Market News and Charts for December 06, 2019

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

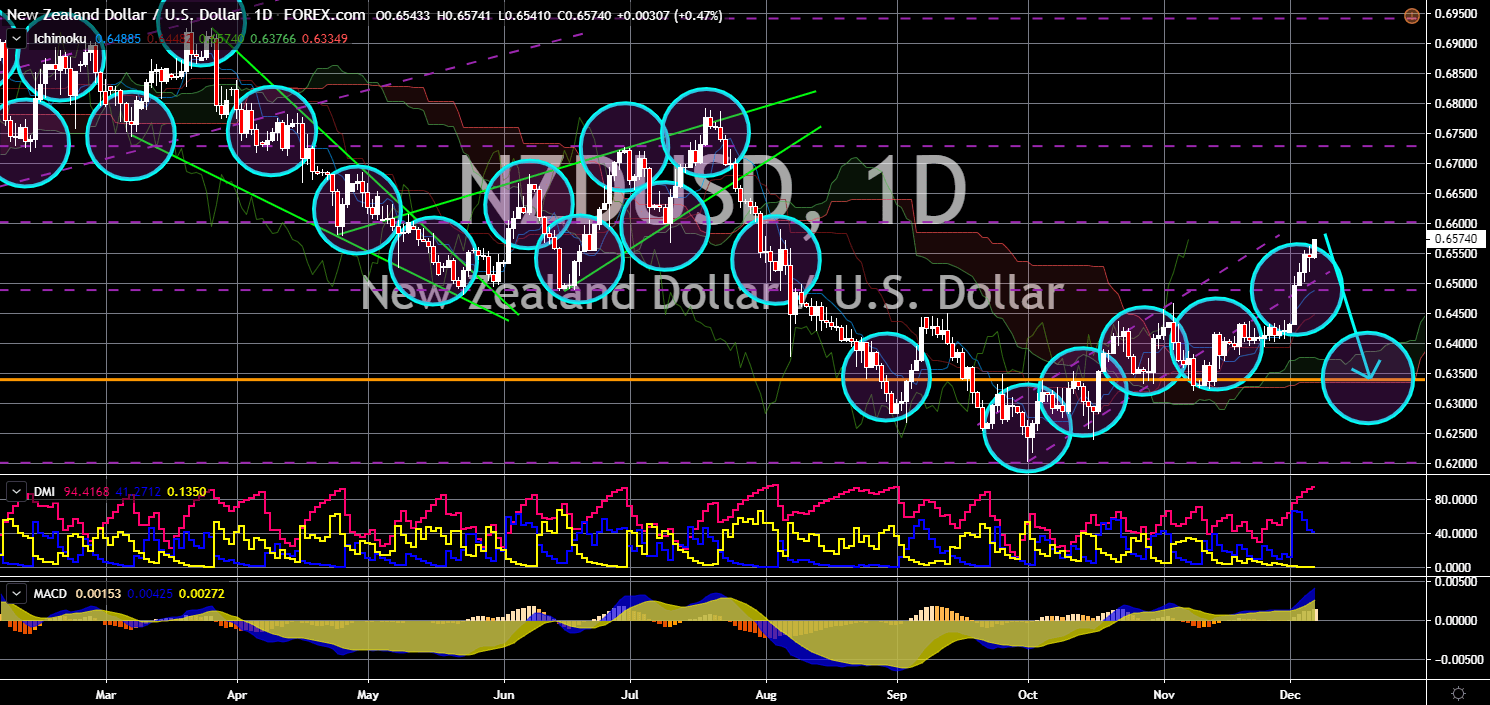

NZD/USD

The pair is expected to reverse back, ending its one (1) week rally. The United State is set to publish its Non-Farm Payrolls (NFP) report today. Investors and traders are anticipating a disappointing result following a weak ADP report on Wednesday. The ADP showed 67,000 jobs creation for November, 44.63% lower from the 121,000 result in October. This is also lower by 54.14% from the 140,000 jobs creation that analysts were expecting. The result on the NFP result is also expected to affect the Federal Reserve’s last meeting for the year on December 10 to 11. And this, in turn, will affect the decisions by the U.S. government whether to continue imposing the second round of tariffs to Chinese products. New Zealand doesn’t have any report for today, which will be an advantage for the kiwi against the US dollar. New Zealand is strengthening ties with the United States following the visit by Prime Minister Jacinda Ardern to the White House.

