Inside bar pattern: what is it for, how can you use it?

Discover the inside bar candlestick pattern, a trader’s key for short-term gains. This compact bar often signals a pause in trending markets, where the next move might be a price breakout, bullish or bearish.

Mastering trading the inside bar could become a core part of your trading strategy. Consider the size of the inside bar and highs of the inside bar to spot a profitable inside bar setup. Utilizing risk-reward ratios wisely turns this pattern into a consistent winner. Whether it’s a bullish inside bar or its bearish counter- trend trading, understanding this pattern can sharpen your market edge.

Inside bar pattern – key takeaways

- Trade inside bars in line with the dominant trend on the daily chart for more reliability and better risk-reward ratios.

- These patterns can signal both continuations and reversals, but they should not be used alone—market context and trends are crucial.

- Practice is key before real trading, and using stop loss placement is essential to protect capital. Inside bars are less effective on chart time frames lower than the daily chart, as they can produce more false signals.

What is an inside bar pattern?

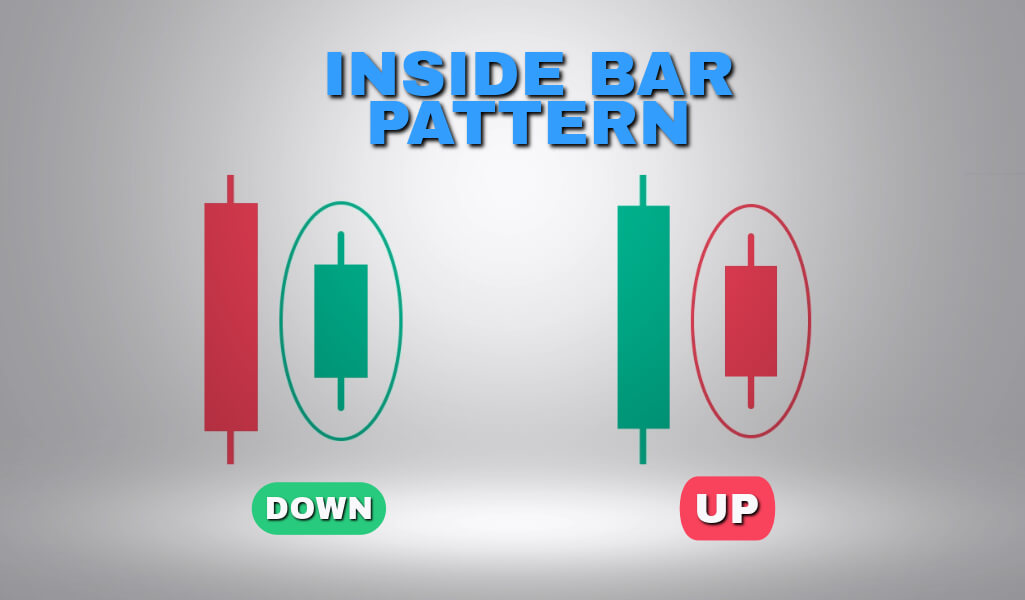

The inside bar strategy, or “inside bar strategy” is a technical figure composed of two candles. A first candle (A) is followed by a candle (B) whose height is lower than the height of the first candle AND the low is higher than the low of the first candle. The first candle is also called the “mother candle” and the small candle “inside bar” or “interior candle”.

The price accelerates when an inside bar pattern breaks. This is explained by the fact that the inside bar indicates a consolidation phase. A market consolidation phase is a bit like the calm before the storm. However, they can also form at market turning points and act as reversal signals from key support and resistance levels.

How to apply the inside bar strategy?

In trading, the inside bar strategy is a simple approach which, when properly applied, allows you to obtain good results.

This strategy can be used alone but it is also possible to combine it with other strategies.

This article is devoted to a simple but effective “inside bar strategy”. If you are looking for a broker to invest in stocks, click here.

Before taking a closer look at the inside bar, we remind you of some basics of Japanese candlesticks. Besides the color of the candles, each has four major points:

The rules of the inside bar strategy

Inside bar buy signals

To get a buy signal, we first look for inside bar patterns on the chart. You can apply this method to any time frame. If you are new to this strategy, it is recommended to start with a higher time unit. This way, you have more time to learn how to master the inside bar figure.

