Oil and Natural Gas: The Price Recovery to the $85.90

- In the previous two days, the oil price found support at the $82.00 level.

- The price of natural gas dropped to $5.40 last night.

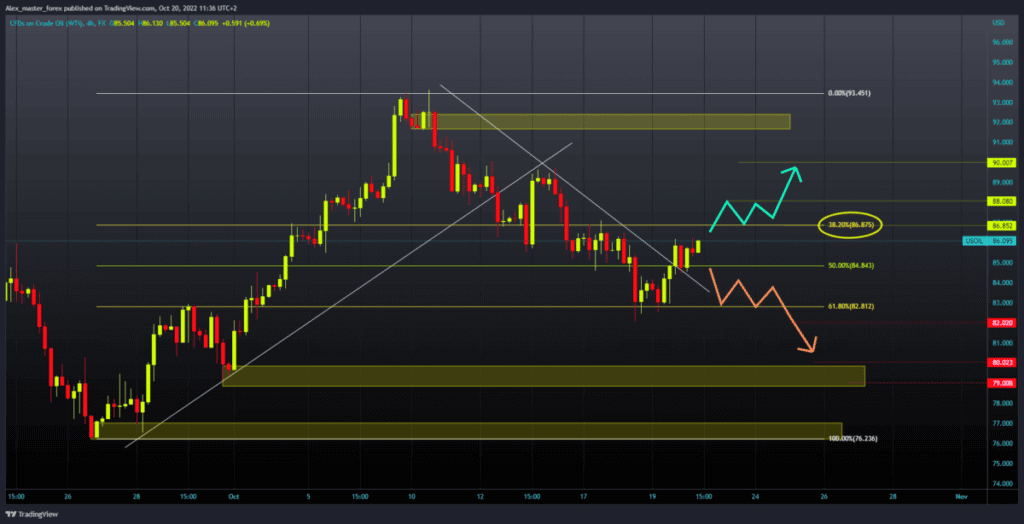

Oil chart analysis

In the previous two days, the oil price found support at the $82.00 level. After this, we see the oil price recovery to the current $85.90. During yesterday’s oil price consolidated around the $85.00 level, and today we saw a break above and the continuation of the bullish impulse. Now we need to move up to $87.00 and try to hold there.

With a new bullish impulse, the price could continue its recovery. Potential higher targets are the $88.00 and $90.00 levels. We need a negative consolidation and pullback below the $85.00 support level for a bearish option.

After that, the price should continue toward the previous support zone at the $82.00 level. If we fail to find support there, a continuation of the fall in oil prices could be expected. Potential lower targets are the $80.00 and $79.00 levels.

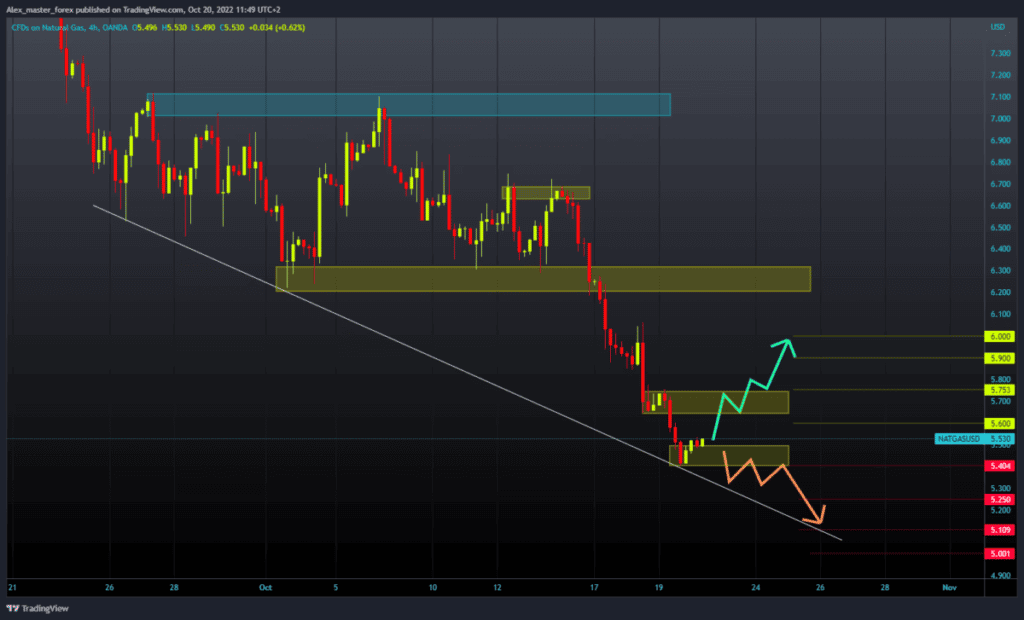

Natural gas chart analysis

The price of natural gas dropped to $5.40 last night. During the Asian trading session, the gas price started a minor recovery to the $5.50 level. We need a positive consolidation and price movement to the $5.60-$5.75 previous support zone for a bullish option.

Then we need to hold on there and try to continue the gas price recovery with a new bullish impulse. Potential higher targets are the $5.90 and $6.00 levels. We need a negative consolidation and a new test of the $5.40 support level for a bearish option. Increased pressure at that level could further lower the price of gas. Potential lower targets are the $5.25 and $5.00 levels.

Market overview

US President Joseph Biden will announce the decision to activate 15 million barrels of oil from strategic reserves in response to recent production cuts announced by OPEC plus countries, US officials said.

In March, Biden approved the use of 180 million barrels of oil from reserves, and it was initially planned that this amount would be used over a period of six months. As a result, strategic oil reserves in the US have fallen to their lowest level since 1984, and the administration in Washington has announced that it is a “bridge” until domestic production increases.

The reserves now contain about 400 million barrels of oil. Biden will also open the door to activating additional quantities from reserves over the winter to keep prices at a lower level.