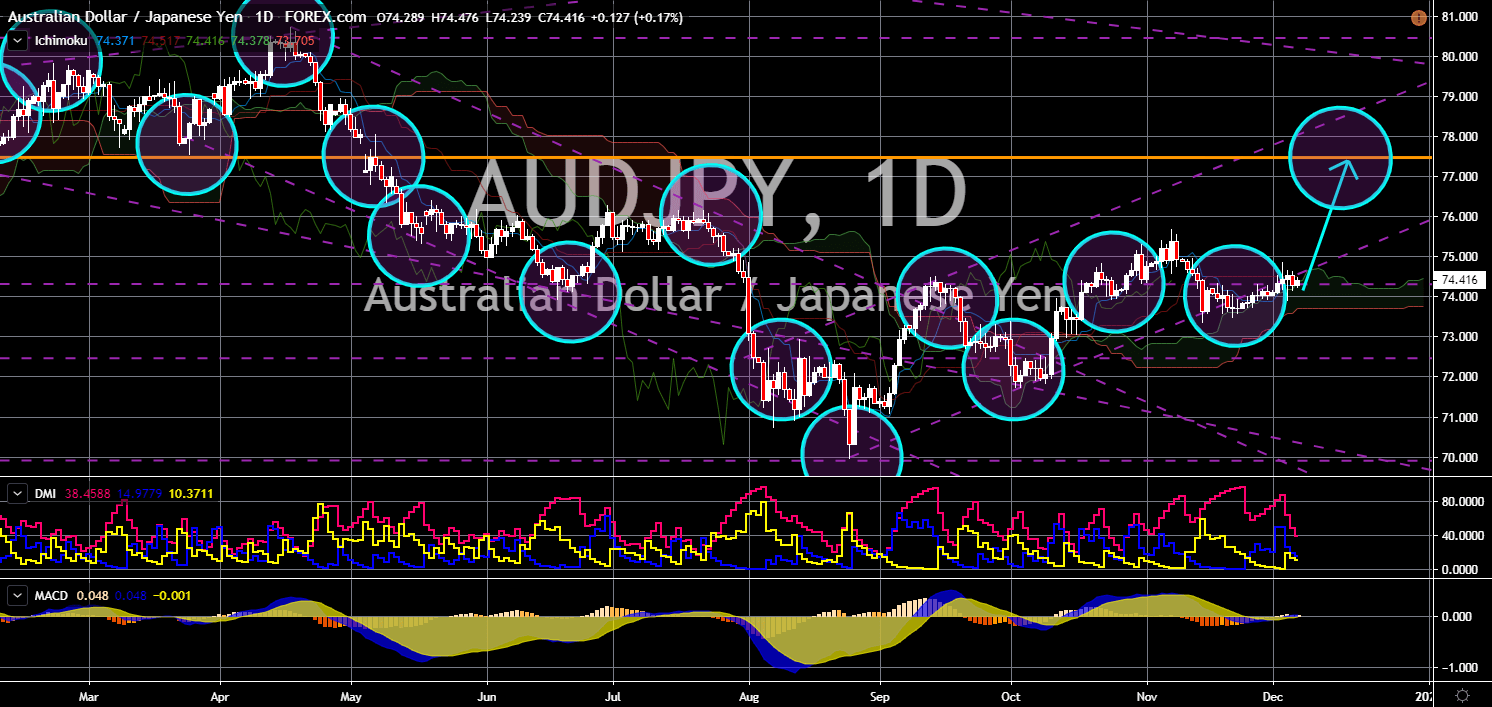

AUD/JPY

The pair will bounce back from two (2) major support lines, sending the pair higher in the following days. Japan Leading Index, on a monthly and yearly basis, shows disappointing figure, which could further drag the Japanese yen. On a month-over-month (MoM) basis, results show that the average movement of twelve (12) composite indices were stagnant at -0.1, still on the negative territory. Its year-over-year basis (YoY), on the other hand, were lower from its previous result and from analysts’ expectations. Despite several trading agreements from the European Union and the United States, the Japanese economy was still sluggish. This was in addition to the country’s ultra-low interest rate and quantitative packages. Australia and Japan were heading the pacific-rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). They were also members of the RCEP (Regional Comprehensive Economic Partnership).

