GBP/USD analysis for April 19, 2021

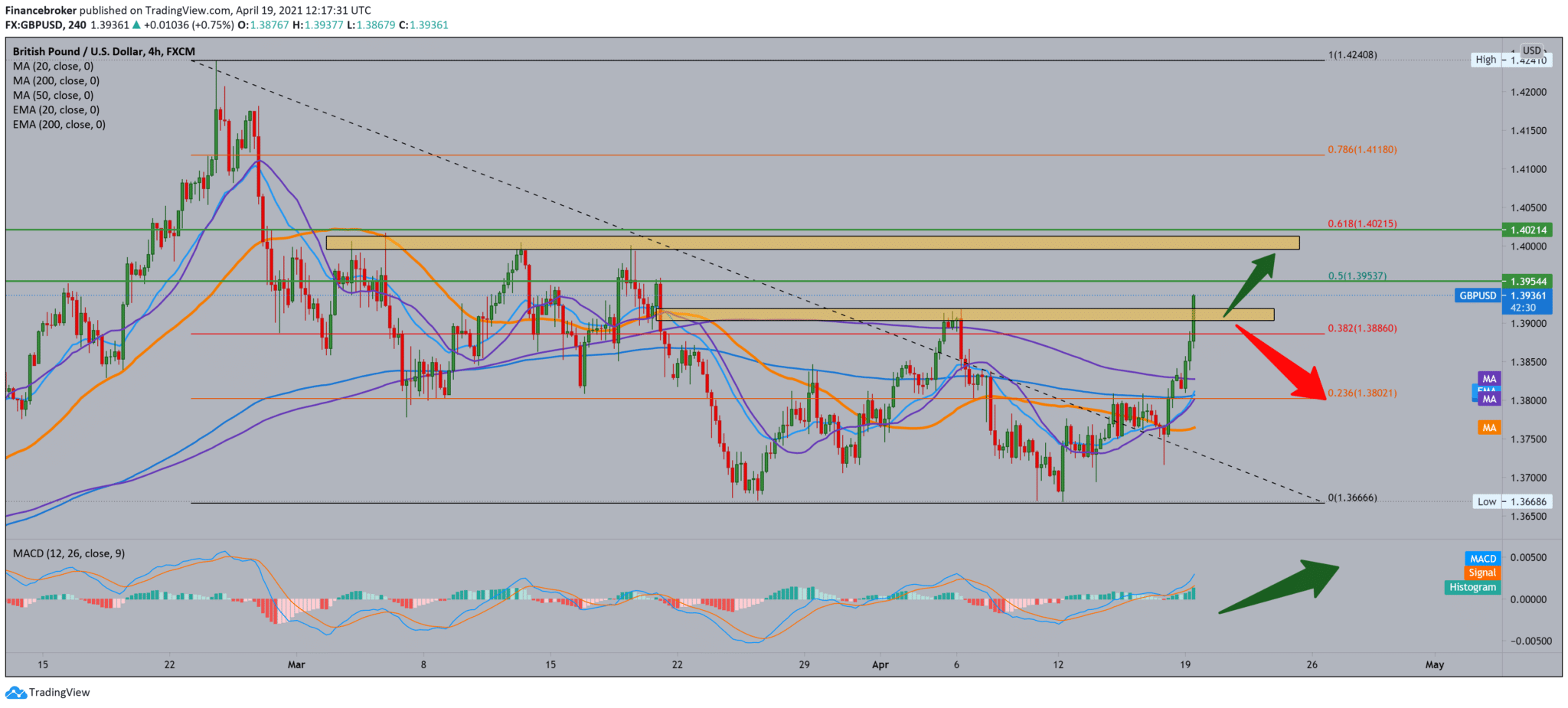

Looking at the graph on the four-hour time frame, we see that the GBP/USD pair found good support at 1.3660, making the jump from that zone to the current 1.39200. Making a break above all moving averages, we are now testing the Fibonacci 38.2% level. We look towards the previous high at 1.40000, where we had a previous withdrawal. If the GBP/USD pair stays above the 38.2% Fibonacci level for a long time, we can expect further growth of this growth to 50.0% and then to a 1.40000 psychological level. The MACD indicator is also in a strong bullish trend, and for now, it only gives us good support.

