Market News and Charts for December 09, 2019

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

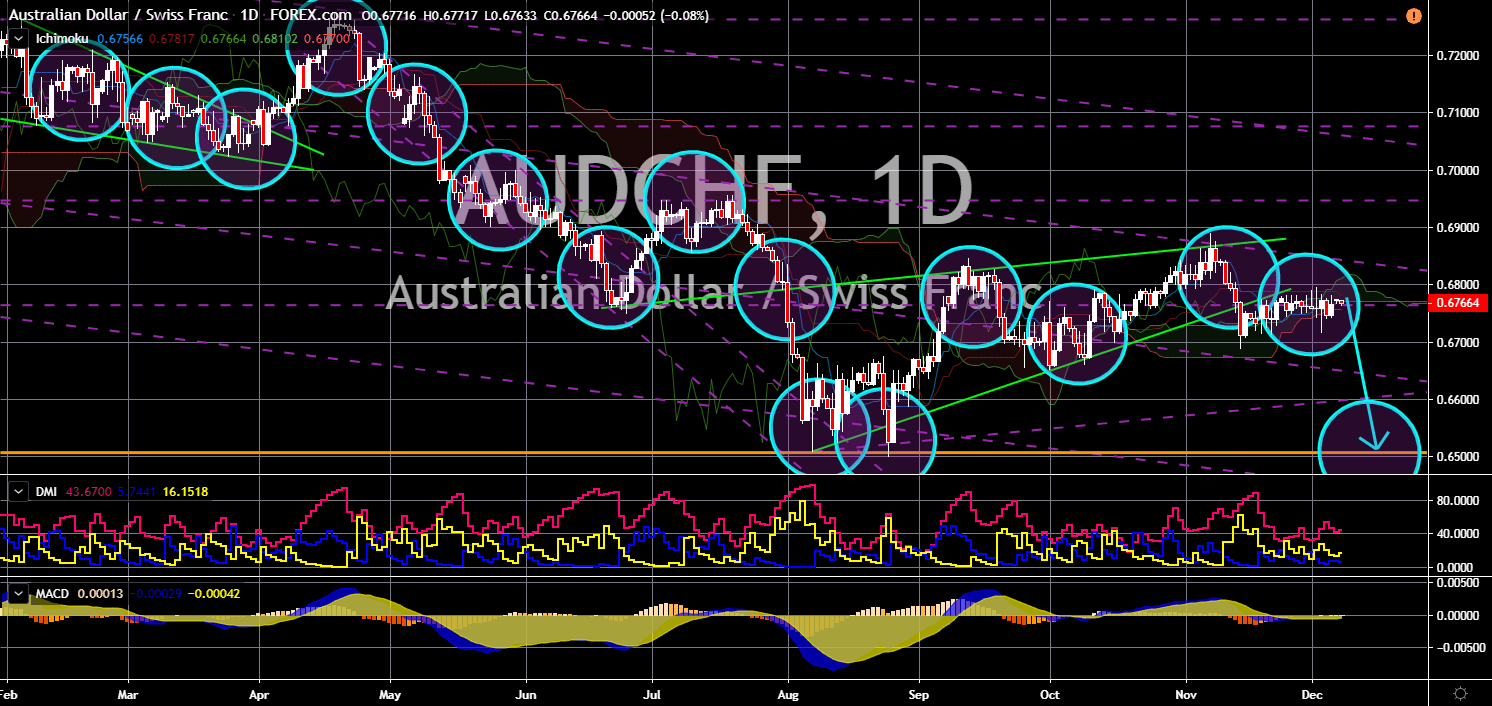

AUD/CHF

The pair will move lower in the following days after it failed to breakout from a major resistance line. Australia is expected to publish a better-than-expected result for its House Pricing Index today, December 09. Since the second half of 2018, the index has been sitting in negative territory. The figures during this time pushed the Australian economy on the brink of recession. However, analysts still expect Australia to remain on the negative territory until certainty on the US-China trade war emerged. On the other hand, Switzerland was able to maintain its economic growth since July. This is expected to support the move by the Swiss government to exit negative rates in 2020. Currently, Switzerland has the world’s lowest interest rate. Despite more countries opting to cut their benchmark interest rates, Switzerland is moving away from its ultra-loose monetary policy amid economic prosperity.

