Market News and Charts for October 29, 2019

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

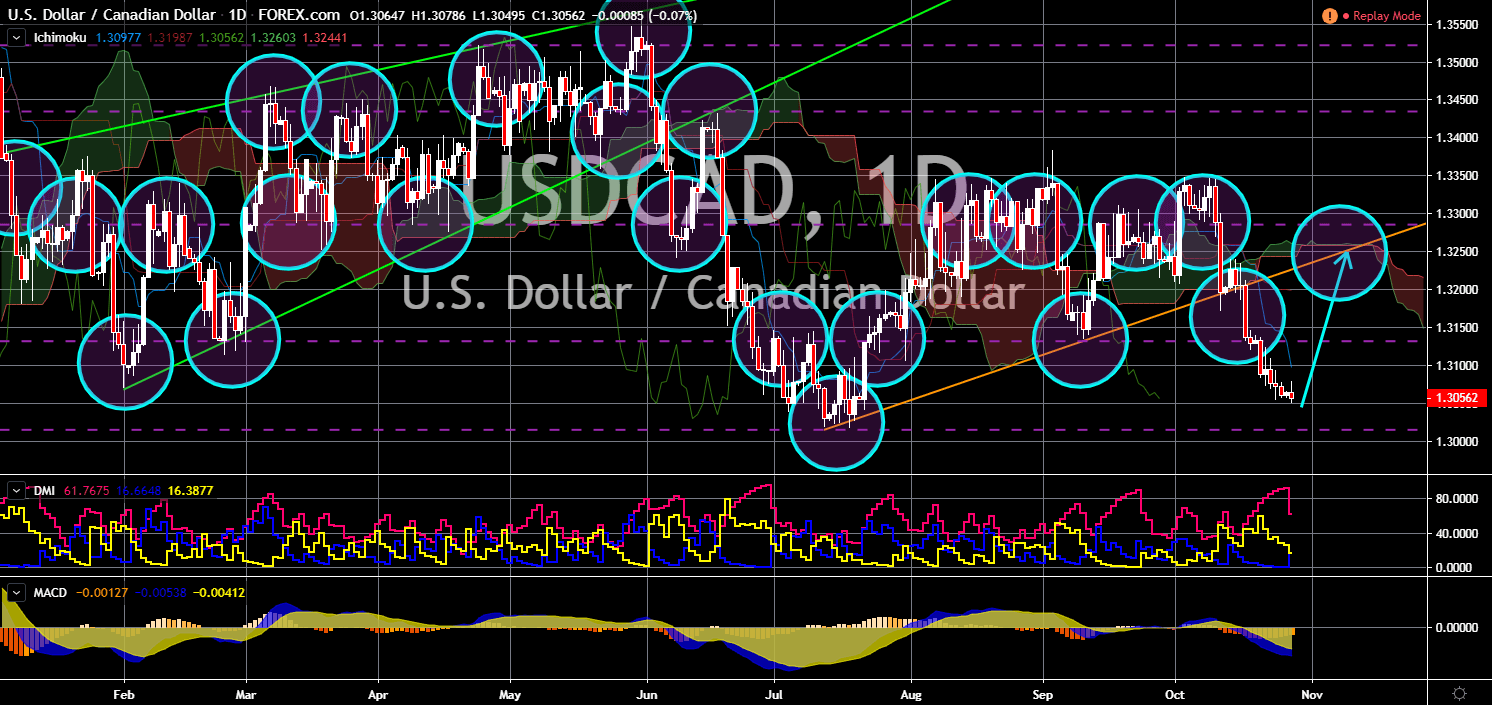

USD/CAD

The pair is seen to regain its strength after it was sold down heavily in the past few days. Justin Trudeau was reelected as Canada’s prime minister for the next four (4) years. However, his Liberal Party didn’t make it through, giving him a minority government. Having a minority to govern, Trudeau might face some blockade for his policies. This is expected to make Trudeau’s job harder. Pressures are also increasing for the PM to better handle issues, specifically when it comes to China and the Kingdom of Saudi Arabia. Despite this, analysts and economists are hopeful that its membership in the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership) will be enough to cover the lost Canada will incur for the ratification of the NAFTA. The North American Free Trade Agreement became a tool for U.S. President Donald Trump to shake what he thinks as unfair trade practices.

