Gold and Silver: The Price of Gold Stopped at the $1621

- The fall in gold prices stopped this morning at the $1621 level.

- During the Asian trading session, the price of silver finds support at the $18.2 level.

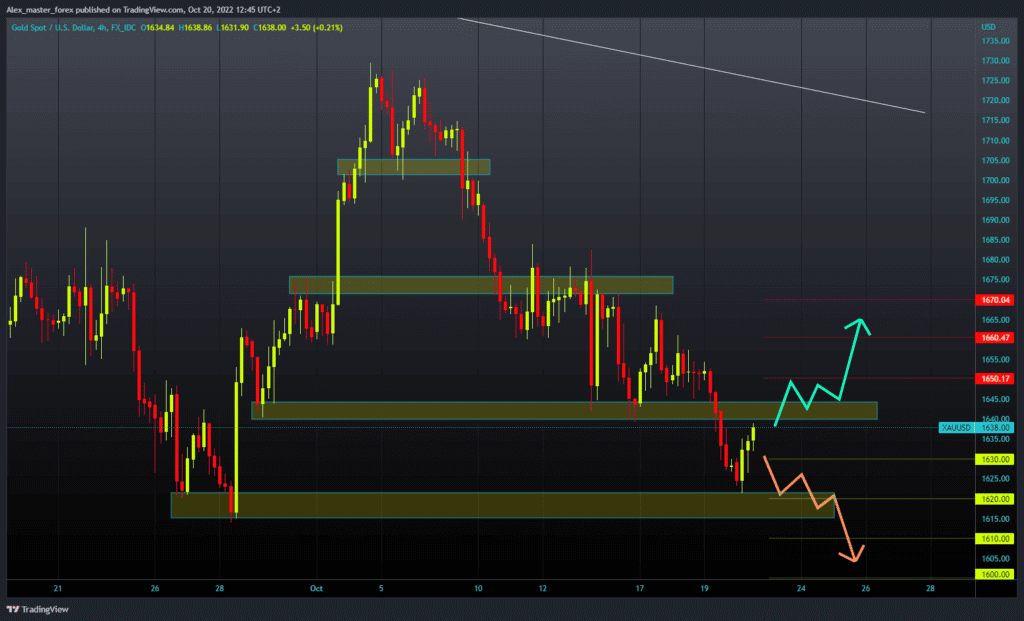

Gold chart analysis

The fall in gold prices stopped this morning at the $1621 level. Since then, the price has been in a bullish surge, and now we are already at the $1635 level. To continue the bullish option, we need further positive consolidation and testing of $1640, the previous level of support from the beginning of the week.

Then we need to hold on to that place and continue the recovery with a new bullish impulse. Potential higher targets are $1650 and $1660 levels. We need a negative consolidation and a return to this morning’s support level for a bearish option. Increased pressure in that place could negatively affect the price of gold. Potential lower targets are $1610 and $1600 levels.

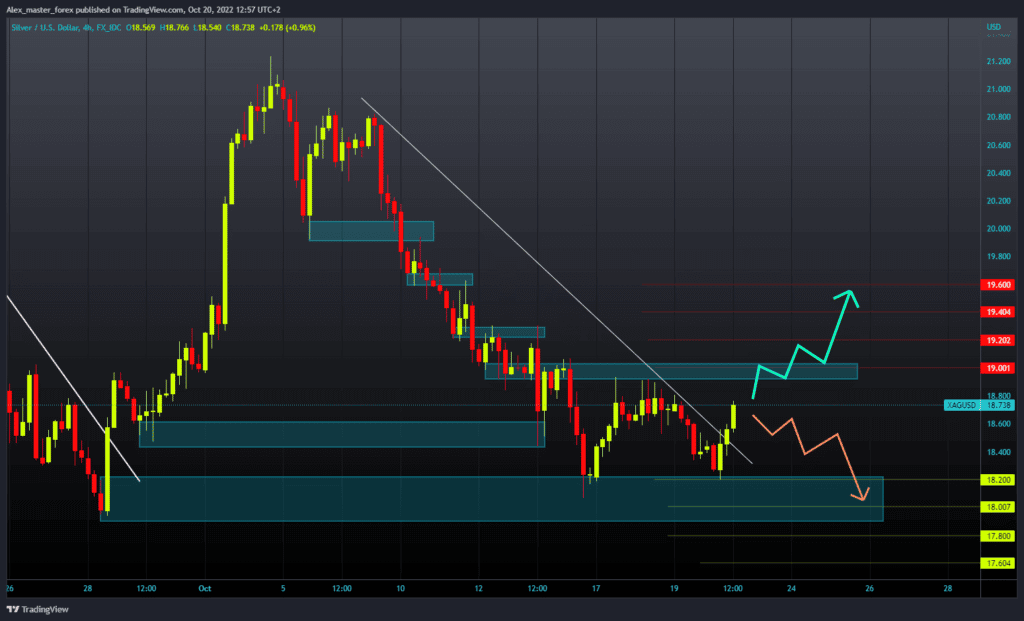

Silver chart analysis

During the Asian trading session, the price of silver finds support at the $18.2 level. A new bullish impulse soon followed, and the price is now $18.75. We could soon test the previous resistance’s zone $18.80-$19.00. If the price manages to move above, it would have a good chance of starting a further recovery.

Potential higher targets are the $19.20 and $19.40 levels. We need a new negative consolidation and a return to the $18.20 support level for a bearish option. The inability to hold on there will lead to a further decline in the price of silver. Potential lower targets are the $18.00 and $17.80 levels.

Market overview

The prospect of more aggressive policy tightening by major central banks is holding back gold prices. Markets expect continued rate hikes by the European Central Bank and the Bank of England. The Federal Reserve is also expected to continue its aggressive rate hike cycle.