EUR/AUD forecast and March 10, 2021

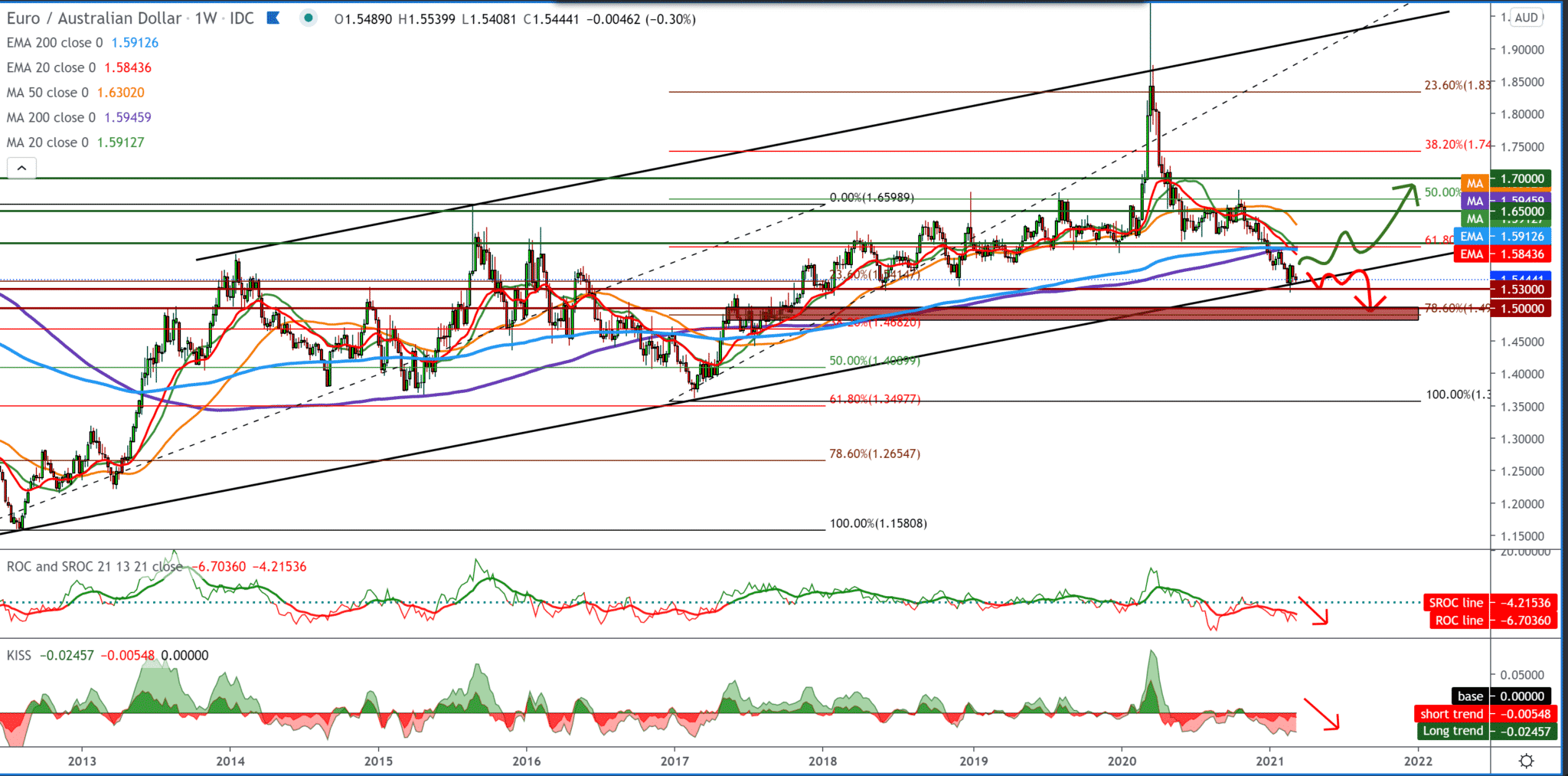

On the weekly chart, we see that the EUR/AUD pair is on the bottom trend line, and we can look at it as potential resistance and support to the pair. The trend is still very bearish, and it is being pressured by moving averages from the top, and we see that the EUR/AUD pair failed to climb above the previous higher low to 1.56500. Reducing the global risk caused by vaccinating the world’s population helps smaller economies such as the Australian economy. Today’s good economic news from China has certainly helped the Australian dollar strengthen as China is one of their main trading partners in foreign trade.

