Gold and Silver: Still bullish trend

- Early this morning, the price of gold interrupted its two-day decline from $ 1,875 to $ 1,835.

- This morning’s price of silver found support at $ 21.87 after yesterday’s fall from $ 22.57.

- Market sentiment remains weak amid concerns that a more aggressive move by major central banks to curb inflation could pose challenges to global economic growth.

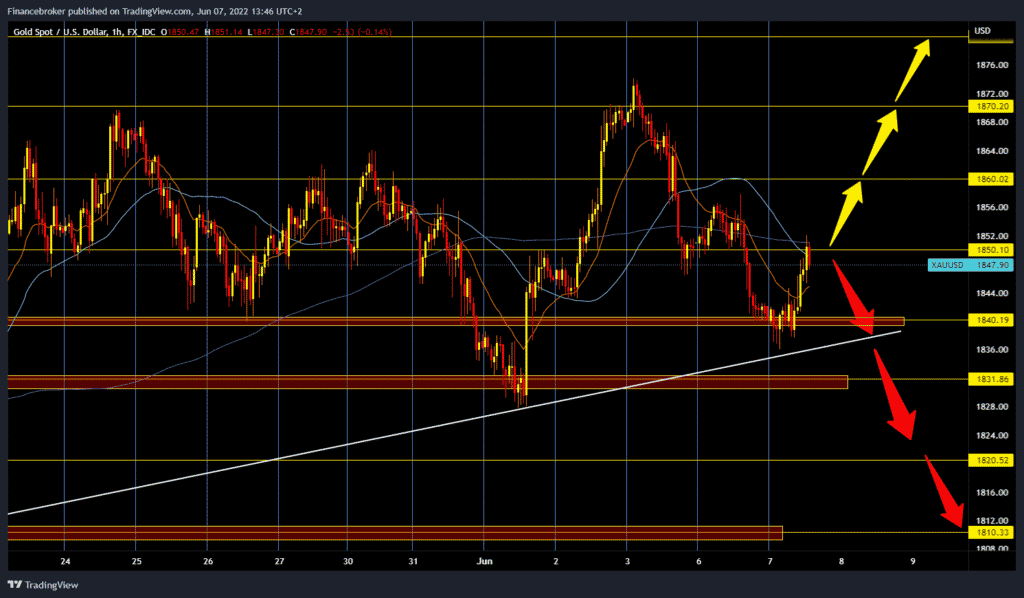

Gold chart analysis

Early this morning, the price of gold interrupted its two-day decline from $ 1,875 to $ 1,835. The gold returned quickly above 1840 dollars, and with the new bullish impulse, we are now testing 1850 dollars. An additional resistance at this level is our MA200 moving average. The price break above opens up space for us to $ 1860, then $ 1870 to the previous resistance zone. If we do not see the formation of a new higher low, we can expect a new withdrawal in the price of gold. Additional support at $ 1840 is our bottom trend line. A break below this lower trend line would increase bearish pressure, and our potential targets are $ 1830, $ 1820 and $ 1810.

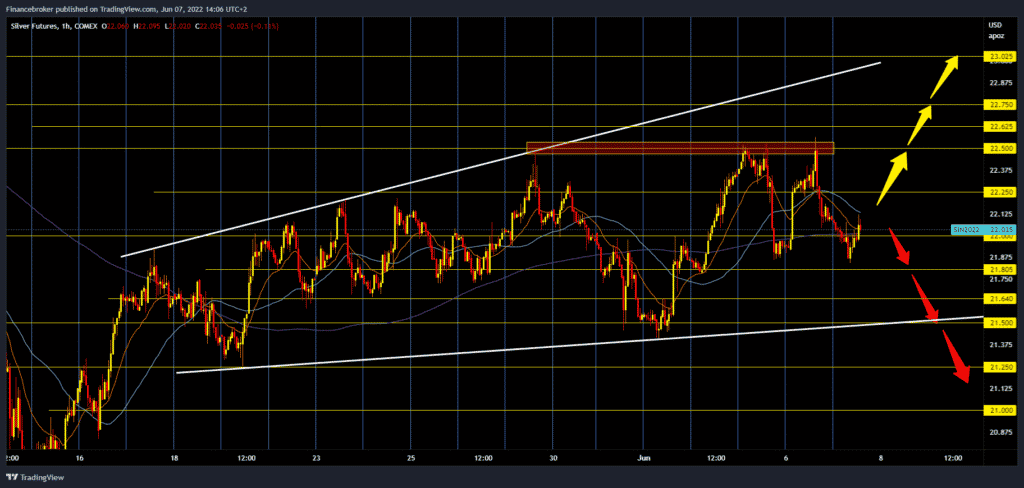

Silver chart analysis

This morning’s price of silver found support at $ 21.87 after yesterday’s fall from $ 22.57. Since then, the price of silver has been in a bullish trend, and now we are consolidating around $ 22.00 and looking at moving averages, we see that they are neutral with mild bearish pressure. Based on that, the price could continue to move sideways or make a smaller pullback to the lower trend line at the $ 21.50 price. For the bullish option, we need the continuation of the current positive consolidation. Our potential next target is $ 22.25, then $ 22.50.

Market overview

Gold remains under pressure. According to a strategist at Commerzbank, a strong payroll report for the NFP released on Friday has exacerbated the potential for falling gold. “Gold is being controlled by a strong U.S. dollar and rising bond yields. Yields on ten-year U.S. vaults are currently again above the 3% mark. This has led to a resurgence in actual interest rates, making gold unattractive to investors. Gold has come under pressure since last Friday, probably thanks to a strong U.S. labor market. Because 390 thousand new jobs were created in the United States in May, more than expected.

Market sentiment remains weak amid concerns that a more aggressive move by major central banks to curb inflation could pose challenges to global economic growth.

Investors seem nervous because the global supply chain disruption caused by the war between Russia and Ukraine will continue to raise consumer prices and force the Fed to tighten its monetary policy faster. The European Central Bank is expected to join its global counterparts and raise interest rates to reduce inflation. This, together with the modest strength of theU.S.S dollar, could further contribute to holding back any significant increase in gold.