the fourth day. We are still testing the $ 108.00 level, and the consolidation is such that we will see a jump to the $ 110.00 level. I need a negative consolidation up to a $ 106.00 support zone for the bearish option. If she doesn’t support us, then we can expect a further drop in the price to last week’s low of $ 102.00.

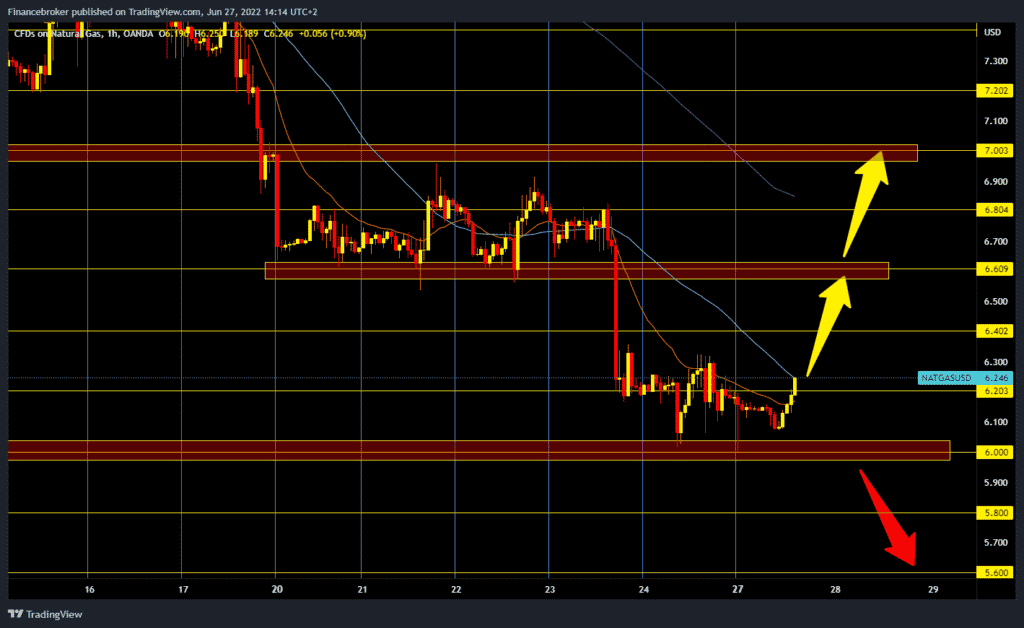

Natural gas chart analysis

During the Asian trading session, the gas price fell to $ 6.00, confirming support at that level. The price didn’t stay there long and began recovering to the current $ 6.24. We can expect to get support in MA20 and MA50 poker averages at this level. That would be a positive move that could push the price to the upper resistance zone at $ 6.60. For the price, it would be great if we climbed above because then there would be a chance to see the price recover to the $ 7.00 level. We need negative consolidation and a return of up to $ 6.00 support for the bearish option. A price break below would open up potential space for us towards the $ 5.00 level.

Market overview

On Sunday, Ecuador’s Energy Minister Xavier Vera-Grunauer warned that oil production had reached a critical level and could be completely stopped within 48 hours if protests and roadblocks continue.

If this situation continues, oil production in the country will be suspended in less than 48 hours because vandalism, seizure of oil wells, and road closures have prevented the transport of equipment and diesel needed to maintain operations.

Today’s figures show a drop in production of more than 50 percent, which was around 520,000 barrels per day before the protest.