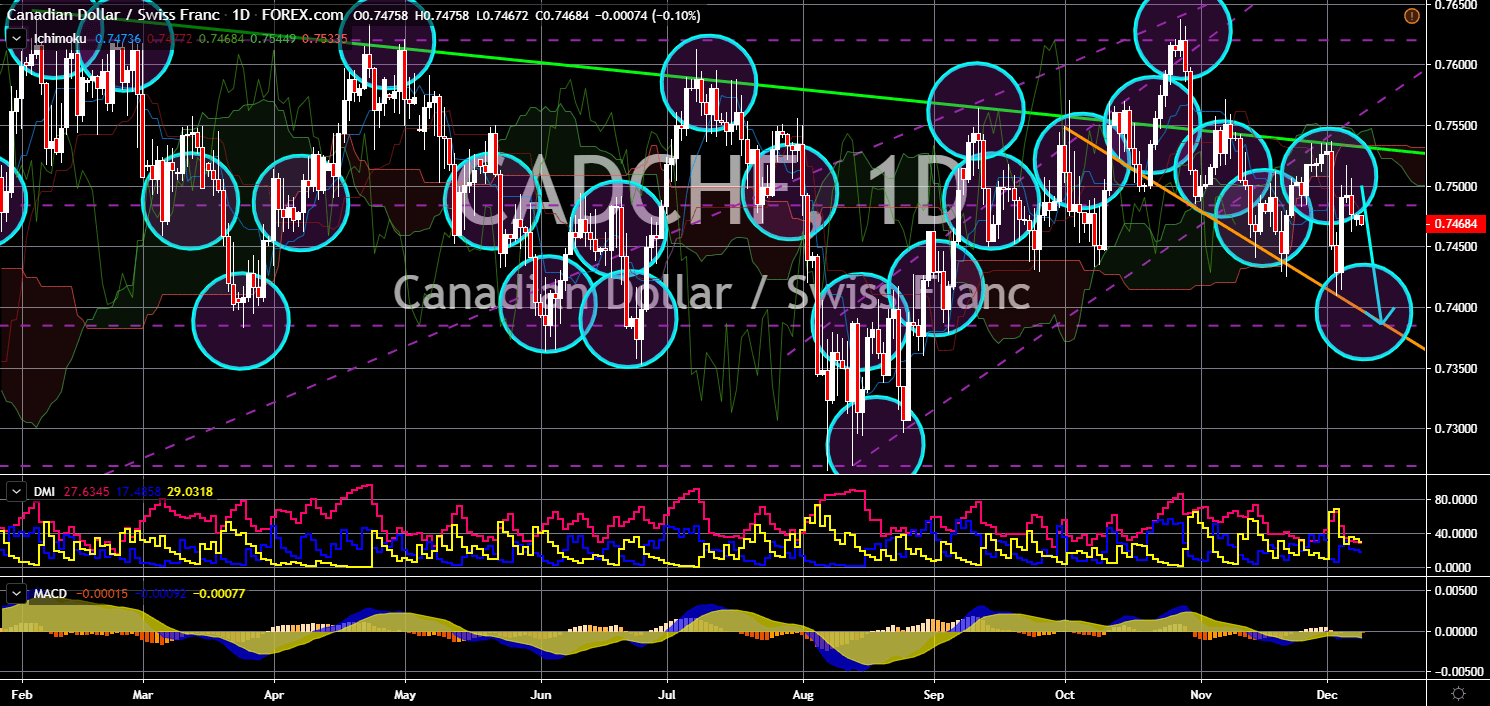

CAD/CHF

CAD/CHF

The pair is expected to continue moving lower as part of the “Falling Widening Wedge” pattern. Investors and traders are anticipating a win for the Conservative Party in the upcoming United Kingdom General Election. In October, Prime Minister Boris Johnson was defeated by the Members of the Parliament on the Brexit deal. He was forced to send a letter to the European Union asking for a Brexit extension. However, he also asked the MPs to open a snap election on December 12 to secure the majority of the House of Commons. This will allow him to take Britain out of the EU even in cases on a no-deal Brexit. This is a positive sign for the post-Brexit signatories, including Switzerland. Canada, on the other hand, was still weighing the temporary tariff rates that will be in effect if the UK crashes out of the EU without a deal. However, once Johnson wins during the election, it will be a missed opportunity for Canada.

