Market News and Charts for November 23, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

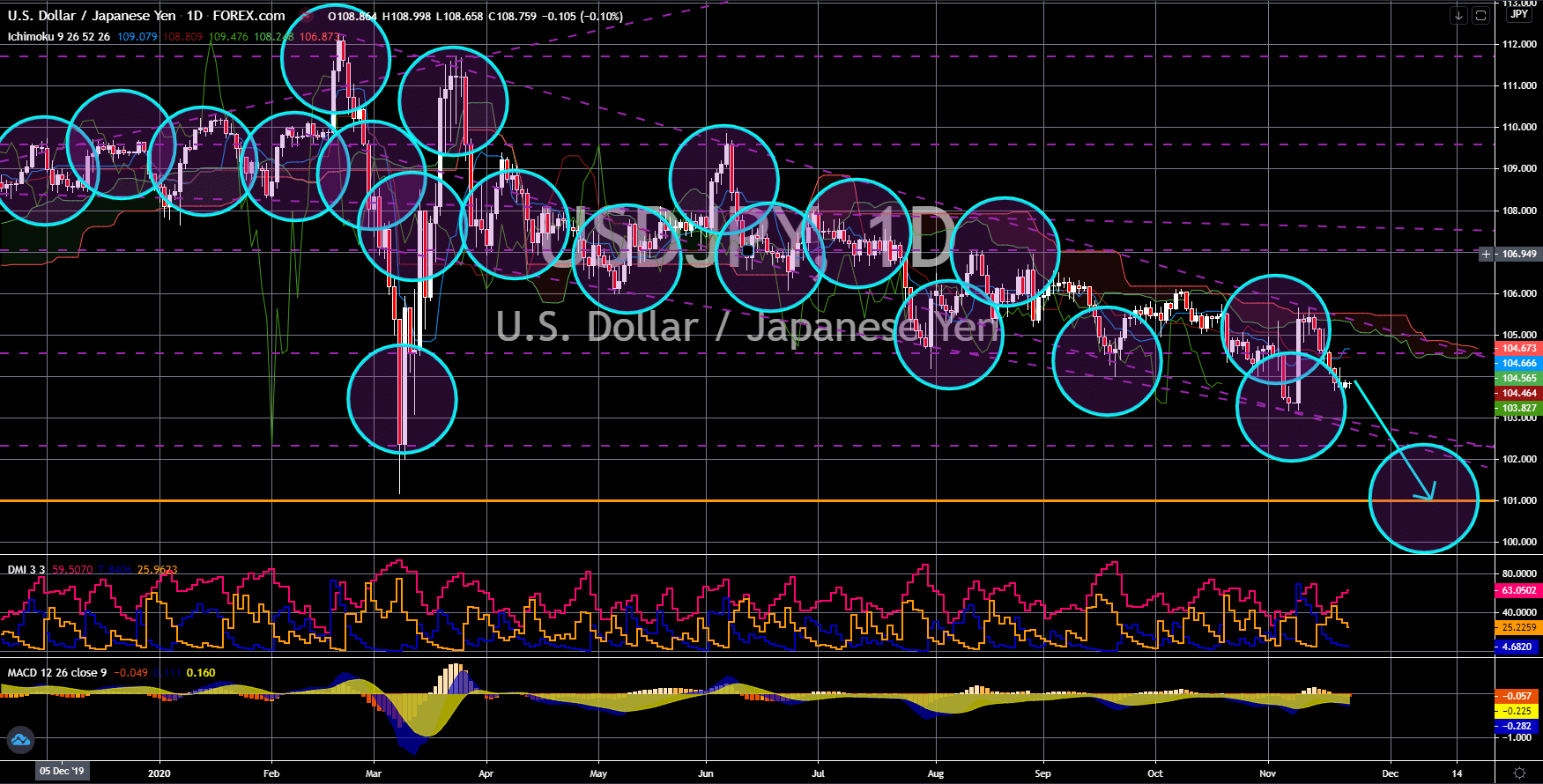

USD/JPY

The pair will continue to move lower in the following days towards the 101.000 support line. The optimism of investors from the recent coronavirus vaccine news quickly fades away. This was amidst the continued rise of COVID-19 cases in the United States coupled with a spike in the number of unemployed individuals in the country. US pharmaceutical companies Pfizer and Moderna reported a high effectiveness rate on its Phase 3 trial. Once approved, the vaccines will be available commercially. However, if the trend in the cases continued in the near term, the daily production of the vaccine will not be sufficient for the number of new cases. The US has currently 12.3 million cases with its highest daily infection recorded on Friday, November 20, at 198,585. The rise in cases reflects in the surge in the number of individuals filing for their unemployment benefits. Last week’s figure was 742,000 compared to the prior week’s 711,000 results.