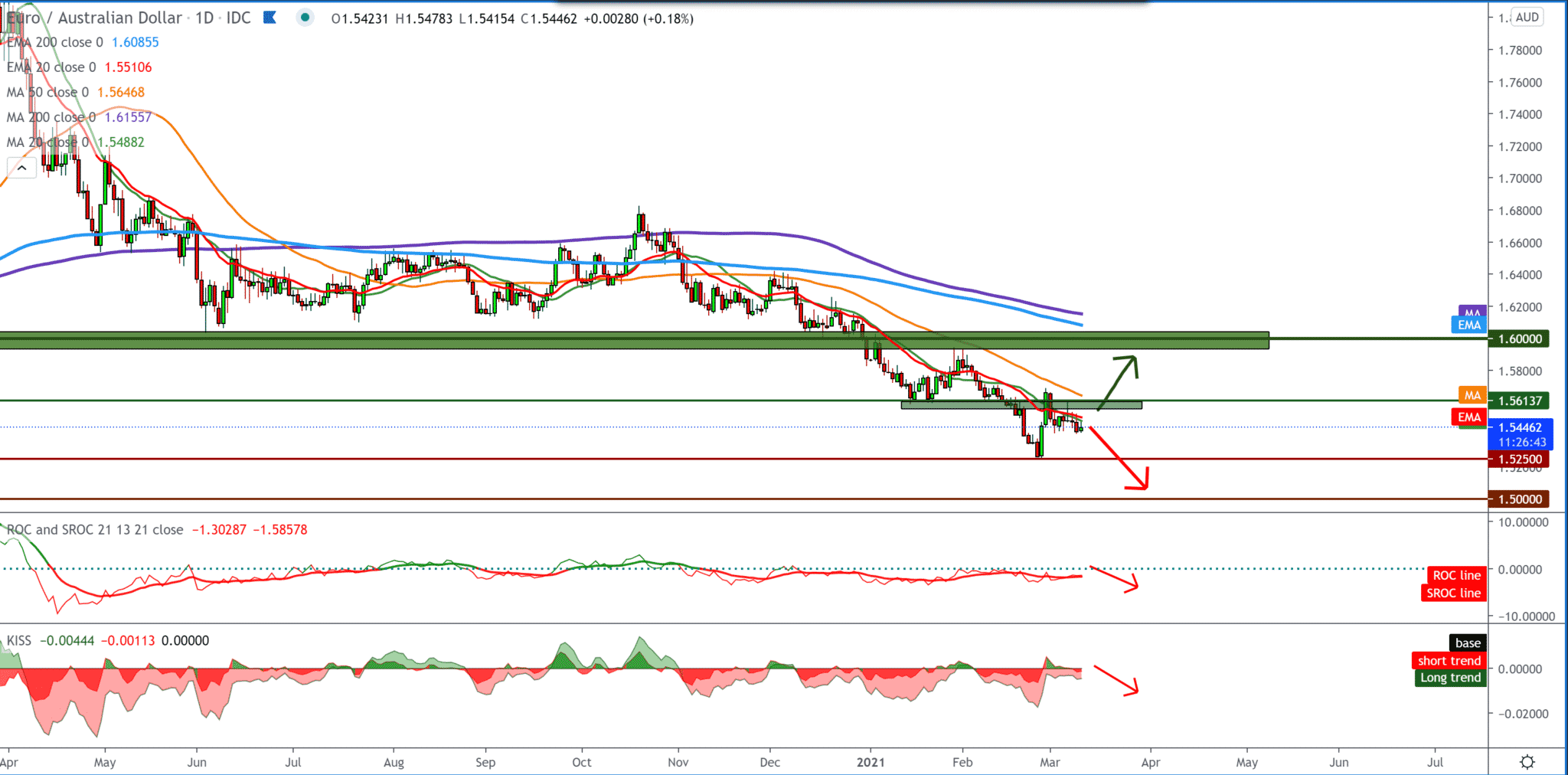

On the daily chart, we notice that the EUR/AUD pair is still in the bearish trend, moving averages are also on the bearish side, we have a good indicator of MA20 and EMA20, which are currently solid resistance on the chart, so we can expect to see the EUR/AUD pair again at 1.52500 at the previous low. For a potential bullish reversal, we need a break above 1.56000. The EUR/AUD pair will then get MA20, EMA20, and MA50 support, and then we can look towards the 1.58000-1.60000 zone.

