Gold and Silver: Impact of Oscillations

- During Asian trading, the price of gold rose to $ 1,840.

- The price of silver started the day very bullish but stopped at the $ 21.50 level.

- Seven leading industrialized countries plan to ban the import of gold from Russia at their summit.

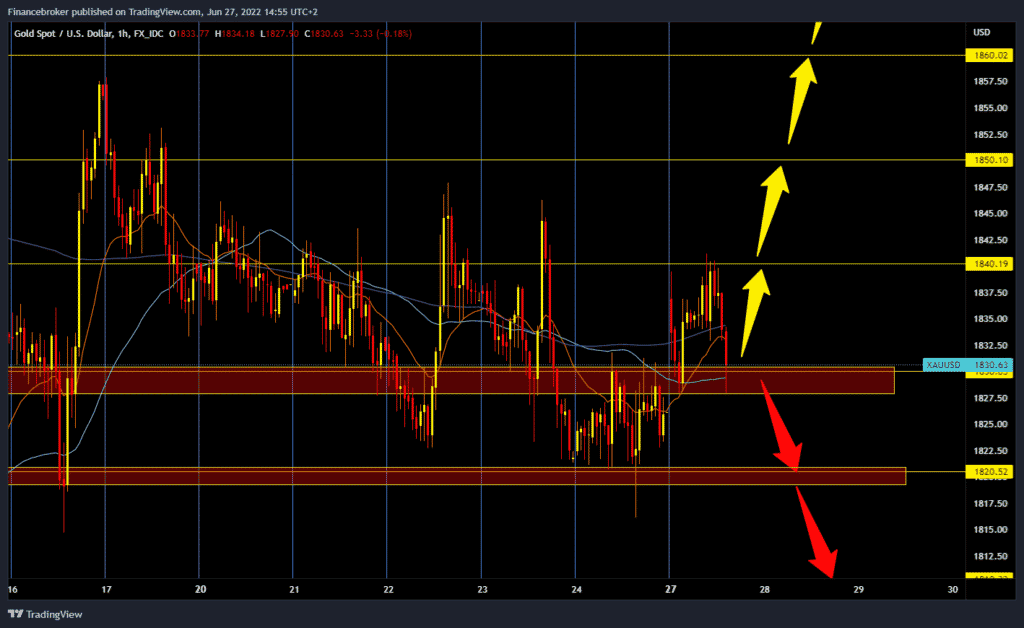

Gold chart analysis

During Asian trading, the price of gold rose to $ 1,840. The summit of the leaders of the group of G7 states made a new decision on sanctions against Russia. Namely, the sanctions will include a ban on importing Russian gold, which caused increased oscillations and a milder price recovery from tonight. Financial markets estimate that there is now only about a 70% chance that the US Federal Reserve will increase the reference interest rate again by 0.75% at the end of July, which is a positive reason for the gold price recovery.

The price of gold is trading around 1830 dollars per fine ounce, representing a price increase of 0.28% since the beginning of trading last night. Now we are again extending the mass support zone to $ 1830. For the bullish option, we need a new positive consolidation and a return above $ 1840. After that, we will see the formation of a new maximum, and our target is the $ 1850 level. If we managed to stay at that level, then there would be a chance to continue further towards the $ 1860 and $ 1870 levels. We need a continuation of the current negative consolidation and a drop to the $ 1820 level for the bearish option. If we break that level, the next potential targets are the $ 1810 and $ 1800 levels.

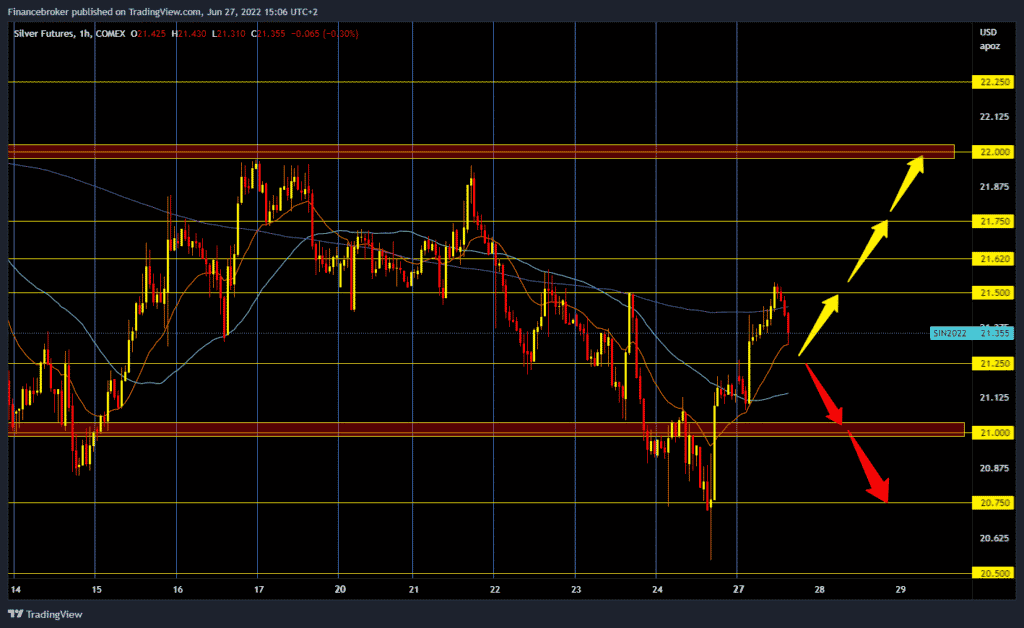

Silver chart analysis

The price of silver started the day very bullish but stopped at the $ 21.50 level. After that, we see a steep retreat to $ 21.30. Additional support at that level is the MA20 moving average. If we get support here, we could start a new bullish momentum. Our targets would be $ 21.60, $ 21.75 and $ 22.00 levels. We need a continuation of the current negative consolidation and a drop below the $ 21.25 support level for the bearish option. After that, we can expect the price to visit the $ 21.00 support zone. Potential lower levels support us at $ 20.75 and $ 20.50 levels.

Market overview

Seven leading industrialized countries plan to ban the import of gold from Russia at their summit. This news can explain the current market reaction. However, the real impact on the gold market is likely to be too small to have a lasting effect on the price trend. The development of inflation and interest rates will continue to impact the price of gold. Inflationary pressures are likely to remain high in the short term. This is positive for gold in its role as protection against inflation. However, inflation also continues to pressure central banks to raise interest rates, which is negative for gold as a non-interest-bearing investment.