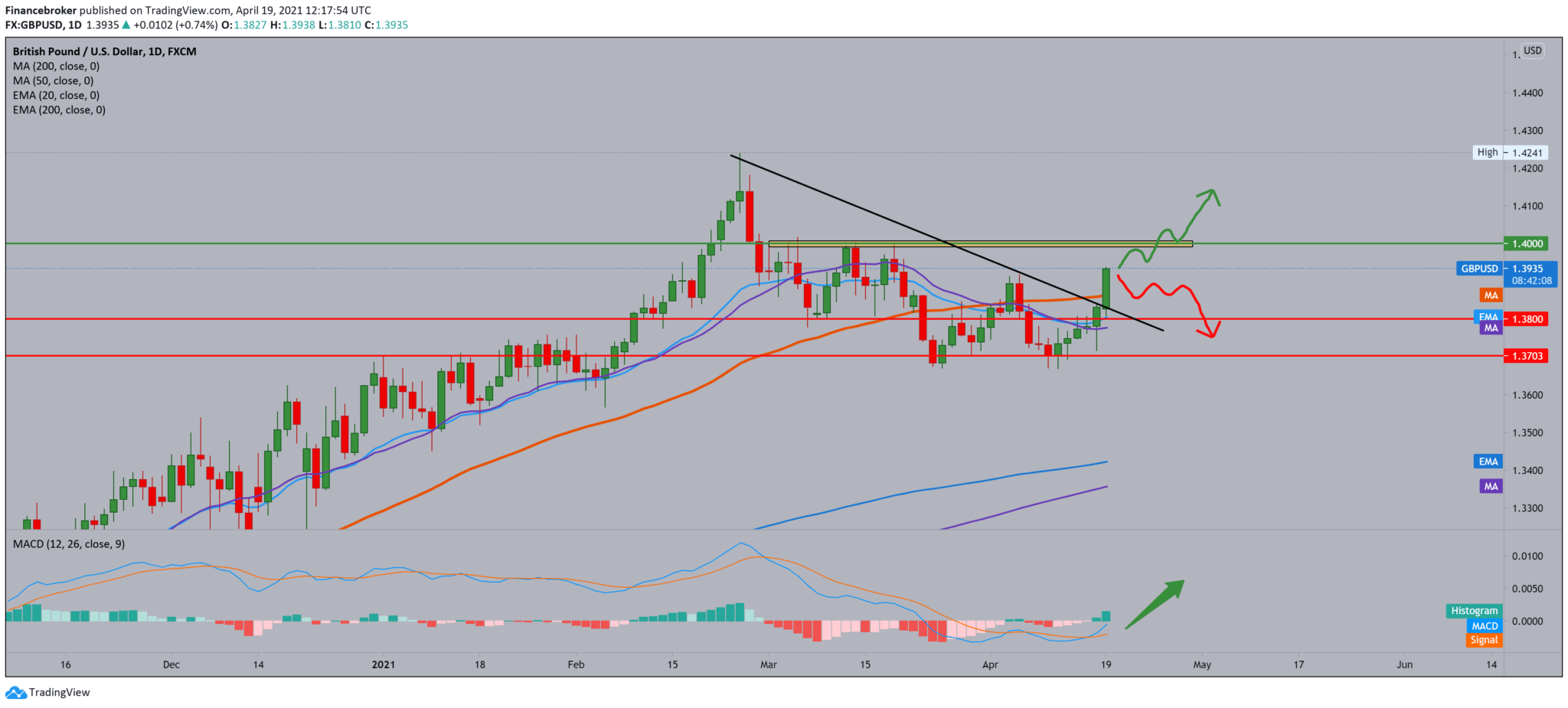

We see that the GBP/USD pair made a double bottom on the daily time frame and are now testing the neckline. The break above us sees for sure a testing zone around 1.4000, and the pullback back lowers us down to support moving averages, first the MA50, then the MA20, and EMA20. A further break below leads us closer to the previous low at 1.37000. Following the MACD indicator, we have just entered the beginning of the bullish trend.