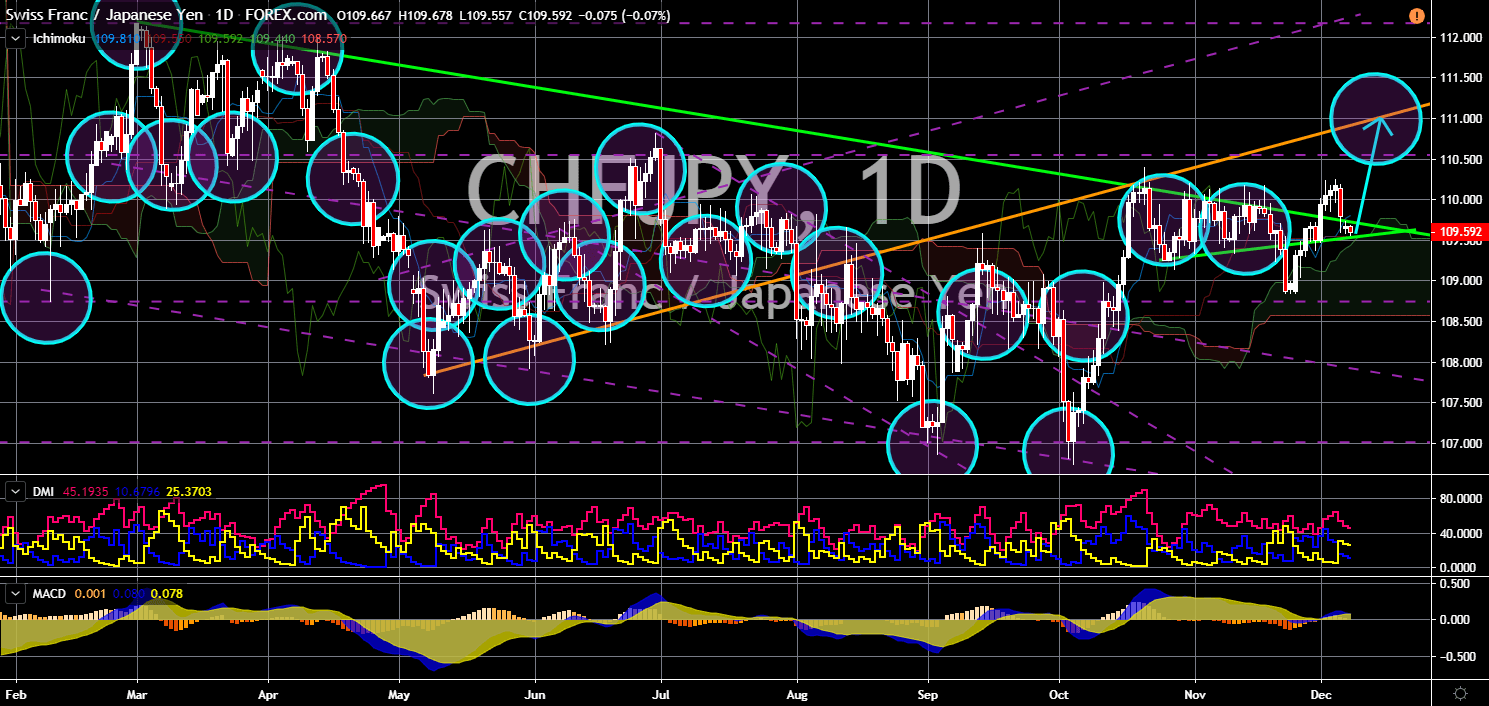

CHF/JPY

The pair is seen to bounce back from a triangle formation, sending the pair higher towards an uptrend resistance line. Switzerland is planning to move away from its ultra-loose monetary policy as the country’s economic environment improves. Unemployment rate is stable at 2.3% in the past six (6) months, the lowest in 17 years. The country currently has the lowest interest rate in the world at negative 0.75% since 2016. Japan is also one (1) of the only four (4) economies in the world with negative rates at negative 0.10%. However, the Japanese government was struck by the escalating US-China trade war. Aside from this, the country is also in a trade war with South Korea. This economic uncertainty has forced the Bank of Japan (BOJ) to introduce a series of economic stimulus to help the economy afloat. Its trade agreement with the United States and European Union further exposed the export-reliant economy to uncertainty.

