Liquidity Preference Theory of Keynes Explained

In his groundbreaking book, “The General Theory of Employment, Interest and Money” (1936), John Maynard Keynes introduced the world to the Keynesian Liquidity Preference Theory.

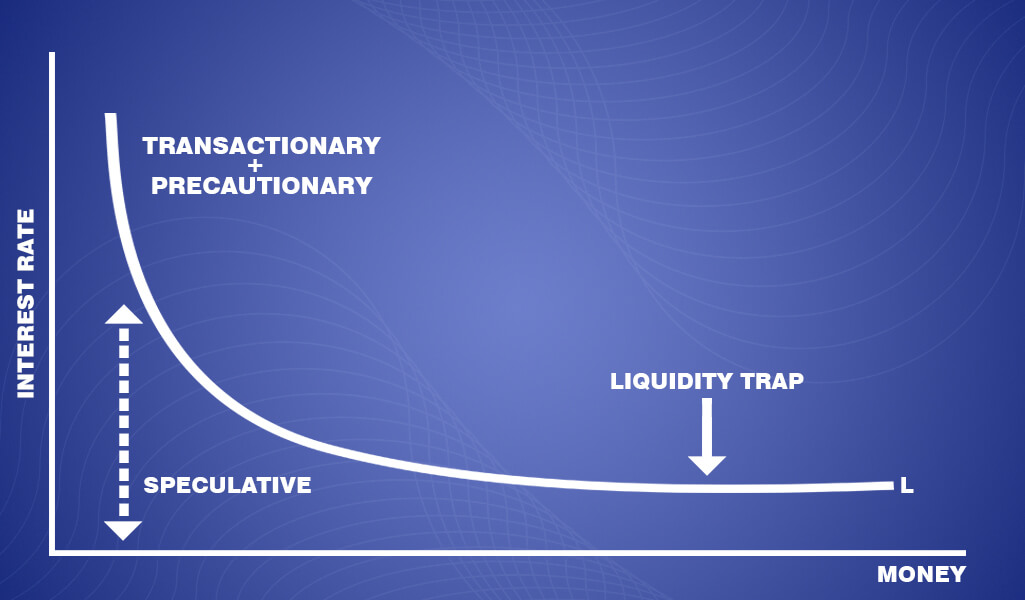

This pivotal concept explores how the supply and demand for money intersect with the motives behind people’s desire to hold cash. At its heart, the theory highlights three core motives: the transactions motive, the precautionary motive, and the speculative motive.

The more quickly an asset can convert into cash, the higher its appeal, especially as the income of individuals rises. But what happens when people expect higher interest rates in the future?

The speculative motive kicks in, impacting the supply of money and its equilibrium in the market. Developed by John Maynard Keynes, this theory continues to shape our understanding of monetary dynamics in both simple and complex financial environments.

Liquidity Preference Theory Explained

In the world of economics, understanding the behavior of consumers and investors when it comes to money is crucial. Enter the Liquidity Preference Theory, a concept introduced by renowned economist John Maynard Keynes. This theory delves into the reasons people prefer liquidity and how this preference affects interest rates.

How does liquidity preference theory work?

At its core, the Liquidity Preference Theory posits that people prefer to hold their assets in the most liquid form: cash. The more liquid the asset, the quicker one can use it for transactions or convert it into cash. As a result, when people have a heightened desire for liquidity, they demand higher interest rates to part with their cash through investments or loans.

Keynes outlined three primary motives that drive the demand for money:

Transaction Motive: People need cash for everyday transactions, making it necessary to hold a certain amount of liquid money.

Precautionary Motive: This is the desire to hold cash for unexpected expenses. It acts as a financial safety net.

Speculative Motive: Investors hold cash to take advantage of future financial opportunities, especially if they believe that bond prices will fall in the future.

Liquidity Preference and the Yield Curve

The yield curve, which plots the interest rates of bonds with equal credit quality but varying maturity dates, can take different shapes based on liquidity preferences. When investors expect interest rates to rise (indicative of a strong liquidity preference), they might avoid long-term bonds. This can result in an upward-sloping yield curve. Conversely, if they expect rates to fall, they may flock to long-term bonds, leading to a downward-sloping or inverted yield curve.

Liquidity Preference Theory and Investing

For investors, understanding liquidity preference is key. When liquidity preference is high, short-term securities might offer higher returns than long-term ones, influencing portfolio construction and asset allocation decisions. Conversely, when liquidity preference is low, investors might find better returns in longer-term investments.

How Does Liquidity Preference Theory Help Understand Financial Crises?

During financial crises, liquidity preference often skyrockets. Investors and consumers alike might scramble for cash, pulling money from stocks, bonds, and other assets. This rush towards liquidity can exacerbate market crashes, making understanding this theory critical for policymakers and investors during turbulent times.

How Does Fiscal Policy Influence Liquidity Preferences?

Fiscal policy, encompassing government spending and taxation, plays a role in shaping liquidity preferences. When a government increases spending or cuts taxes, consumers might feel more financially secure, potentially reducing their liquidity preference. Conversely, austerity measures or tax hikes might heighten the demand for liquidity as people brace for economic downturns.

In conclusion, the Liquidity Preference Theory offers a foundational understanding of why people cling to cash and how this behavior influences broader economic dynamics. From everyday financial decisions to navigating complex market scenarios, this theory sheds light on the underlying currents shaping the monetary world.

In Conclusion – Liquidity Preference Theory Explained

In “The General Theory of Employment, Interest and Money” (1936), economist John Maynard Keynes unveiled the Keynesian Liquidity Preference Theory. This concept delves into why people hold onto cash, pinpointing three central motives: transactions, precautionary, and speculative.

Transactions Motive: Individuals need readily available cash for daily transactions.

Precautionary Motive: People desire a cash cushion for unexpected expenses.

Speculative Motive: Investors retain cash, anticipating potential financial ventures, especially when expecting bond prices to drop.

The theory indicates that the more swiftly an asset turns into cash, the more attractive it becomes. If higher future interest rates are anticipated, the speculative motive influences money supply and market balance.

Liquidity Preference Theory affects interest rates by suggesting that when the preference for liquidity rises, individuals demand greater interest rates to invest or lend their money.

For investors, recognizing liquidity preference is pivotal. High liquidity preference suggests short-term assets might yield better than long-term ones. During financial crises, a surge in liquidity preference can intensify market downturns. Finally, fiscal policy, through government spending or tax decisions, can mold liquidity preferences, impacting economic stability.