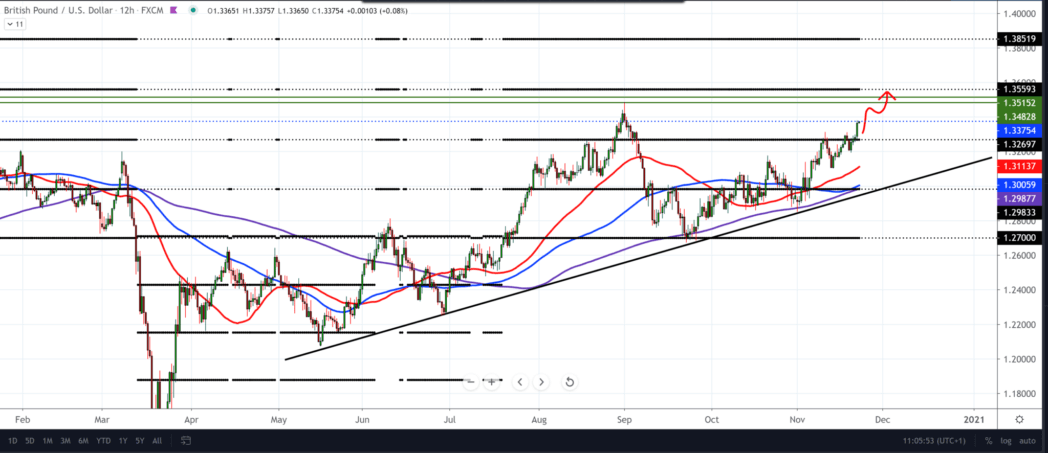

GBP/USD forecast for November 23, 2020

The GBP/USD pair managed to break above 1.33000 and continue towards 1.34000.

Positive news about the vaccine has reduced the risks, and investors are getting rid of the dollar, and other currencies are using it to their advantage and returning to normal sometime after Easter is the assumption of Matt Hancock, the British Minister of Health.

He spoke after AstraZeneca and the University of Oxford in a phase three trial showed that the vaccine was 70% effective when given two full doses one month apart. At the same time, this number rose to 90% when half the dose was initially given, and the full dose a month later is slightly lower than the competition of Pfizer / BioNTech and Moderna.

Moreover, as the British government agreed to buy 100 million doses, the pound also responded positively. The British media report that the Brexit agreement was “95% done” and that it is basically inevitable.

However, investors know that most of the details of future EU-UK relations have been ready for some time, while those 5% – fisheries, state aid, and governance – remain points that hamper the agreement’s signing.

Sterling is advancing against a range of currencies in early trade, spurred by talks so Prime Minister Boris Johnson could intervene this week to negotiate trade talks between the EU and the UK. He should intervene this week and talk to the President of the European Commission, Ursula von der Leyen, to reach an agreement across the line, but with the usual warning to agree to the agreement at any cost.

If both years can somehow find a middle ground after years of quarrels and disagreements, an agreement seems much more likely than before. From the GBP economic news, we have The Composite PMI Index, The Manufacturing Purchasing Managers ‘Index, The Services Purchasing Managers’ Index, as well as a speech by the Bank of England (BoE) Monetary Policy Committee (MPC) Member Andy Haldane.

All this news will have an impact on the GBP/USD pair. If the pound continues with this positive trend, we can expect the pair to rise to 1.35000.

-

Support

-

Platform

-

Spread

-

Trading Instrument