Gold and Silver: Bullish Trend For The Third Day

- During the Asian trading session, the price of gold rose to the $1727 level, after which we saw a pullback to the $1710 support level.

- The price of silver is in a bullish trend for the third day, and today’s maximum obstacle is at the $18.50 level.

- Recession fears fueled by Europe’s energy crisis are keeping investors on the sidelines while boosting yields globally.

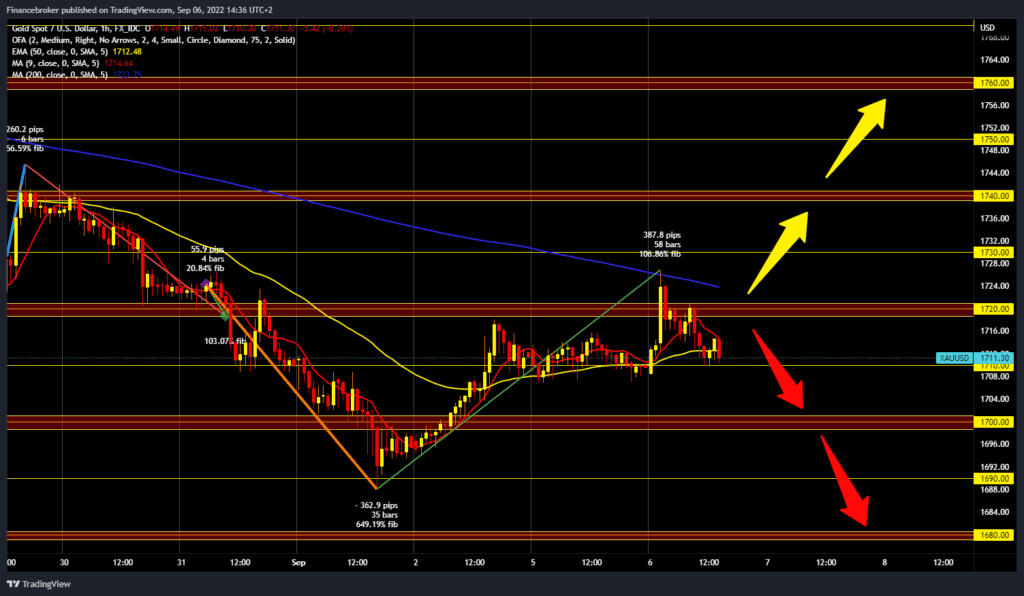

Gold chart analysis

During the Asian trading session, the price of gold rose to the $1727 level, after which we saw a pullback to the $1710 support level. For now, we are managing to stay above, but there are indications that we will see a break and pullback of the price to the $1700 level. If we do not find that support, the price could fall to the $1690 level, last week’s minimum. A potential lower target is the $1680 support level. We need a positive consolidation and a return above the $1720 level for a bullish option. Additional resistance at that level is in the MA200 moving average. A break above the gold price would contribute to a better atmosphere and potential further recovery. The following higher targets are $1730 and $1740 levels.

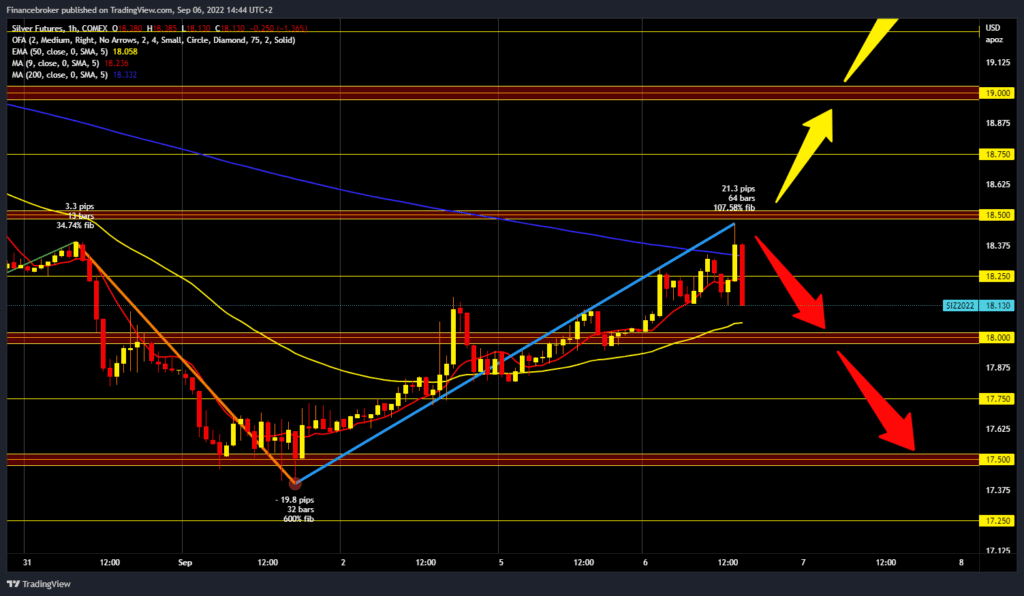

Silver chart analysis

The price of silver is in a bullish trend for the third day, and today’s maximum and obstacle is at the $18.50 level. The price has already retreated below $18.25 and continues towards the $18.00 support level. The MA50 moving average provides additional support at that level. A break below the silver price would increase the bearish pressure, and we would see a continuation of the negative consolidation. Potential lower targets are the $17.75 and $17.50 levels, our last week’s support zone. For a bullish option, we need another positive consolidation and a return to the $18.50 resistance level. A break above silver prices and staying at that level would signify that we could see a new bullish impulse. Potential higher targets are $18.75 and $19.00 levels.

Market Overview

Recession fears fueled by Europe’s energy crisis are keeping investors on the sidelines while boosting yields globally. This morning the RBA increased its interest rate from 1.85% to 2.35%, tomorrow the BoC also announced an interest rate increase from 2.50% to 3.25%, and on Thursday, there is a high chance that the ECB will increase its interest rate from 0.50% to 1.25%. This scenario does not suit gold at all, and we could expect further price pullback.