Oil and Natural Gas: Heating season

- During the Asian trading session, the oil price was stable, consolidating around $ 119.00.

- The price of natural gas continues to rise despite the end of the heating season.

- Natural gas futures reached a 13-year high at higher temperatures to come next week, combined with lower production levels.

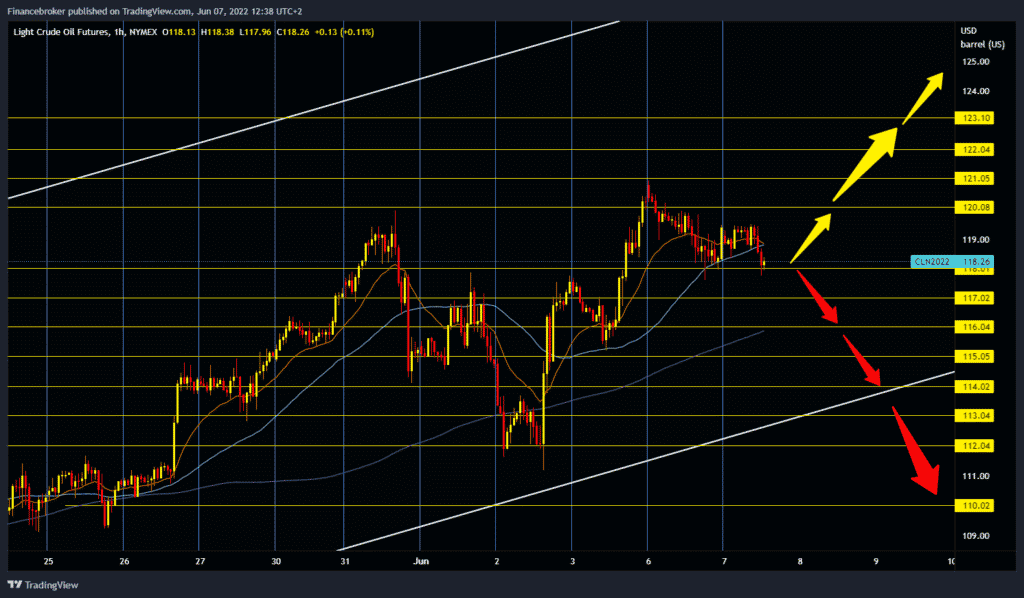

Oil chart analysis

During the Asian trading session, the oil price was stable, consolidating around $ 119.00. As the European session began, the price of black gold began to fall, and we are now at $ 118.00, which is a drop of 0.37% compared to the beginning of trading last night. The price has dropped below the MA20 and MA50 moving averages, which technically increases the bearish pressure, and our target is the MA200 moving average of around $ 116.00.

Yesterday, the oil found support in a similar position and managed to stay above, and today we have a new test of the same position. The maximum pullback price on this time frame could happen up to the lower trend support line in the zone around $ 113.00-114.00. For the bullish option, we need consolidation at $ 120.00. After that, we need to break above and test yesterday’s high at $ 121.00, and further bullish momentum could climb us to a $ 122.00 price.

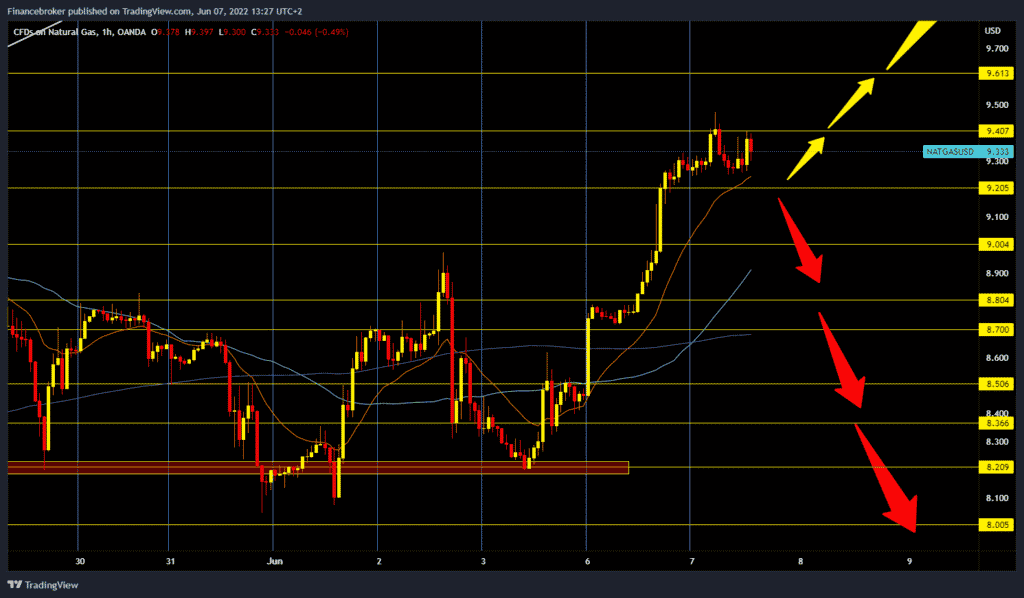

Natural gas chart analysis

The price of natural gas continues to rise despite the end of the heating season. The price of natural gas has been in a strong bullish trend for the previous two days. Support was found at $ 8.20. This morning, during the Asian trading session, the price of natural gas formed a new thirteen-year high at $ 9.48. The last time the gas price was here was in 2008, during the previous economic crisis. Let’s go back to the daily analysis. During the European session, the price ranges from 9.20 to 9.40 dollars. On the downside, we have support in the moving average of MA20, and if there is a break below and below $ 9.20, we could see that the withdrawal continues until the next better support. Potential lower support levels are $ 9.00 and $ 8.80, the previous place where the price has stood for a long time.

Market overview

Natural gas futures reached a 13-year high at higher temperatures to come next week, combined with lower production levels.

On Monday, Henry Hub’s natural gas futures rose nearly 10% to a 13-year high. Demand for natural gas in Texas is expected to rise to a record high this week – even before the hottest part of summer.

Natural gas futures also encourage growing demand, declining production and growing exports of liquefied natural gas (LNG) from the Gulf Coast, redirecting domestic supplies.

In its perspective for 2022, published at the end of May, the Federal Energy Regulatory Commission (FERC) predicted that the demand for natural gas in the USA would be higher than the supply this summer. As reported by NGI, FERC sees a 3.4% increase in dry natural gas production in the U.S. during the summer months, compared to a projected 4.8% increase in consumption over the same period.