Island Reversal Pattern – trading explained by an expert

Have you ever heard about the Island Reversal chart Pattern lately? Are you into the stock market or Forex, considering upgrading your knowledge of candlestick patterns?

Let’s get to know all the essential information about one of the most famous candlestick patterns lately, shall we?

What is the Island reversal definition?

The island reversal pattern is a significant price pattern observed on bar charts or candlestick charts. It appears on daily charts and consists of trading days separated by price gaps. This pattern indicates a potential reversal of the current trend, from upward to downward or downward to upward.

Key Characteristics of the Island Reversal Pattern

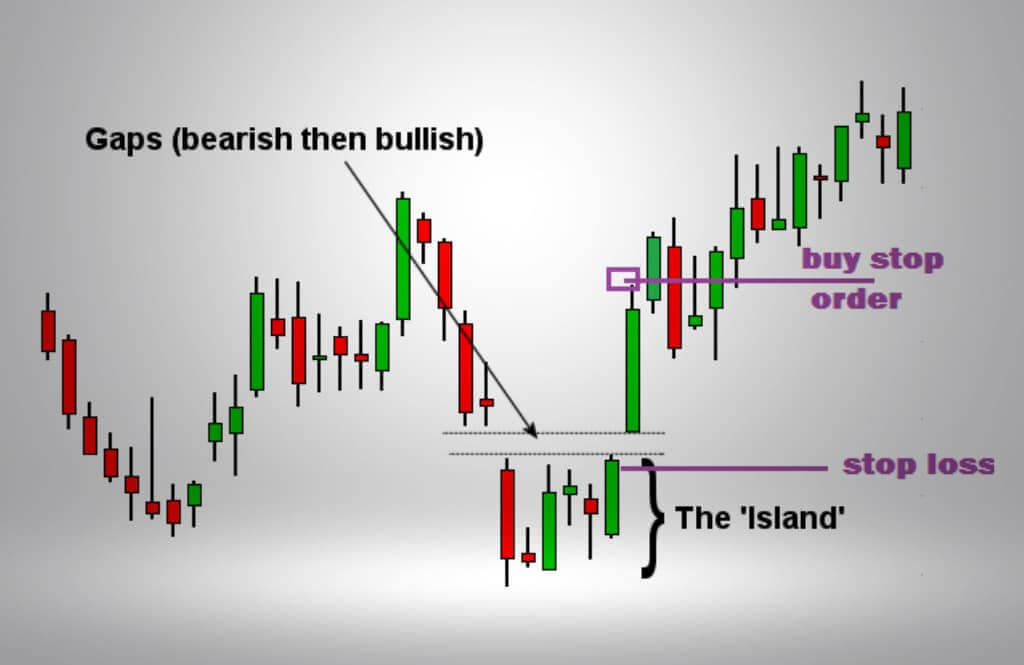

When analyzing the island reversal pattern, several key characteristics should be considered. Firstly, this pattern emerges when two distinct gaps isolate a cluster of trading days. Secondly, the pattern typically suggests a reversal and can apply to bullish and bearish changes.

Notably, island reversals transitioning from upward to downward trending prices are more common than the opposite scenario.

Understanding the Island Reversal Pattern

The island reversal pattern is a unique identifier in technical analysis. It is defined by the presence of price gaps on either side of a group of trading periods, usually spanning several days.

While conventional wisdom suggests that price gaps will eventually be filled as prices retrace, the island reversal pattern challenges this notion. It proposes that the two gaps within the pattern may remain unfilled for a considerable period.

Top and Bottom Formations of Island Reversal

The island reversal pattern can manifest as a top or a bottom formation, with tops being more prevalent. This pattern exhibits five distinctive characteristics:

- It occurs after a prolonged trend leading up to the pattern.

- It begins with an initial price gap.

- A cluster of price periods follows, characterized by trading within a defined range.

- Increased trading volume is observed near the gaps and during the island phase compared to the preceding trend.

- The pattern concludes with a final gap that isolates the island of prices from the previous trend.

Observations and Indicators for Island Reversals

Island reversals can encompass a range of prices spanning different time frames, such as days, weeks, or even months. Therefore, monitoring the gaps that define and complete this pattern is crucial. Gap patterns occur when a significant price disparity occurs between consecutive days.

Gaps up form when two consecutive white candlesticks show an opening price higher than the previous day’s closing price. Conversely, gaps occur when two consecutive red candlesticks reveal an opening price lower than the previous day’s closing price.

Like other reversal patterns, island reversals typically receive support from breakaway gaps that initiate the formation of the isolated island cluster. Furthermore, an exhaustion gap often emerges to signal the conclusion of the pattern. The appearance of the exhaustion gap is generally the first indication of a new trend, accompanied by several runaway gaps in the same direction before an eventual exhaustion gap. Some authors who have researched this price pattern suggest that it occurs infrequently and tends to yield unsatisfactory performance results.

Bullish and bearish reversal patterns

Bullish and bearish reversal patterns significantly impact trading strategies, providing insights into market conditions and price movements. Traders use tools like moving averages to detect potential shifts in sentiment.

Support/resistance levels validate reversals, while fundamental analysis complements technical analysis. Different strategies cater to day, position, and swing traders. Adaptation and continuous monitoring ensure robust decision-making. The importance of bullish reversal patterns cannot be overstated in the trading realm.

These patterns provide valuable insights into future price movements, presenting favorable buying opportunities. Operating within varying time intervals, these patterns are reliable indicators of ongoing trends. Traders, whether day traders or position traders, employ distinct trading approaches to capitalize on these bullish reversals. To succeed in trading, thorough analysis and effective risk management strategies are of utmost importance.

Understanding the significance of bullish reversal patterns is crucial in trading. These patterns offer insights into future prices and create buying and selling opportunities. Spanning different time intervals, they indicate ongoing trends, guide day traders, and position traders in their strategies.

Utilizing moving averages, traders navigate market conditions and support/resistance levels. The fundamental analysis complements technical analysis in identifying pattern formations. Recognizing double bottoms on price charts, swing traders anticipate trend reversals. By closely monitoring market prices, traders adapt their positions. Ultimately, comprehending bullish reversal patterns helps traders make informed decisions and achieve success in trading.

Decoding Trend Reversals: Chart Patterns for Market Shifts

Trend reversals signify a significant change in price direction within financial markets. Traders rely on chart patterns to identify these shifts. Chart patterns, observed across different timeframes, display visual formations of price data that indicate potential trend reversals.

Common patterns include double tops/bottoms, head and shoulders, triangles, and wedges. These patterns reflect changes in market sentiment and act as signals for adjusting positions or entering new trades. While chart patterns provide valuable insights, traders should consider additional indicators, market conditions, and risk management techniques to confirm trend reversals.

By leveraging chart patterns alongside other tools, traders can effectively identify and capitalize on trend reversals.

Bottom Line

If you’ve been looking for a proper trading education regarding pattern forms on Investopedia or other crucial resources, you’ll get additional information about the Island Reversal Pattern. It’s also important to find all the types of trading strategies available that would additionally help your trading career with your knowledge of chart patterns.

As a takeaway, it’s crucial to understand that the Island Reversal Pattern represents a specific price pattern on a daily chart that includes assembling days that are split up by gaps in the price action. It’s utilized by traders who want to confirm whether prices would reverse any trend they’re presently manifesting either upward or downward or vice versa.