What is a momentum candle in Forex?

A momentum candle is a candlestick with a long real body and short or absent wicks, indicating strong buying or selling pressure. Momentum candles can be used to identify trend continuations and reversals, as well as potential breakout opportunities.

What is momentum trading strategy?

Momentum trading is a trading strategy that seeks to profit from the continuation of existing price trends. Momentum traders typically use technical indicators such as moving averages, MACD, and RSI to identify trends and potential reversals. They may also use candlestick patterns, such as the hammer and shooting star, to confirm momentum signals.

Momentum Candle and Risk Management

It is important to use risk management techniques when trading momentum candles. This is because momentum candles can often lead to large price movements, which can result in significant losses if the trade goes against you.

One way to manage risk is to use stop-loss orders. A stop-loss order is an order to sell your position if the price falls below a certain level. This will help to limit your losses if the trade goes against you.

Another way to manage risk is to position size carefully. Only risk a small percentage of your trading capital on each trade. This will help to protect your overall trading account from large losses.

How to trade momentum candles?

Identify the trend by looking for higher highs and higher lows for an uptrend or lower highs and lower lows for a downtrend.

- Look for key levels such as support and resistance levels, trend lines, and moving averages.

- Look for a momentum candle close to a crucial level, characterized by a sizeable body and minimal wick.

- Validate the trade with additional technical tools. For instance, if a momentum candle forms close to a resistance zone, enter a long position only after the price surpasses and retests the resistance.

- Implement sound risk control measures, including stop-loss orders and careful position sizing.

The most commonly used candle momentum patterns in Forex

Bullish engulfing pattern

This pattern is formed when a bullish candle completely engulfs the bearish candle that precedes it. It indicates that the bulls are taking control of the market and that a price reversal is likely.

Bearish engulfing pattern

This pattern is formed when a bearish candle completely engulfs the bullish candle that precedes it. It indicates that the bears are taking control of the market and that a price reversal is likely.

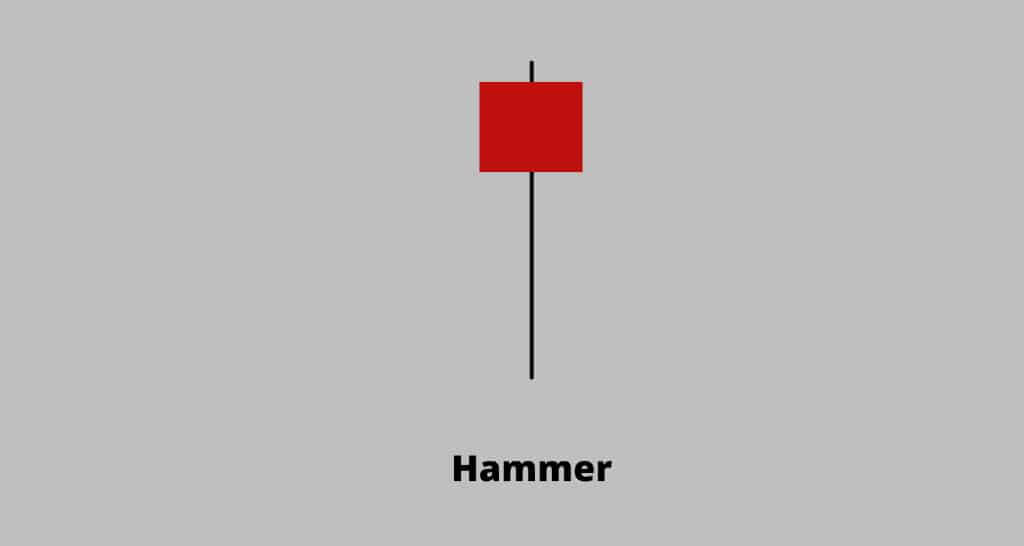

Hammer pattern

This pattern is formed when a bullish candle has a long lower wick and a small real body. It indicates that the bulls were able to push the price higher after facing strong selling pressure.

Inverted hammer pattern

This pattern is formed when a bearish candle has a long upper wick and a small real body. It indicates that the bears were able to push the price lower after facing strong buying pressure.

Piercing line

This pattern is formed when a bullish candle opens below the previous bearish candle’s low and closes above its high. It indicates that the bulls are taking control of the market and that a price reversal is likely.

Here is an example of how to use a bullish engulfing pattern to enter a long trade:

- Identify a bullish engulfing pattern on the price chart.

- Place a buy order above the high of the bullish candle.

- Place a stop-loss order below the low of the bearish candle that precedes the bullish candle.

- Take profit at a predetermined level, such as at a key resistance level or at a certain percentage gain.

It is important to note that this is just a basic example and that there are many other ways to trade candle momentum patterns. It is important to backtest any trading strategy before using it in a live trading environment.

Momentum Candle: In Conclusion

Momentum candles are beneficial for those practicing technical forex trading, offering insights into trend strength. When combined with additional technical indicators, they can highlight opportunities for profitable trades.

Nonetheless, trading with momentum candles requires careful risk management due to their potential volatility and unpredictability.

Momentum candles are a type of candlestick with a long real body and short or absent wicks. They indicate strong buying or selling pressure and can be used to identify trend continuations, reversals, and potential breakout opportunities.

Momentum traders use technical indicators and candlestick patterns to identify momentum signals and confirm trades. One common candle trick is to look for candles with long real bodies and short or absent wicks.

Another trick is to look for breakout candles that close outside of the previous candle’s range.Momentum candles can be a valuable tool for Forex traders. By identifying and understanding momentum candles, traders can improve their chances of success in the market.