NZD/USD forecast for March 10, 2021

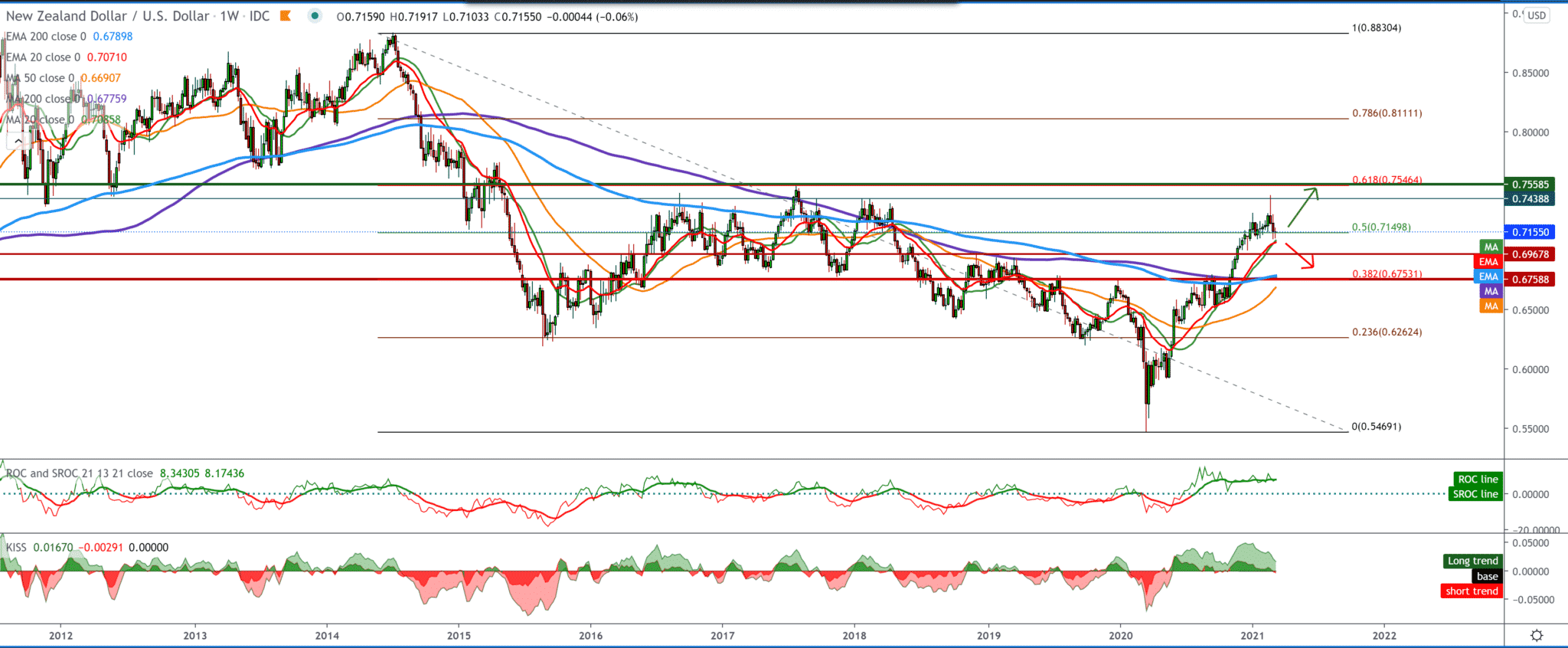

Looking at the chart on the weekly time frame, we see that the NZD/USD pair has made a pullback to the moving averages of the MA20 and EMA20, which have so far been supportive and pushing the NZD/USD pair up without letting it sparse into the bearish trend. So we need to pay special attention to zone 0.70000-0.71000, and this is where we need to look for support on the chart.

If we look at the Fibonacci pair, it tests the 50.0% level at 0.71550, and based on that, and it is very difficult to determine the further continuation of the trend because the support below is close. We can say that we are still in the bullish trend and that we see this as a pullback, waiting for better support and a place for a new buy position. If the moving averages MA20 and EMA20 do not hold up, we go down to MA200 and EMA200 with Fibonacci testing 38.2% zone 0.67500-0.68500.