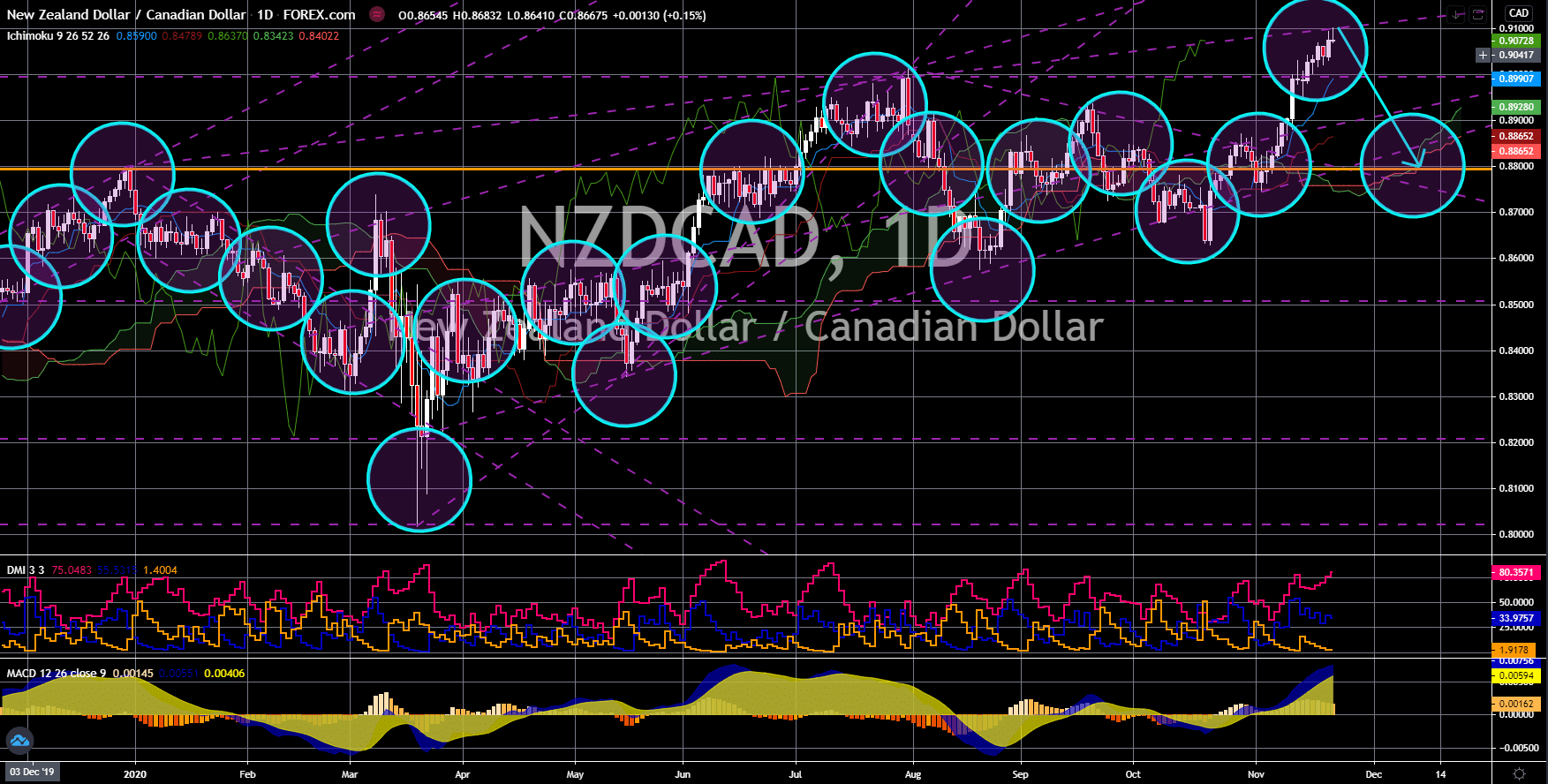

NZD/CAD

The pair failed to break out from a major resistance line, sending the pair lower towards a major support line. While the number of unemployed individuals in the US continues to increase, Canada has seen some improvement in its most recent ADP Nonfarm Payrolls report. The number of claimants for unemployment benefits in American rose by 742K. On the other hand, Canada recorded its lowest number of job losses in last Thursday’s report, November 19, at -79.5K. The trend suggests that Canada will be able to create more jobs in the coming months. This was backed by the rise in the retail sales report for the month of September. Canada recorded an increase of 1.1% in consumption on the said month while ADP Nonfarm Payrolls posted its third-largest job loss during the pandemic at -770.6K. While New Zealand has also an impressive Q3 retail sales at 28.0%, credit card spending was still down YoY at -6.3%.