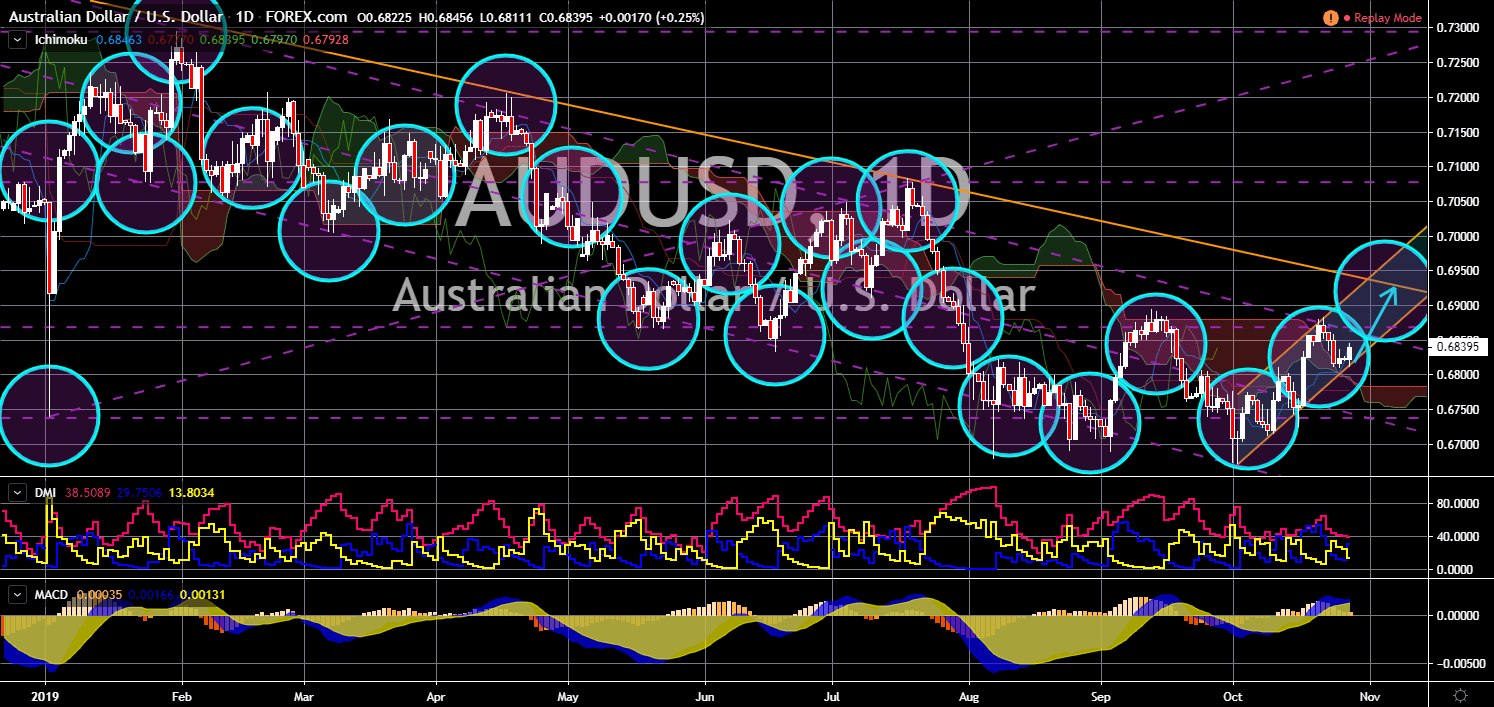

AUD/USD

AUD/USD

The pair will bounce back from the steep uptrend channel support line. Demand for the Australian Dollar was rising amid the Consumer Price Index (CPI) report today and the expected meeting of the Reserve Bank of Australia (RBA) on November 05. CPI data shows that the RBA failed to stimulate the prices of consumer goods to increase its inflation and combat a possible interest rate cut by the central bank. The RBA cut its benchmark interest rate twice this year as fears of looming global recession cripples on the country’s economy. These two (2) cuts slashed 75-basis points on its interest rate leaving only 0.75% as its current interest rate. In other news, Australia is following the steps by the EU after it sued Google (Alphabet). The Australian Competition and Consumer Commission (ACCC) accused the U.S. technology giant of false and misleading representation to its consumers about the personal location data Google collects.