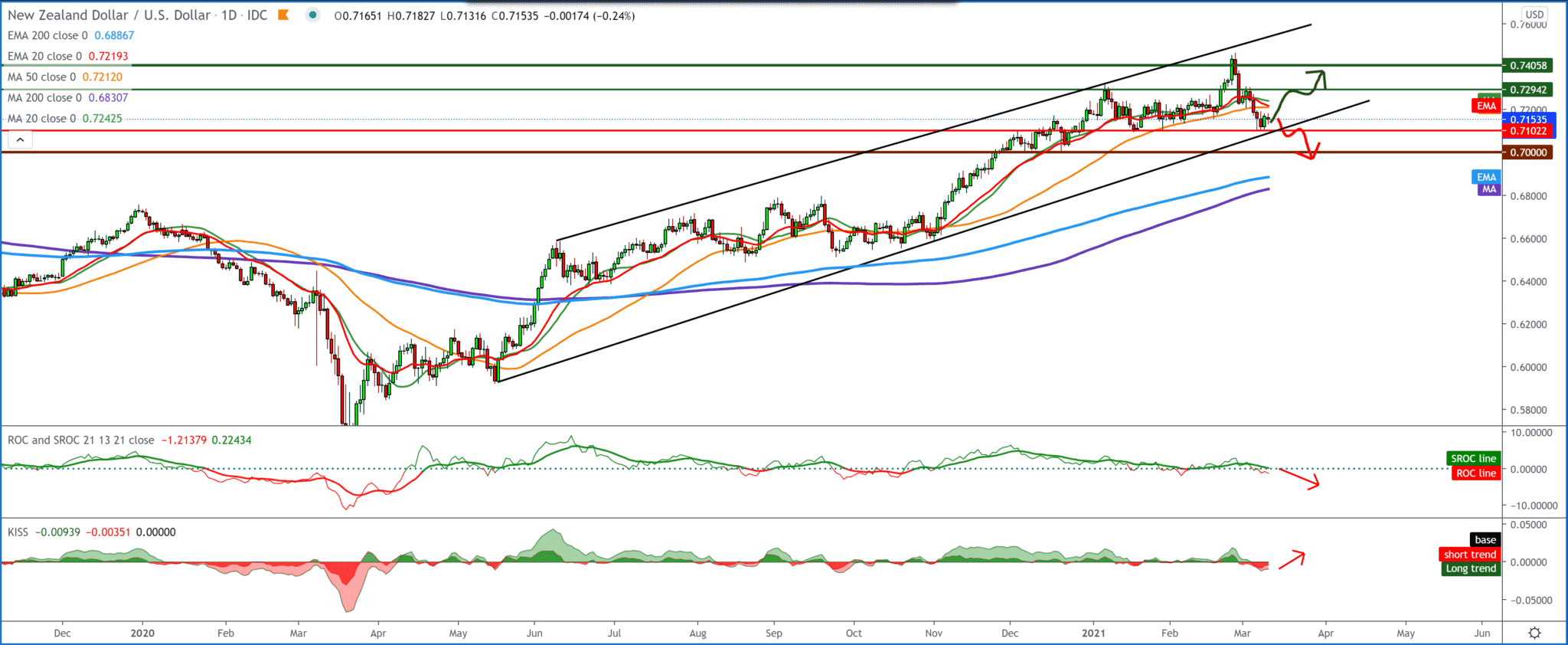

On the daily time frame, we see the steam movement in the rising channel, where I am now testing the channel’s lower edge. Moving averages MA20, EMA20 and MA50 are now on the bearish side, giving signals for a downward trend, and based on them. Our targets are MA200 and EMA200, moving averages approaching the psychological zone around 0.70000. To continue the bullish scenario, we need a break above 0.72000 with MA20 and EMA20 support.