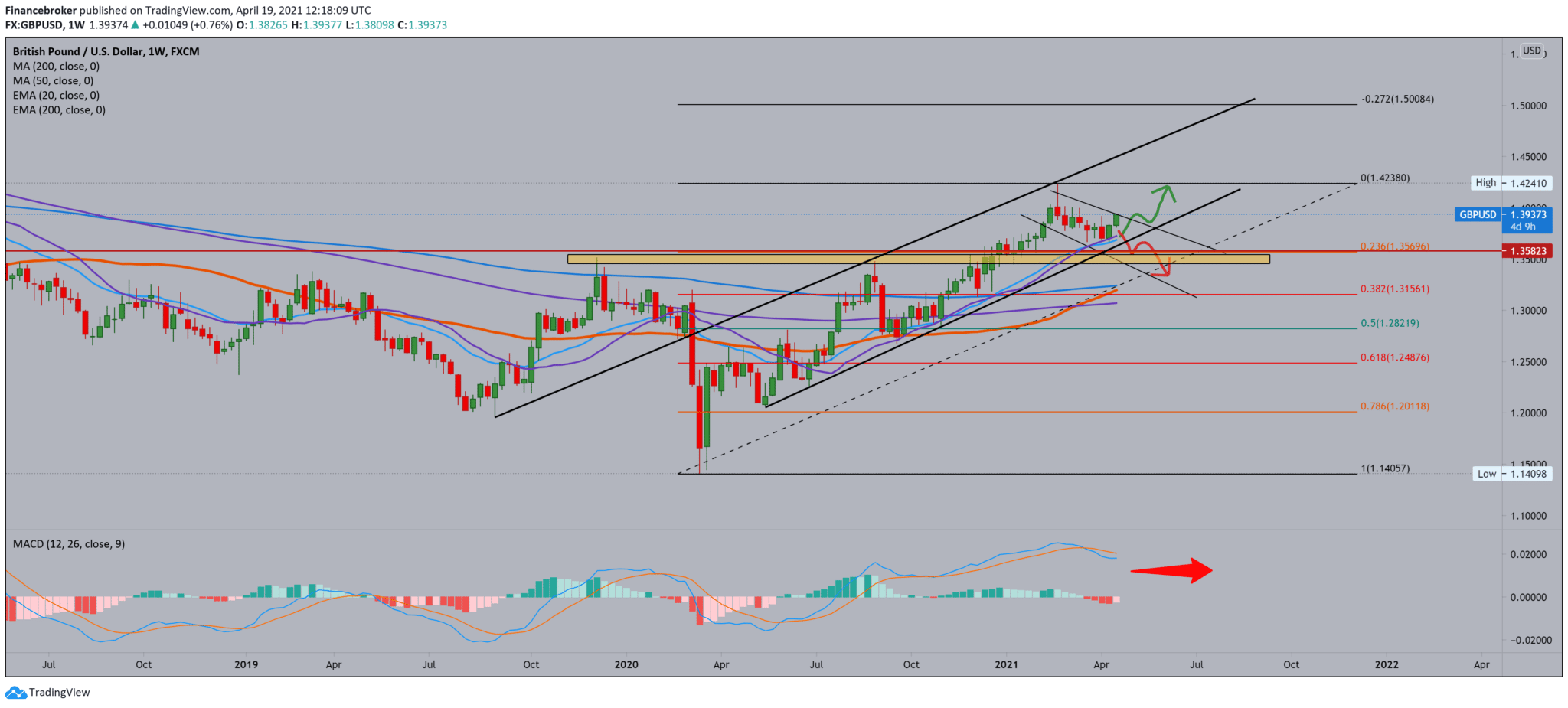

In the weekly time frame, we see that we are moving further in a growing channel, with support on the bottom line with moving averages that provide additional support, leading the GBP/USD pair to higher levels. The MACD indicator is currently neutral, but we can expect it to be bullish if it closes positively for the pound this week.

From the news for the GBP/USD currency pair, we can single out the following:

House prices in the U.K. reached record highs in April, as real estate available for purchase hit the lowest share ever recorded due to high demand, the real estate website Rightmove announced on Monday.

House prices rose 2.1 percent monthly in April, after rising 0.8 percent in March. Average house prices reached a record 327,797 GBP. Tim Bannister, director of Rightmove’s asset company, said: “This is only the second time in the last five years that prices have risen by over 2 percent in a month, so it’s a big jump, especially considering the locking restrictions. The main factor driving the cable comes from the dollar’s weakness, which has suffered a twofold decline in U.S. Treasury yields and risk sentiment.

However, this trend could be reversed. The world is cheering for a U.S. exit from the coronavirus crisis. Strong U.S. spending is seen as a catalyst for global growth. The change could be due to the

development of President Joe Biden’s infrastructure spending plans. If his $ 2.25 trillion plant gets a boost, it could cause bond sales, which would increase yields. Moreover, the president wants to bring in profit tax increases, something Vol Street doesn’t like. Market rally stops, a sure dollar may see new demand.

-

Support

-

Platform

-

Spread

-

Trading Instrument