Gold and Silver: Stagnation

- During the Asian trading session, the price of gold stagnated.

- The price of silver continues its bearish trend after failing to stay above the $ 21.50 level yesterday.

- The emergence of new purchases in US dollars has put some pressure on dollarized goods.

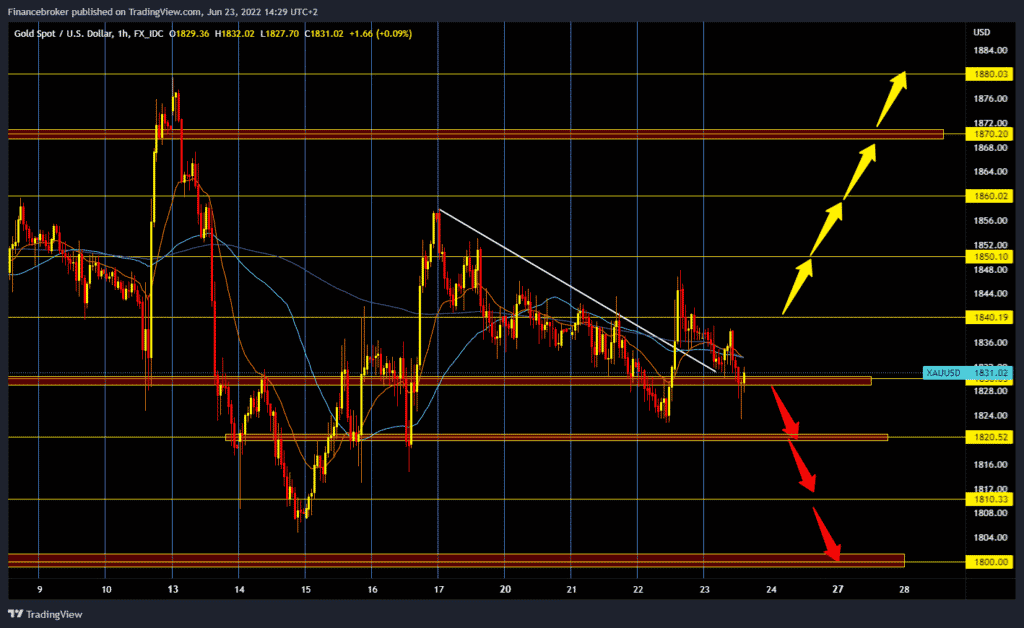

Gold chart analysis

During the Asian trading session, the price of gold stagnated. Fed President Jerome Powell confirmed in the US Congress yesterday that the Fed is fully committed to bringing prices under control, even if it risks an economic downturn. He said the recession was on its own, reflecting fears in financial markets that tightening the pace of Fed monetary tightening would slow economic growth.

The price of gold is trading at around 1830 dollars per fine ounce, which is a drop in price of 0.36% since the beginning of trading last night. For the bullish option, we need a new positive consolidation and the formation of a higher low at the $ 1830 level. After that, the price should continue towards the $ 1840 level. Our next target is the $ 1850 level. For the bearish option, we need continued negative consolidation and a decline below $ 1830. After that, we descend further towards the $ 1820 support zone. If it does not support us, the price of gold could continue towards $ 1810 and $ 1800 lower zones of support.

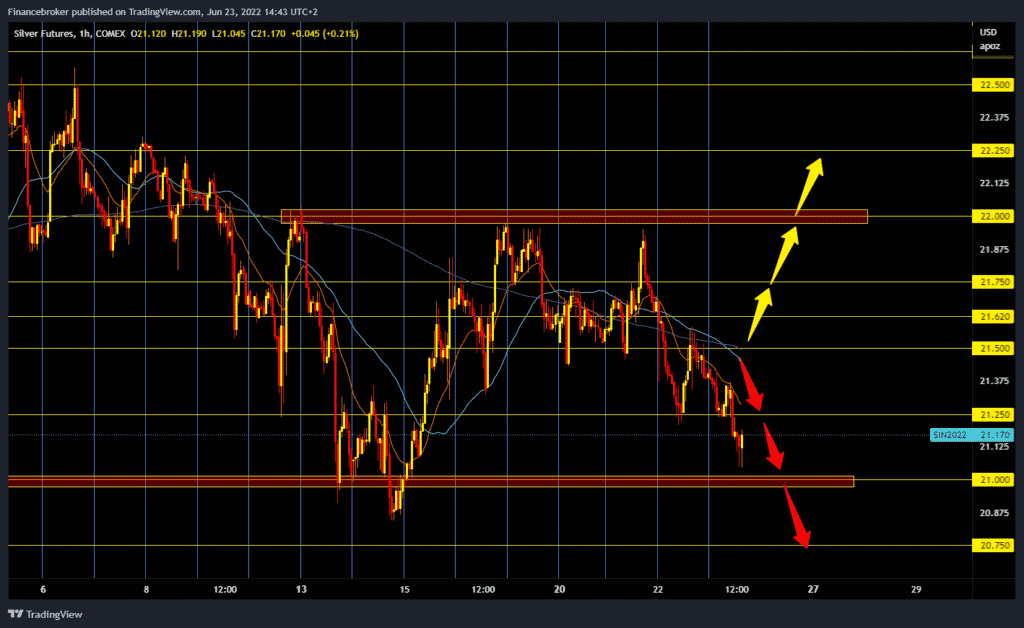

Silver chart analysis

The price of silver continues its bearish trend after failing to stay above the $ 21.50 level yesterday. During the Asian session, the price of silver continued to fall from $ 21.30 and stopped at the $ 21.05 level. At the $ 21.00 level, we expect some support before the next big move on the chart. For the bullish option, we need a new positive consolidation and a return above the $ 21.25 level. After that, the silver could continue its recovery towards the $ 21.50 resistance zone. If we climb above, we can expect further progress towards $ 22.00 this week’s resistance zone. We need negative consolidation and another $ 21.00 support zone test for the bearish option. The break below lowers us to last week’s low at $ 21.87.

Market overview

The emergence of new purchases in US dollars has put some pressure on dollarized goods. The downside seems to be mitigated for now, amid the prevailing risk-free mood, which tends to use gold as a safe haven. Market sentiment remains volatile amid doubts that major central banks could raise interest rates to curb rising inflation without affecting economic growth. In addition, the disappointing release of the eurozone PMI in June raised concerns about a possible recession and affected investor sentiment. The global flight to security has reduced yields on US Treasury bonds, which could prevent dollar bulls from making aggressive bets and further help limit gold losses.