| General Information |

|

|---|---|

| Broker Name: | FXGT.com |

| Broker Type: | Forex & CFDs |

| Country: | Seychelles, South Africa, Vanuatu, Cyprus |

| Operating since year: | 2019 |

| Regulation: | Seychelles Financial Services Authority (SFSA), South African Financial Services Conduct Authority (FSCA), