Gold and Silver: Lower trend line?

- During the Asian trading session, the price of gold continued its bearish withdrawal from $ 1,848 to $ 1,842.

- During the Asian trading session, the price of silver continued to recede.

- The US dollar reached a 19-year high last month, putting gold prices under pressure.

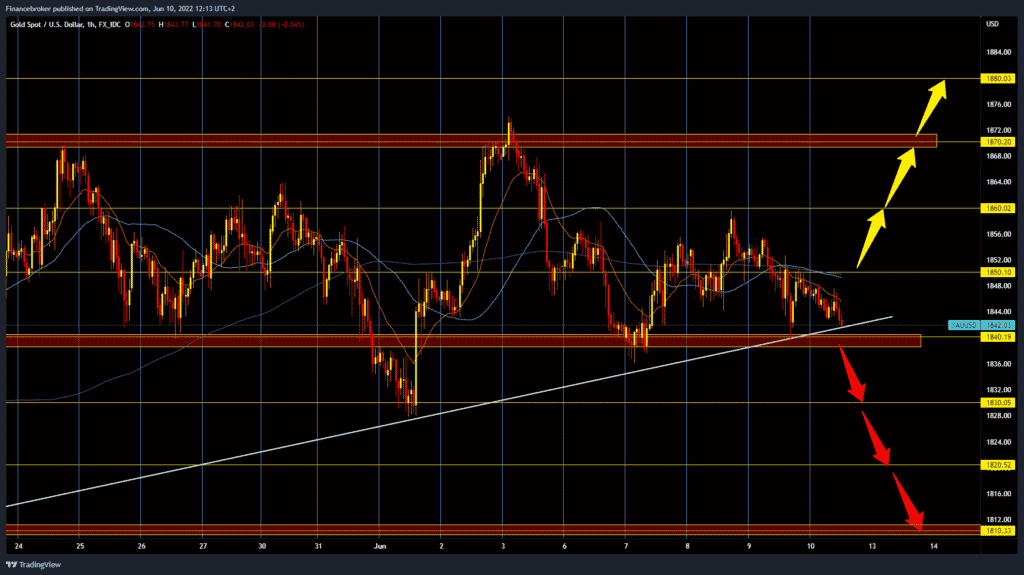

Gold chart analysis

During the Asian trading session, the price of gold continued its bearish withdrawal from $ 1,848 to $ 1,842. We are now very close to the $ 1840 support zone. The dollar index began to strengthen again, which was immediately reflected in the price of gold. If the dollar continues to strengthen, the price of gold could slip below 1840 dollars and continue to fall. Potential lower support targets could be $ 1830, $ 1820 and $ 1810. For the bullish option, we need a new positive consolidation and a return to the price above 1850 dollars. If the price manages to stabilize above 1850 dollars, it could then continue towards the next target at 1860 dollars. We can expect greater resistance at the $ 1,870 level because we have stopped there several times in previous bullish attacks.

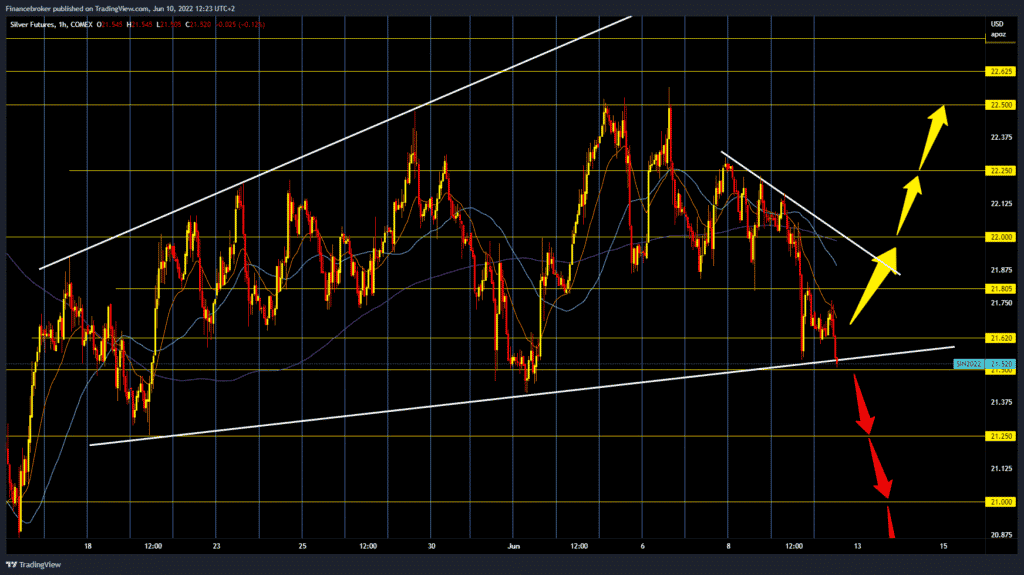

Silver chart analysis

During the Asian trading session, the price of silver continued to recede. We are now testing the lower trend line of support, and we could see a break below if we stay in this zone for too long. Continuing negative consolidation would push the price lower toward the $ 21.25 level. If we don’t find support there either, the price could slide further towards $ 21.00 and maybe even lower. For the bullish option, we need a new positive consolidation and a return of the price of silver above $ 21.80. At $ 22.00, we come to the upper trend line connecting the previous peaks. A price break above would boost bullish optimism, and the price could continue towards the 22.25 next resistance zone. If the bullish impulse continues, it is not excluded that we will visit last week’s resistance zone at $ 22.50-22.60.

Market overview

The US dollar reached a 19-year high last month, putting gold prices under pressure. But since the economists of ANZ Bank see the decisive peak in dollars, the yellow metal should breathe a sigh of relief in the coming period. The current USD cycle has probably peaked. The US Federal Reserve may be on the right track to lead to a further increase in interest rates, but the markets are now reassessing how high the Fed funds rate will be, given the tightening of financial conditions.

The price of gold is trading with big losses on the last day of trading this week. At the same time, investors continue to seek refuge in the safe US dollar amid persistent fears of rising inflation and a potential recession. Tightening central banks worldwide to try to cut inflation has again raised fears of potential continued inflation growth.