Market News and Charts for January 18, 2019

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

EUR/CHF

The pair was expected to go up in the following days after it broke out of the downtrend channel’s resistance line. The European Union had been pressuring Switzerland to sign a framework deal, which will put together a series of 120 bilateral trading agreement with the EU. The European Union warned that it will freeze Switzerland Stock Exchange access to its Single Market on June 2019 if Switzerland will be unable to sign the agreement. Switzerland is neither a part of the European Union nor the European Economic Area, which gives countries the ability to access the EU’s, Single Market. But a bilateral trade agreement between the two countries gave it the ability to access the trading bloc’s, Single Market. The EU investors own 25% of the Stock Exchange’s total value. The relationship between the European Union and Switzerland provides an insight into a complicated relationship in the future between the European Union and the United Kingdom once it officially withdraws on March 29, 2019.

EUR/GBP

The pair is seen to continue its steep decline and breakdown of the current support line. The deadlock with the United Kingdom’s withdrawal from the bloc was currently the most visible issue with the divorce of the European Union and the United Kingdom. The great English-speaking democratic country, the United Kingdom, is one of the key figures in ending the Cold War and the dissolution of the USSR (Union of Soviet Socialist Republics). Its withdrawal from the bloc will shed the number of democratic nations in the EU. As experts see the current turmoil in the Europe region, the Brexit will not divide the European Union, but the rising Nationalism will. The European Union was now divided between the West and the East, with a small group CEE (Central and Eastern Europe) seen to be making a move contrary to the European Union’s plan. China, Russia, and the United States were now luring to be an ally to the small group, which can have a huge impact with the European Union’s future leadership.

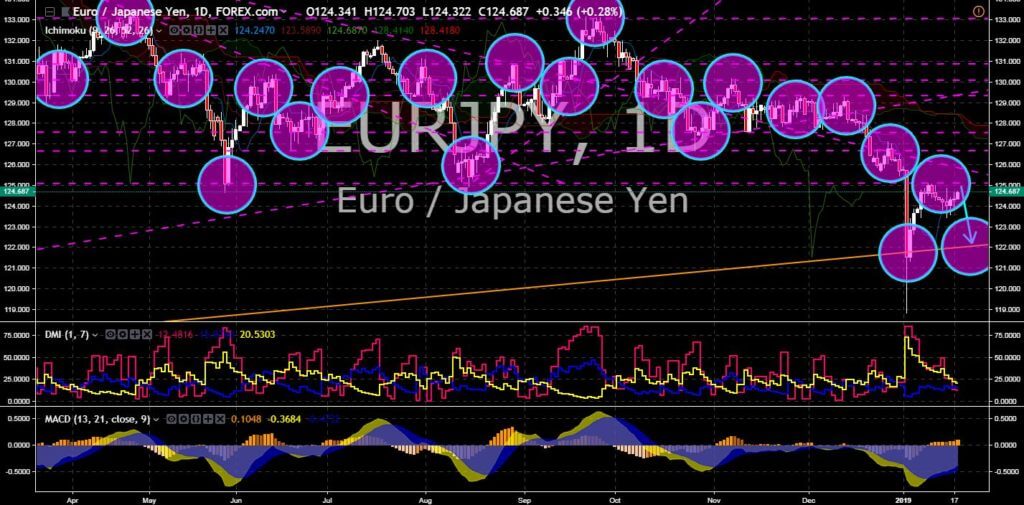

EUR/JPY

EUR/JPY

The pair was expected to reverse in the following days after failing to break out of the resistance line. January 26 will mark the first anniversary of the United States withdrawal from the TPP (Trans-Pacific Partnership), a key strategy in former US President Barack Obama’s Asia policy. However, in just two months after the US withdrawal, Japan and Australia led the ratification and revised it to CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). The trading bloc will come into effect on March 01, 2019. The European Union was also extending its influence on South America with the Mercosur deal, and to Japan with the EU-Japan Free Trade Agreement. Japan was trying to gain back its regional power by passing a law to reinterpret Article 9 of its constitution that prevents the country from making offensive equipment that can be used in times of war. The European Union, however, was having trouble with its Nationalist members.

USD/CAD

USD/CAD

The pair is set to continue its fall after failing to reverse and break the resistance line. As the United States preferred bilateral trades with countries, it was now having a hard time to tackle different issues at the same time with policies that seemed to benefit and hurt the country at the same time. The US pulled out from the Syrian civil war but had left Israel as the only remaining opposition force against the Syrian government and Russian backed Iraq. The United States also pulled out from Asia with its withdrawal from the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership) that gave China the opportunity to flex its muscle in the region. And now, China is hitting back to Canada over the US extradition of Huawei’s No.2, daughter and heiress to Huawei. But the division between the Democrat and Republican needs to be addressed first for Trump to be able to approve his key policies to help him fulfill his promise during the 2016 US Presidential Election.