Gold and Silver: Seven-day bullish consolidation and more

- Gold continues its seven-day bullish consolidation that began on May 16.

- During the Asian session, the price of silver consolidated at around $ 21.65, after which the price took a positive step, rising to the current $ 21.95.

- ECB President Lagarde hinted at an upcoming turnaround in interest rate policy.

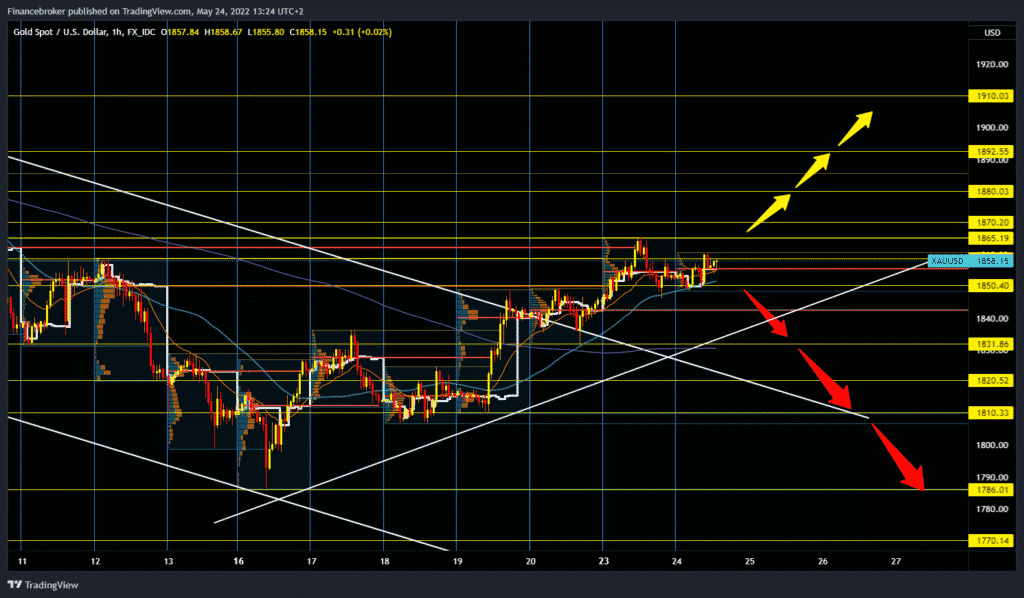

Gold chart analysis

Gold continues its seven-day bullish consolidation that began on May 16. Today, the price is in the range of 1850-1860 dollars. For two days now, the price has managed to stay above 1850 dollars, and if this consolidation continues, we will probably see the testing of yesterday’s high at 1865 dollars. The dollar is still retreating at 105.00, and gold traders use it skillfully. We need a break above yesterday’s resistance to continue the currently bullish option. After that, our potential targets are $ 1,870, $ 1,880, $ 1,890 and $ 1,900. For the bearish option, we need negative consolidation and pullback prices below $ 1,850. After that, I can expect the price to drop to $ 1840 and lower the trend line. The price break below could bring us down to the following potential targets of $ 1830, $ 1820 and $ 1810.

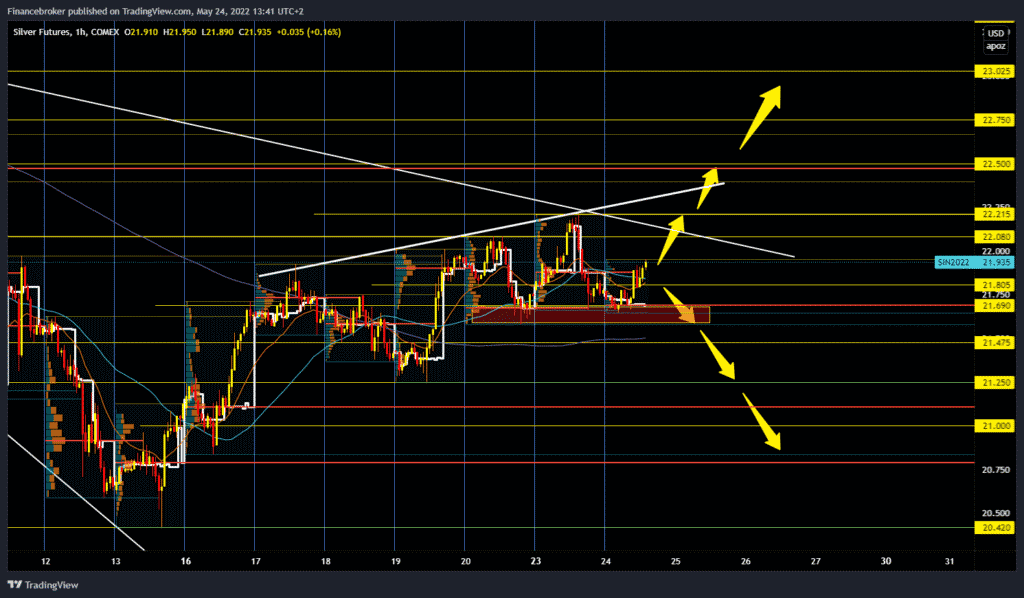

Silver chart analysis

During the Asian session, the price of silver consolidated at around $ 21.65, after which the price took a positive step, rising to the current $ 21.95. If this trend continues, we could test yesterday’s high again at $ 22.20. For further continuation, we need a price jump to $ 22.50 and stay at that level if we continue to continue on the bullish side. Our following bullish targets could be $ 22.75 and $ 23.00 levels. We need to withdraw below the $ 21.60 level for the bearish option, and after that, we can expect continuation on a bearish side. Our first target and support was last week’s low at $ 21.25. If he doesn’t support us, we ask for the next one at $ 21.00, then $ 20.75 and $ 20.50 level.

Market overview

ECB President Lagarde hinted at an upcoming turnaround in interest rate policy. The news caused a noticeable appreciation of the euro yesterday, withdrawing gold to $ 1,865 for a while. However, Commerzbank economists report that gold in euros is being kept under control.

Lagarde announced an ‘increase in interest rates for the period after the third quarter.

Our ECB observer believes that the ECB would consider 1-1.5% as a neutral rate. We assume that the ECB will raise the deposit rate by 25 basis points at each of its seven meetings between July and next May, bringing the rate to 1.25%. Market expectations are that interest rates will rise to 1.0% by then.

It is believed that the euro could benefit from the possibility of a more restrictive monetary policy of the ECB for some time, provided that the situation in Ukraine does not significantly worsen. This should support gold in US dollars but keep gold in euros at the current level.