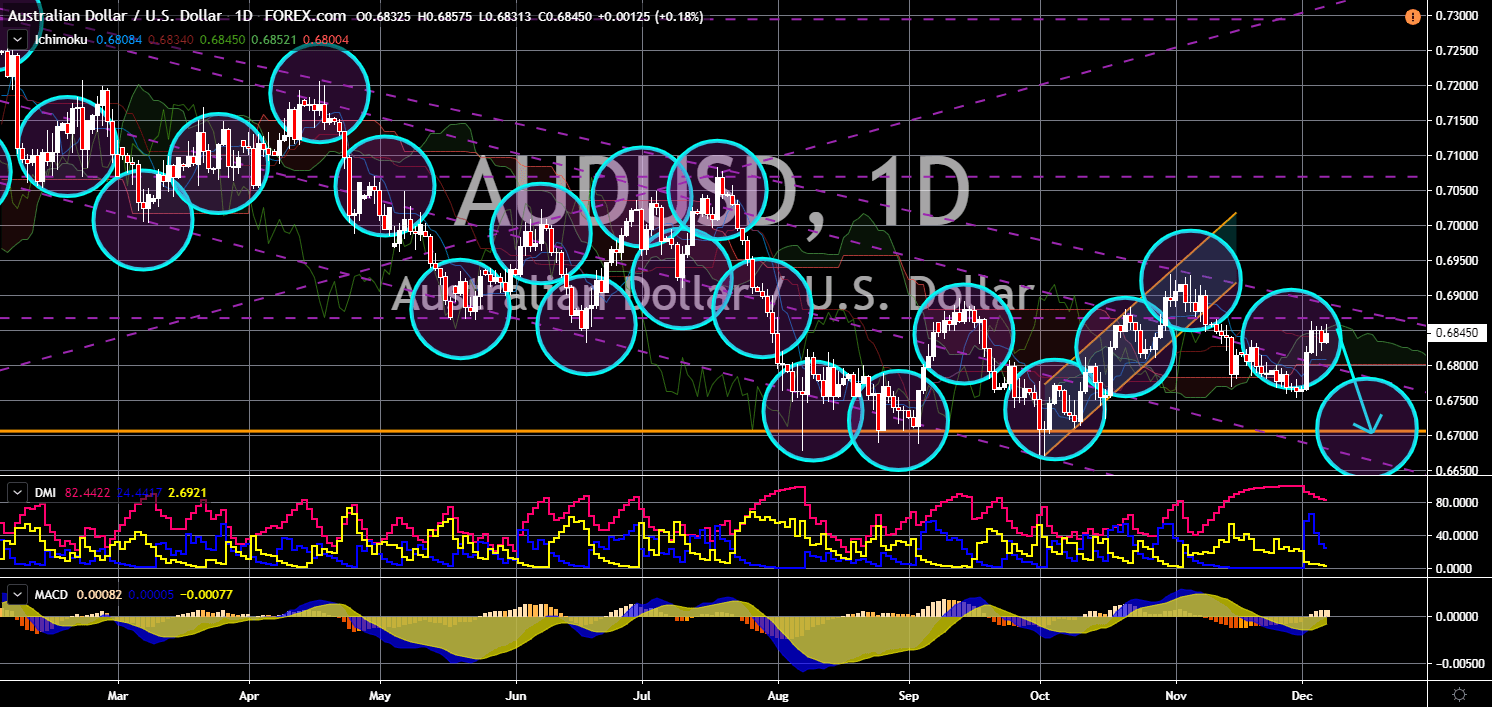

AUD/USD

The pair will fail to breakout from a major resistance line, sending the pair lower towards a major support line. The value of the US dollar will be affected from the Non-Farm Payrolls report scheduled today, December 06. The Federal Reserves will also have its last meeting for the year on December 10-11. The central bank will discuss the current state of the US economy and decide whether to hold or cut its benchmark rate. On December 15, the United States is also scheduled to impose the second round of tariff to Chinese exports. Despite this, the sluggish Australian economy will prevent the greenback from trading lower. Australia is still flirting with recession and the slowdown is expected to continue next year. Primary reason for its weak economy was the escalating trade war between the United States and China. The imposition of tariffs to China will directly hit the Australian economy.