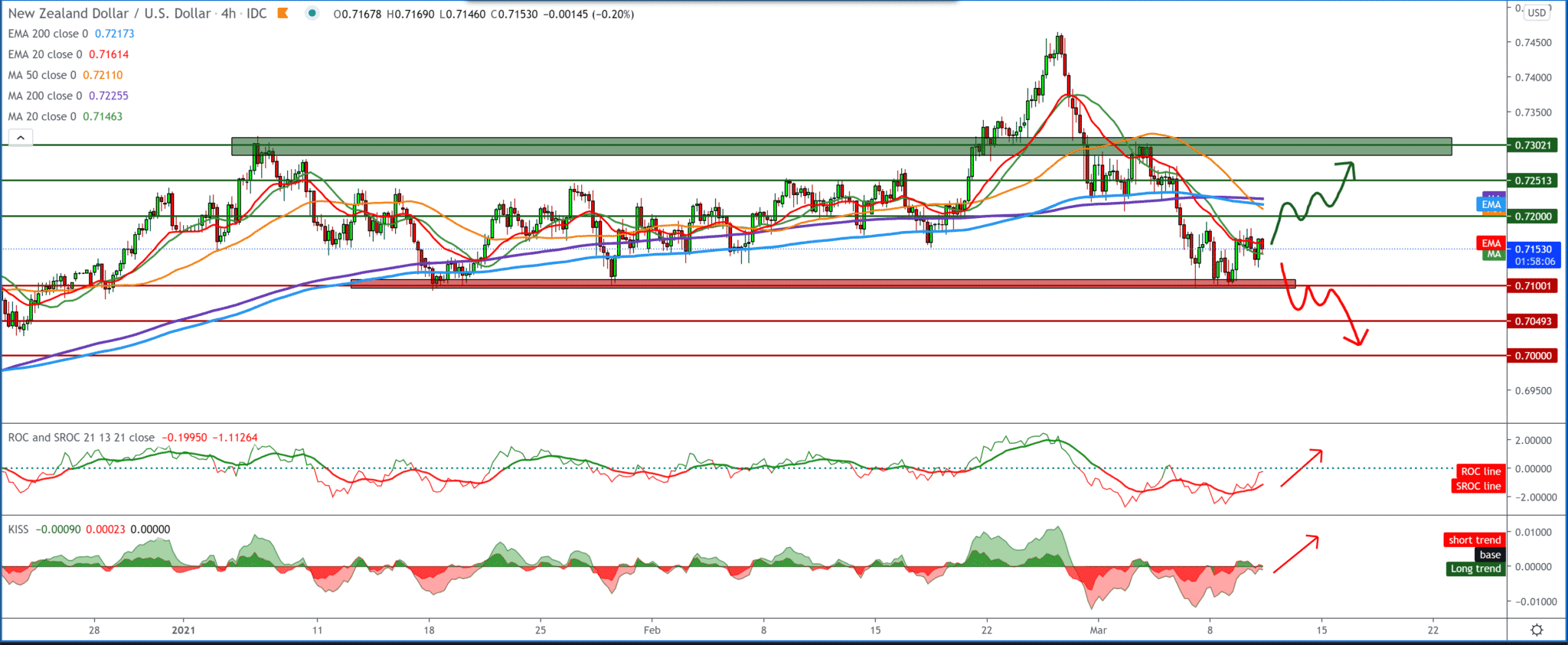

We see the NZD/USD pair moving sideways in the range of 0.71000 to 0.73000 during this year, with a single jump to 0.74500, but quickly returned down to this zone in the four-hour time frame. The NZD/USD pair currently finds support at 0.71000. The MA20 and EMA20 are currently being tested, while the MA50, MA200, and EMA200 are on the bearish side. Here, however, we can expect better support at 0.71000 and jump again to 0.73000, where we would again test the upper limit of this zone. The dollar has strengthened since the beginning of the year against other currencies, but the NZD is holding up very well for now.

From the news for the NZD/USD pair, we will single out the following: The value of consumption of electronic retail cards decreased seasonally by 2.5 percent compared to the month in February, New Zealand statistics announced on Wednesday – after a drop of 0.3 percent in January. Consumption in the basic retail industry decreased by 2.5 percent compared to the month. On an annualized basis, total spending on retail cards decreased 5.3 percent after an increase of 1.9 percent in the previous month.

-

Support

-

Platform

-

Spread

-

Trading Instrument