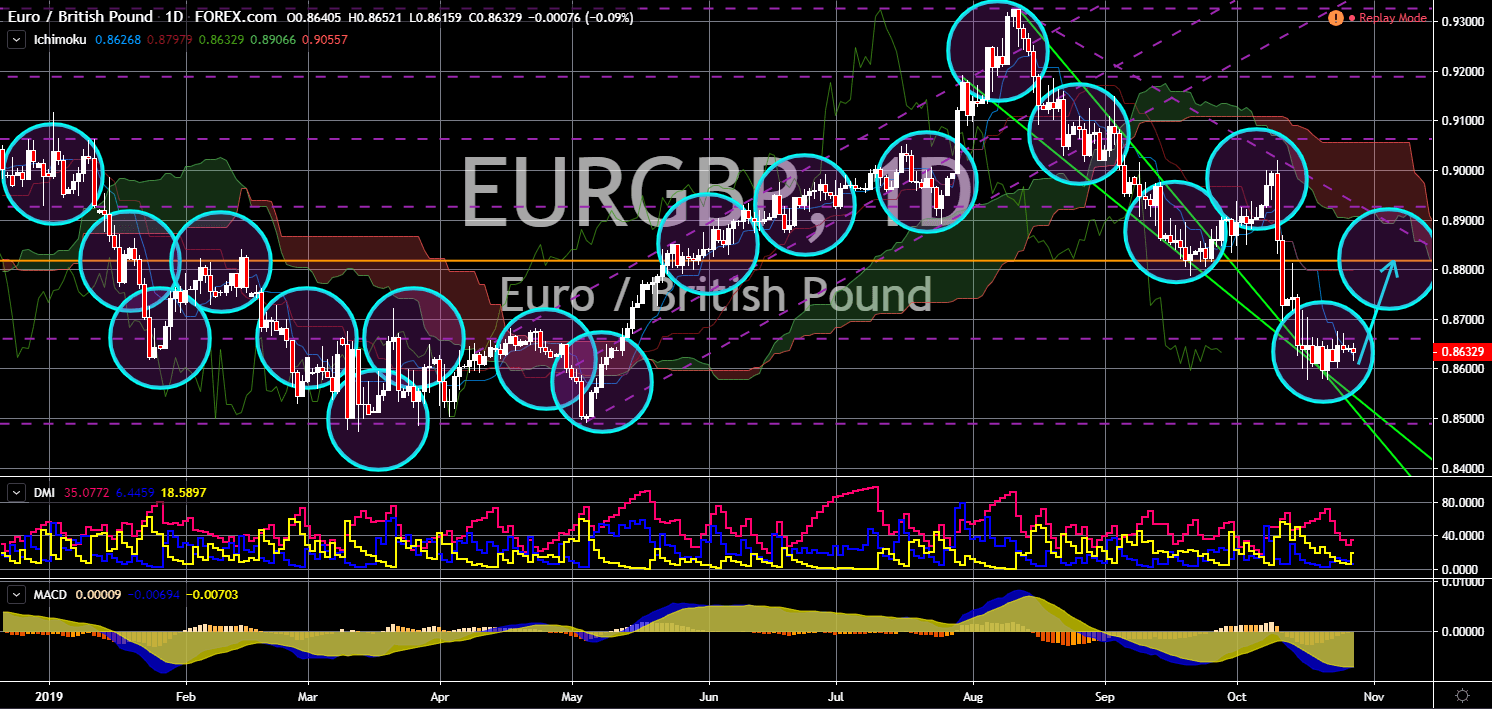

EUR/GBP

The pair is expected to reverse back and to move higher in the following days towards a key resistance line. The European Union agreed to a Brexit extension for another three (3) months. This was after British Prime Minister Boris Johnson was forced by the UK Parliament to send a letter to European Council President Donald Tusk asking for an extension. The move by the members of the parliament was in response to a trade deal agreed by Johnson and European Commission President Jean-Claude Junker. The UK Parliament is looking for a deal that will benefit the country following reports that the Brexit deal might cost Britain $89.71 billion. The current deal is expected to lower United Kingdom’s GDP growth to 3.5% over the next ten (10) years. PM Johnson, on the other hand, is seeking for a general election on December to gain majority in the parliament and to take the UK out of the EU with or without a deal.