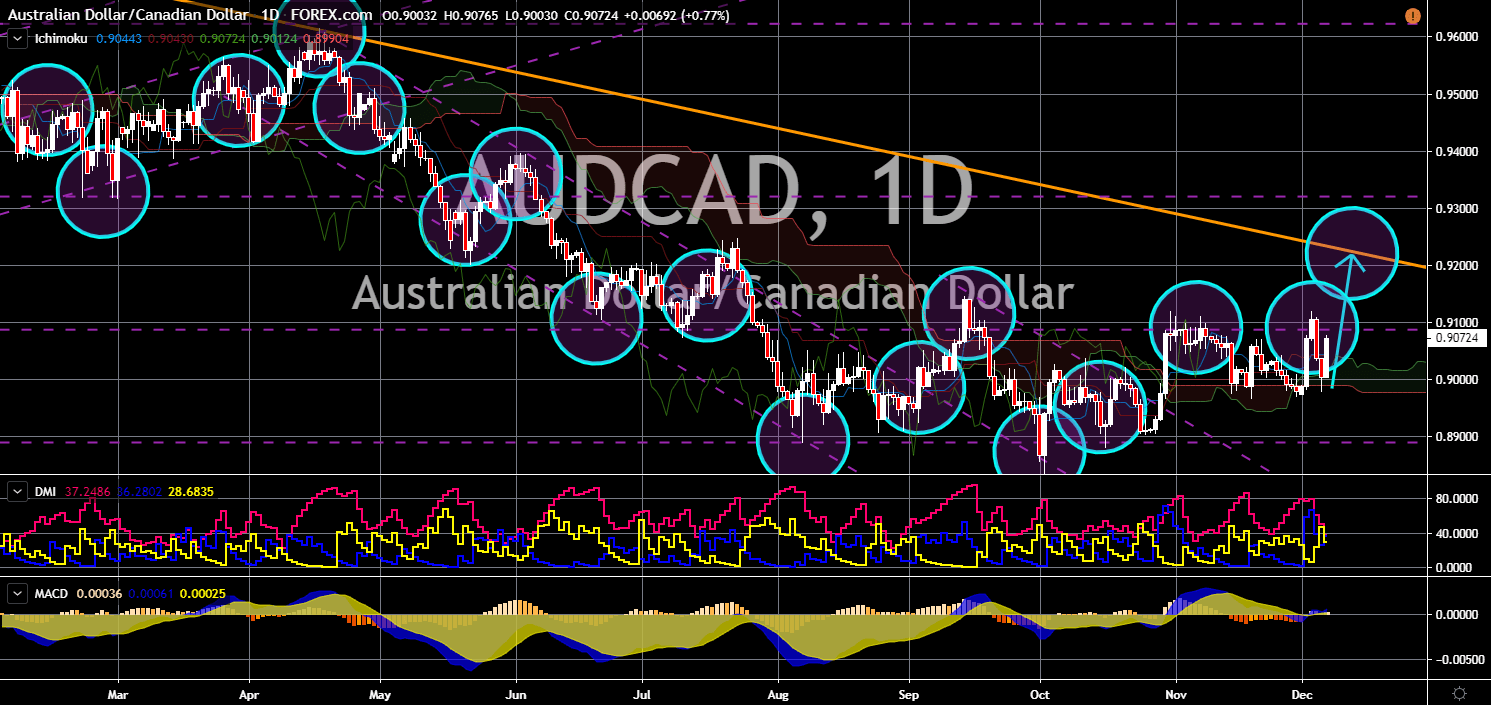

AUD/CAD

The pair is expected to breakout from a major resistance line, sending the pair higher towards a downtrend resistance line. Canada published a disappointing employment result today, December 06, which is expected to send the CAD lower in today’s trading session. Unemployment rate rises to 5.9% from 5.5% in October. This is the highest figure since October 2018. At the same time, jobs creation slumped by 71,200 from the previous record of 1,800. Analysts were also expecting Canada to create jobs for November by 10,000. This was given its resilient economy that prevents the central bank from cutting its interest rate. Canada was among the handful of countries that decline to cut rates despite most central banks from developed and developing economies cutting their benchmark interest rate. The delay in the approval of NAFTA (North American Free Trade Agreement) is also affecting the country’s economy.