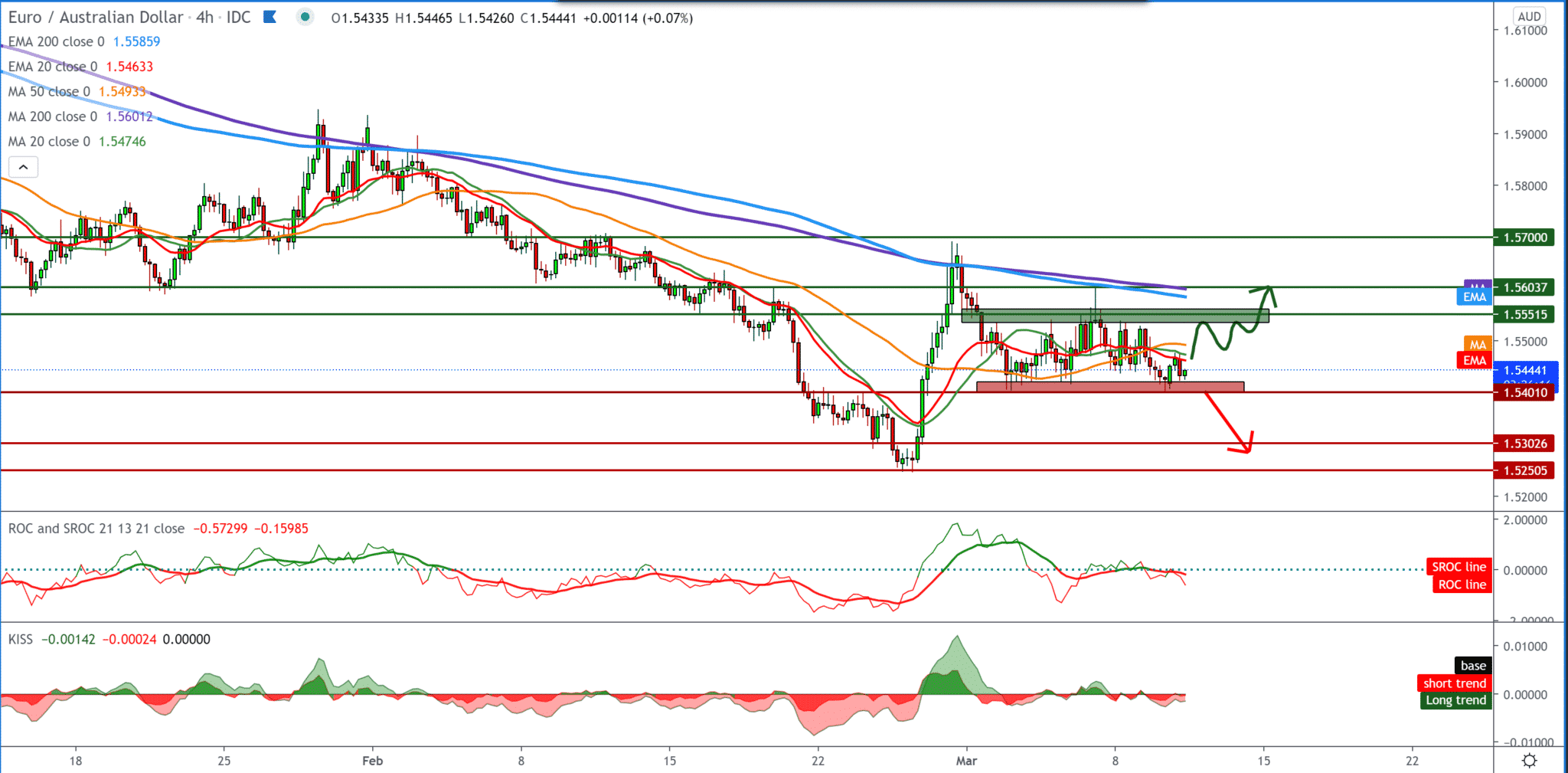

On the four-hour time frame, we see that the EUR/AUD pair moves sideways in the range between 1.54000-1.55500, a break below 1.54000 leads us when it is 1.52500-1.53000, and a break above 1.55500 leads us to 1.56000 approaching the previous high near 1.57000. Moving averages are in the middle of this sideways consolidation and so far are of no help for any short-term trendsetting.

From the economic news for these two currencies, we can single out the following: The total number of building permits issued in Australia in January fell seasonally by 19.4 percent compared to January. The Australian Bureau of Statistics announced on Wednesday and amounted to 15,926. That was in line with expectations after an increase of 12.0 percent in December.

Australia’s success in combating COVID-19, the promise that the vaccine will end the pandemic, and the support of government stimulus policies have contributed to sustainable growth. All components of the index were higher in March.

Confidence in the economic outlook led to an increase with the sub-index “economy, next 12 months” by 3.7 percent and the sub-index “economy, next 5 years” by 2.3 percent.

Data on industrial production in France recovered faster than expected in January, data from the statistical office Insee showed on Wednesday. Industrial production rose 3.3 percent month-on-month in January, reversing a 0.7 percent drop in December. Economists forecast growth of 0.5 percent. Compared to February 2020, the last month before the first general lock, production remained lower in the manufacturing industry by 2.6 percent and by 1.7 percent in the industry.

-

Support

-

Platform

-

Spread

-

Trading Instrument