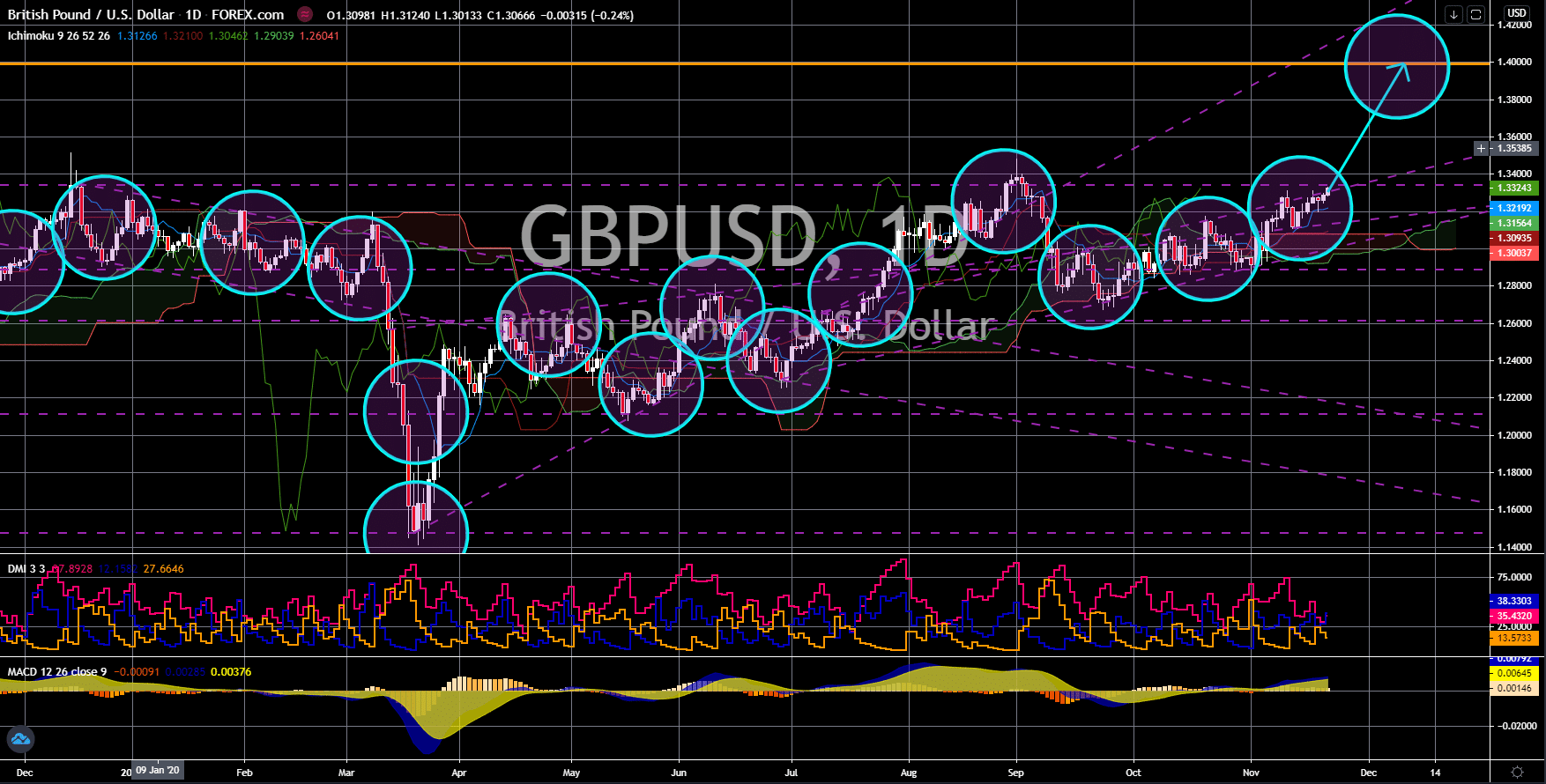

GBP/USD

The pair will break out from a major resistance line, sending the pair higher towards its April 2018 high. The United Kingdom had several positive results last week despite the overall weakness in the European economy. Retail sales MoM grew by 1.2% for the month of October. Despite posting a lower figure against its prior result of 1.4%, the reported number was still better than analysts’ expectations of 0.1%. The YoY figure, on the other hand, remains strong with the reported figure of 5.8%. The same scenario happened with the Core Retail Sales MoM and YoY report which posted 1.3% and 7.8% results, respectively. For Monday’s report, November 23, the UK expects 42.5 points for its Composite PMI from 52.1 points in the previous month. However, the Manufacturing and Services PMI would easily offset this expected decline with strong expected figures. Analysts’ forecasts were 53.3 points and 52.3 points, the same figure as last month.