After noticing an inside bar, you notice that the largest candle is always to the left of the other candle. To enter a position, you must use a buy stop order. The stop level is at the highest level of the parent candle (the left candle). If the price exceeds this level, it is appropriate to open a long position. Then place a stop sell order to protect your capital. You place it just below the lowest price of the parent candle.

We use a filter to avoid taking long positions while the price is in a downtrend. We therefore use the 21-day MME. If the 21-day EMA is bearish or moving horizontally, then we refrain from taking a long position.

Inside bar sale signals

To identify sell signals, we first look for inside bar patterns on the chart. Like buy signals, you can apply this method to any time frame. But in our case, we use the daily chart and the 4h chart.

To get sell signals, a 21-day EMA must be bearish. This implies that the price is in a downtrend. We then look for inside bar patterns and place a stop sell order at the lowest price of the parent candle. We associate our stop buy order at the highest price of the parent candle.

Inside bar trading in practice

To put the strategy into practice, we use the three most traded stocks during the first quarter of this year to see the result obtained. We use the daily chart to keep it simple. The shorter the chart period, the more signals the strategy will give. We use a trailing stop to protect capital as soon as we record a 1% gain.

The blue arrow indicates the period favorable to taking long positions. In other words, when we see an inside bar on the chart in the blue zone, it is then appropriate to place a buy stop above the parent candle. The protective stop is placed under the lowest of the mother candle. Depending on your risk appetite, you can use a trailing stop or a fixed stop that you move as the trade becomes profitable.

The blue zone is determined by the direction of our trend filter, the 21-day EMA. If the 21-day EMA is clearly bearish, then for short positions we are only interested in a sell stop entry. This entry is made by placing the sell stop below the lowest price of the parent candle. The protective stop or trailing stop is placed above the highest price of the parent candle.

The trend filter: the 21-day EMA

The indicator used in this strategy is the 21-day exponential moving average (EMA). This indicator allows us to detect the trend. If the EMA is moving upward, then it is a bullish trend. If the EMA is moving downward, then it is a downtrend. An EMA that moves horizontally means that the price is in a period of consolidation. In this case, an “inside bar strategy” does not apply.

Tips on Trading the Inside Bar Pattern

- Start by trading inside bars that align with the dominant trend on the daily chart.

- Use inside bars at key levels for reversals with caution; they require more skill.

- Focus on the daily chart for inside bars; lower time frames often give false signals.

- Multiple inside bars within one mother bar suggest a longer consolidation, hinting at a stronger breakout.

- ‘Coiling’ inside bars indicate a series of progressively smaller bars, signaling potential for a significant move.

- Practice spotting inside bars on your charts before you trade them in real markets.

- Make your first inside bar trade on the daily chart during a clear trend.

- Inside bars can follow pin bars or form part of a fakey pattern, making them crucial to learn.

- Inside bars often present attractive risk-reward ratios, with tight stops and potential for strong breakouts.

Inside bar chart pattern pros

The advantage of this strategy is that the risk/reward can considerably benefit the trader. But it goes without saying that some trades will also generate losses. It is essential to always use a stop-loss order to protect your capital. You can use this strategy as a base and add some parameters to it. Very often, investors tend to complicate their lives. This strategy is a good example of the KISS principle (Keep it simple) which means that there is no point in complicating things.

Disadvantages of using inside bar pattern

You should not use the inside bar as an isolated factor. Price action trading strategy is extremely important when trading markets using inside bar patterns.

Also, don’t sell or buy a breakout if you didn’t first take a look at the overall market situation. You should determine whether there is a trend, and if the inside bar is near support and resistance levels.

Inside Bar Patterns is not so effective for a lower time frame. The best time frame for Inside Bar pattern is the daily chart or above. Inside bar patterns lose their effect if it’s Below the four hour charts.

Inside bar pattern – In conclusion

The inside bar strategy is a straightforward yet effective trading method. It involves spotting a smaller “inside bar” candle within the range of a larger “mother candle or mother bar.” This pattern can signify either a continuation or reversal, depending on the trend and position relative to the 21-day exponential moving average (EMA).

Traders seek buy signals when the price breaks above the mother candle’s high in a bullish trend, while sell signals occur when the price drops below the mother candle’s low in a downtrend.

The strategy favors higher time frames like the daily chart to avoid the noise and false breakouts common in shorter time frames.

It is critical to trade inside bars with the trend and to use stop-loss orders to manage risk. Inside bars can offer high risk-reward opportunities but should not be traded in isolation without considering the overall market context.