Gold drops and Silver continues recovery

- During Asian trading, the price of gold dropped from the $ 1840 level, and now we will test the $ 1830 level.

- The price of silver resisted pressure for the second day and remained above $ 21.50.

- European Union leaders are expected to maintain sanctions on Russia.

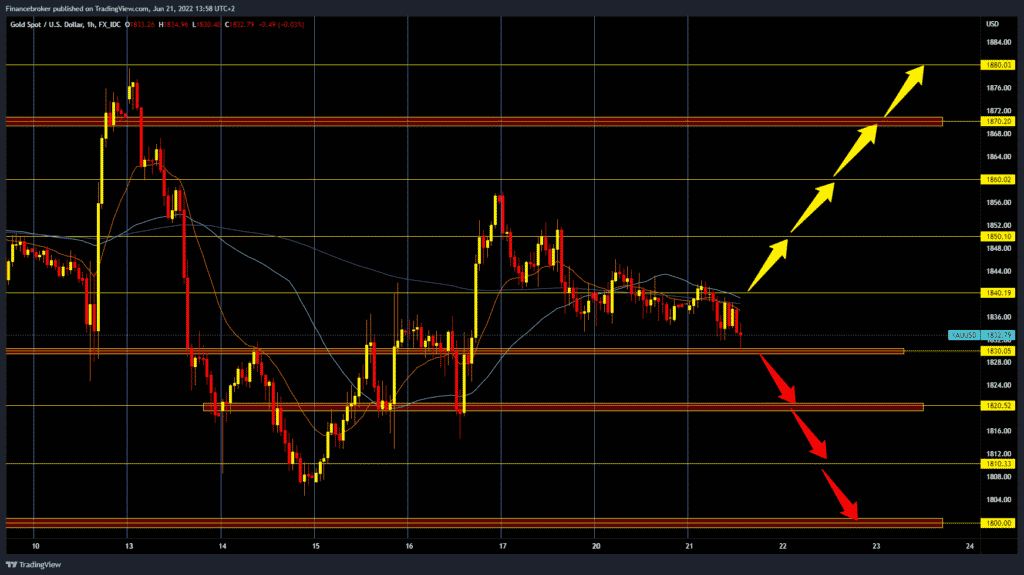

Gold chart analysis

During Asian trading, the price of gold dropped from the $ 1840 level, and now we will test the $ 1830 level. Financial markets estimate that there is a 98% chance that the US Federal Reserve will increase the reference interest rate again by 0.75% at the end of July, which was the reason for the increased volatility and the withdrawal of the gold price. The price of gold is trading around $ 1831.5 per fine ounce, which is a drop in price of 0.35% since the beginning of trading last night. There is increasing pressure on $ 1830, and we may see a break below. We are looking for the next support at the $ 1820 level, the place of support on June 16. If the pressure on the price of gold continues, it could continue lower towards $ 1810 and $ 1800 psychological support. For the bullish option, we need a new positive consolidation and a price jump above the $ 1840 level. After that, the price could try to test the $ 1850 level. If it succeeds, the next target is the $ 1858 previous high and the $ 1870 upper resistance zone.

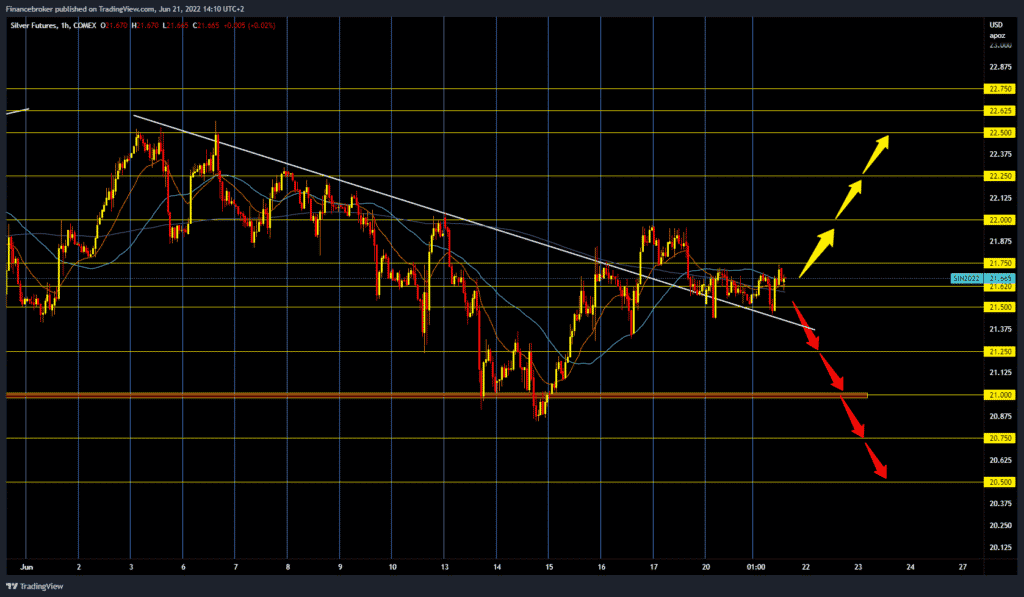

Silver chart analysis

The price of silver resisted pressure for the second day and remained above $ 21.50. The price movement takes place in the range of $ 21.50-21.75. For the bullish option, we need continued positive consolidation and a price jump to the $ 22.00 level. A price break above $ 22.00 would bring us back into the bullish trend with the goal of climbing to the next resistance zone around $ 22.50. We need negative consolidation and new testing of the $ 21.50 support zone for the bearish option. A fall below this level would lead to the forming of a new lower low, which is a sign of a further pullback of the price. Potential lower targets are $ 21.25 and $ 21.00 support levels.

Market overview

European Union leaders are expected to maintain sanctions on Russia at this week’s summit, Reuters reports, citing a draft document. The draft document mentions that EU leaders could consider a possible next round, this time targeting gold. The latest version of their draft conclusions read: “Work on sanctions will continue, including strengthening implementation and preventing circumvention.”

Although no new package is being prepared, officials said that work is underway to identify sectors that could be affected. Gold is one of the possible targets, officials familiar with the discussions said, adding that “it is not yet clear whether the measure could ban exports to Russia, imports from Russia or both.”

According to a report by the Swiss Federal Customs Administration, Switzerland exported about 105 tons of gold in May. Less than half of this total went to China and India. At 10 tones, gold exports to China were the lowest in 14 months. This could be related to the closure due to the coronavirus, which has severely limited public life. India imported only 36 tons of gold from Switzerland – the highest figure in six months. The price of gold in Indian rupees fell sharply from mid-April to mid-May, encouraging Indians to buy gold. The Bank of India reported more than 100 tones of gold imports in May.