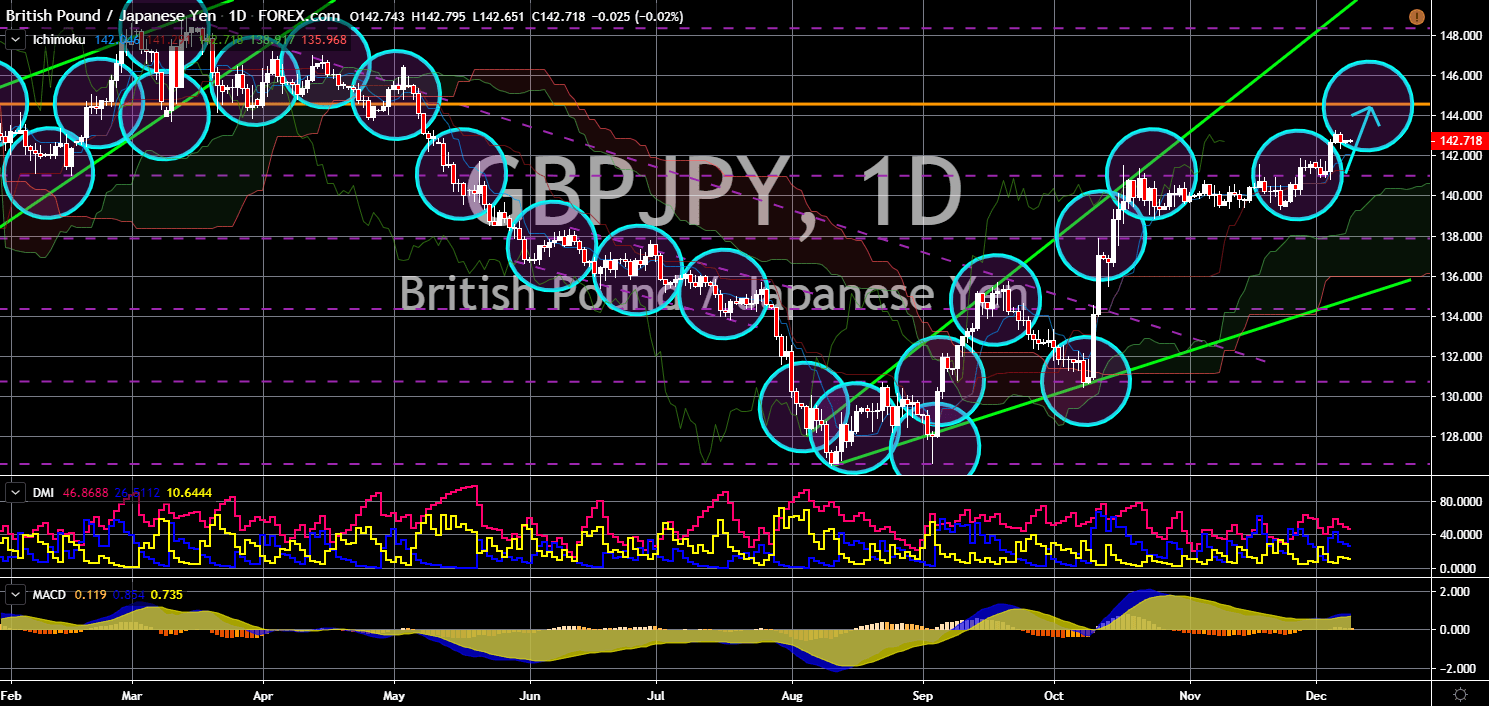

GBP/JPY

The pair will continue to move higher in the following days to retest its six (6)-month high. The United Kingdom will be having a general election on December 12, Thursday. The vote is expected to cement certainty as to whether Britain will leave the bloc with or without a deal. PM Boris Johnson is seeking to gain the majority in the parliament following several defeats of the Conservative Party to secure a Brexit deal. He promised to tackle Brexit and immigration, which are a sensitive topic for the UK, once he won the election. Analysts see this statement to help Johnson win the election. With the looming election, demand for the British pound is soaring. On the other hand, investors and traders are reluctant to be exposed with the Japanese yen following Japan’s cabinet approval of $239 billion stimulus package. A low interest rate, specifically a negative one, coupled with a quantitative easing (QE) will send the value of the yen lower.