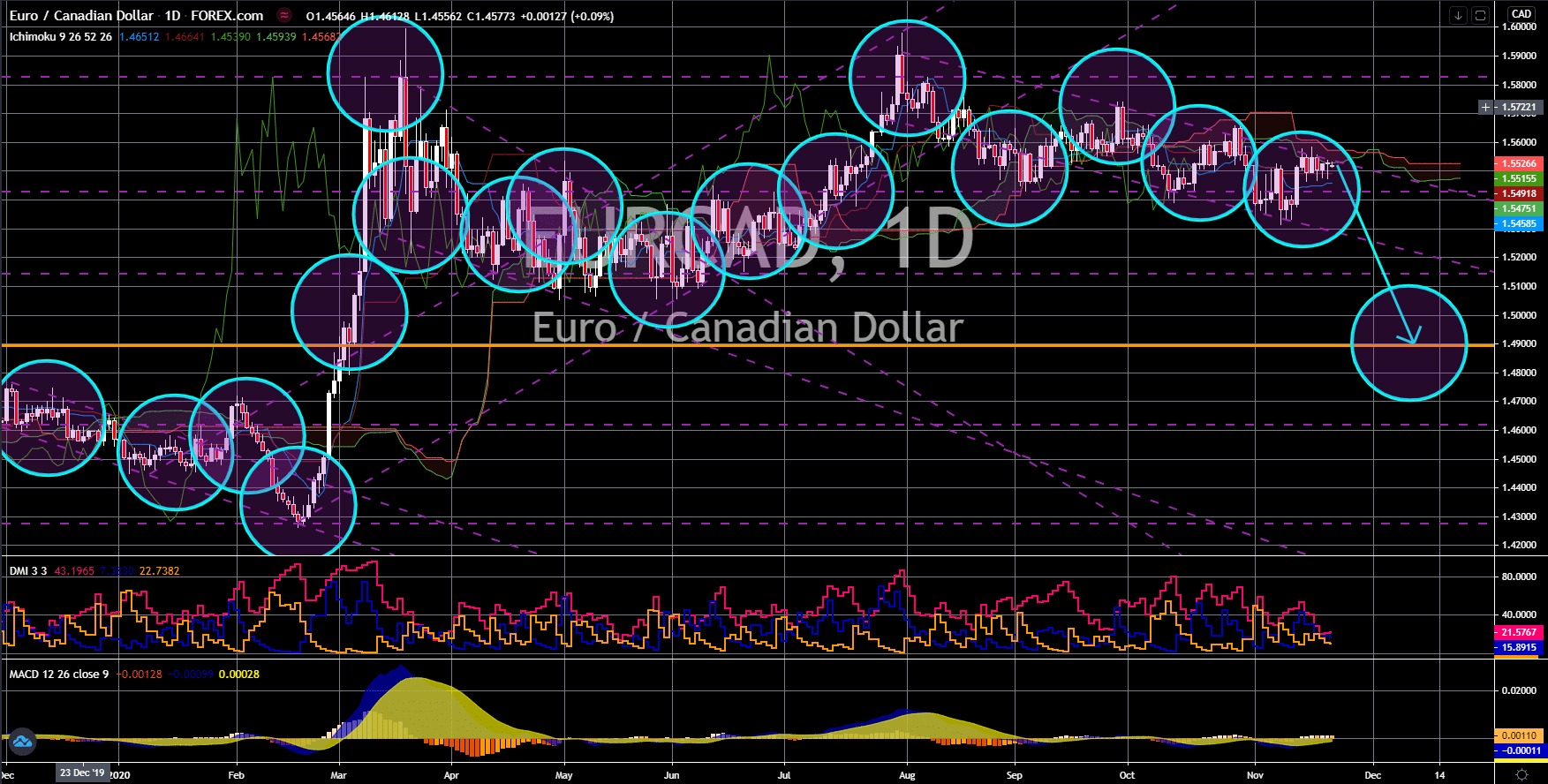

EUR/CAD

The pair failed to break out from a downtrend channel resistance line, sending the pair lower towards a key support line. The EUR investors will start the week with a bleak outlook on its Monday reports. The EU and the bloc’s two (2) largest economies – Germany and France – are set to publish its Composite, Manufacturing, and Services PMI reports. All nine (9) reports are expected to post lower figures compared to their previous records. For Germany, the numbers were 50.4 points, 56.5 points and 46.3 points, respectively. France, on the other hand, received the lowest expectations from analysts. Forecast for the above-mentioned reports were 34.0 points, 50.1 points, and 37.7 points. Meanwhile, analysts are anticipating 45.8 points, 53.1 points, and 42.5 points for the EU bloc. Analysts are also expecting devastating news for the Brexit negotiations. The transition is set to end on January 01, 2021.