How to Avoid the Early Withdrawal Penalty from Individual Retirement Accounts

What can you do if you have drained your emergency fund but your unforeseen costs keep on piling up? Is there a solution without finding out how do you borrow money from cash app or get into debt? Many Americans choose to utilize their tax-advantaged retirement savings, such as 401(k) or IRA.

While it may be a decent alternative to the lending option, the government still imposes a penalty on such withdrawals made before the age of 59 ½. In this article, we are going to talk about the exceptions and tips on how to avoid paying this penalty for early withdrawals of funds from individual retirement accounts.

Taxes and Early 401(k) Withdrawal Penalty

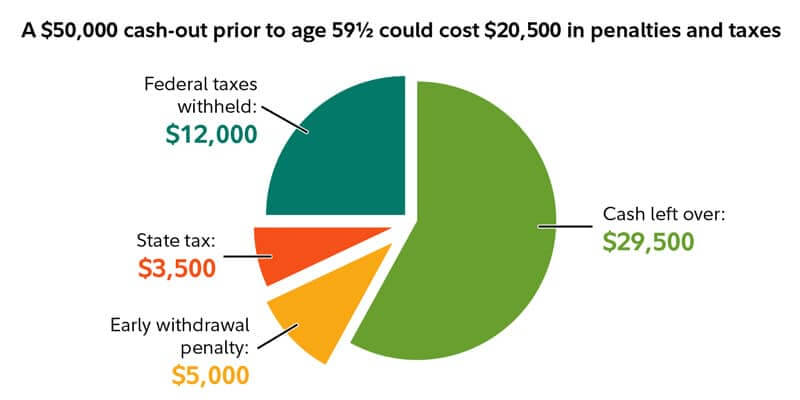

Cashing out earlier may lead to a large tax bill. The plan administrator will automatically withhold 20% of the withdrawal and send it straight to the IRS. This sum will be used to cover the federal income taxes a person has to pay on this withdrawal. In other words, a big portion of your savings will be given to the IRS.

Source: Fidelity

It is the money you have been setting aside for many years. And you won’t be able to save this chunk of funds for your retirement anymore. Apart from state and federal income tax, investors younger than 59 ½ who cash out can have to cover a 10% early withdrawal penalty. Hence, a $50,000 cash-out before this age could cost you $20,500 in taxes and penalties.

If you still need to make a withdrawal, certain hardship situations may be exceptions from paying the penalty, but the taxes will still need to be paid:

- Withdrawals of nondeductible contributions to 401(k) and traditional IRA plans aren’t subject to the same taxes as deductible contributions. Employees still need to pay taxes on any earnings withdrawn from their accounts.

- Withdrawals from 401(k) and IRA plans with pre-tax contributions include taxes as common income rates.

- You can take out contributions from a Roth IRA at any time. These earnings can be taken out tax-free and penalty-free after the investor turns the age of 59 ½, and the account should have been open for five or more years.

Top Ways to Avoid Early Withdrawal Penalty

Consumers are meant to contribute to their retirement accounts to finance their lifestyle in their golden years. If you encounter a sudden financial disruption, you may decide to tap these contributions.

Withdrawing a portion of your retirement savings earlier may cost you a penalty. Are you willing to learn about the ways to avoid this penalty both for your savings in the workplace plan such as 401(k) or IRA? Yes, here are the exceptions to this rule.

Higher Education Expenses

You won’t need to pay the penalty if you utilize the funds from your IRA or 401(k) fund to cover higher education costs. The funds may be used not only for your education but also for your spouse, children, or even grandchildren.

Such expenses include equipment, books, supplies, fees, and tuition. Room and board are also included in this list. Students need to attend a vocational school, university, or college that can take part in U.S. Department of Education student aid programs.

Health Insurance for Unemployed People

If you lost employment, you wouldn’t need to pay the penalty on distributions to cover your health insurance premiums or those for your dependents or spouse. You should have obtained unemployment benefits for 12 weeks via a state or federal program. You may take out some funds from your IRA account within the same year or the next year you obtained unemployment.

People Who Buy Home for the First Time

This title doesn’t mean you should only aim to purchase your first home. According to the IRA regulations, this exception refers to all consumers who haven’t owned a home within the past two years.

If you have an IRA account and haven’t been a homeowner for the last two years, you may take out up to $10,000 without penalties. However, keep in mind that these finances should be only utilized for qualified expenses such as rebuilding a home, building it from scratch, or the expenses of purchasing a new home.

Death

If the owner of the IRA fund dies, beneficiaries who inherit this account mustn’t pay any penalties for withdrawing the money before they turn 59 ½.

Adoption or Birth

Every parent has the right to utilize up to $5,000 per adoption or birth from their retirement funds. Associated costs can be covered using this money. You can make the withdrawal within the year after you adopted the child or after the child was born.

Unreimbursed Medical Costs

If you need to cover some medical expenses, you may not need to pay the penalty for withdrawing cash from your individual retirement fund. Medical costs must be unreimbursed and exceed 7.5% of your yearly adjusted gross income. Tax deductions shouldn’t be itemized to obtain this benefit.

Disability

Some disabled consumers can also avoid paying the tax penalty. You need to be permanently disabled to qualify for this exception. What does it mean to be totally disabled? It means you can’t perform any gainful activity due to mental or physical condition.

This condition must be certified by a physician. It can be really tough to qualify for this rule as a person needs to be bedridden or near death to avoid a penalty for early money withdrawal from their 401(k) or IRA.

The Bottom Line

Summing up, you should pay the penalty for the early withdrawal of funds from your individual retirement account or 401(k). In order to avoid this penalty, you may qualify for one of the abovementioned cases. Even though you will avoid a penalty, these withdrawals may still be subject to state and federal tax.

If you want to define what taxes you owe, you may consult with a certified tax professional who will help you submit the necessary forms. Taking out a personal loan or boosting your earning potential may be helpful to cover urgent monetary needs apart from taking more from your retirement account.