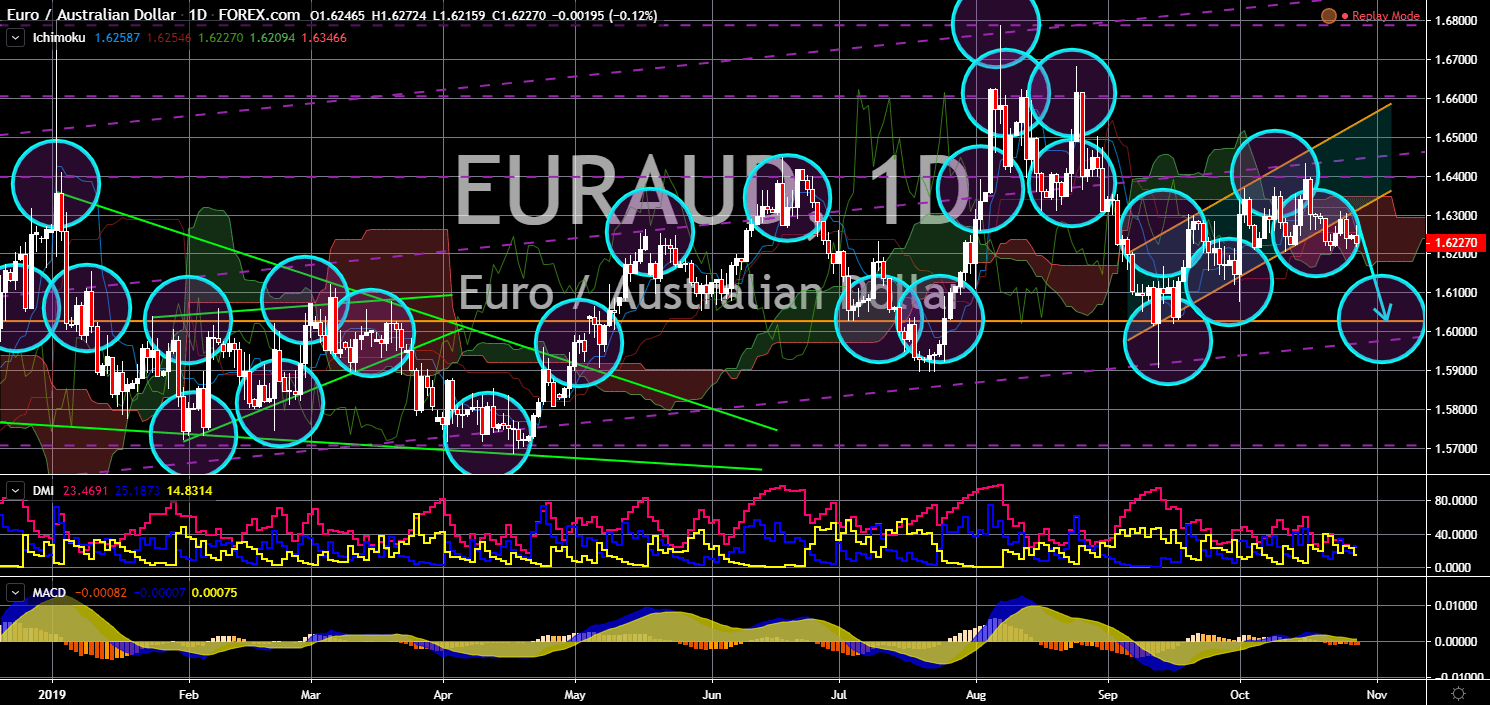

EUR/AUD

The pair is expected to continue moving lower in the following days after it broke down from an uptrend channel support line. Australia is following the step by the European Union after its sued Google (Alphabet). The Australian government accused the U.S. technology giant of misleading its smartphone users about how it collected and used personal location data. These efforts are expected to advance the global crackdown on the world’s biggest technology firms. Despite being Australia’s effort for its digital taxation, the European Union is still at odds with the country over its signing of the post-Brexit trade agreement. In line with this, the EU banned Australian cheese exports who uses names relating to any EU locations or terms. However, the Brexit uncertainty and slowdown in the European region is expected to weigh down on the single currency. Australia, on the other hand, is increasing its exposure in Southeast Asia.

-

Support

-

Platform

-

Spread

-

Trading Instrument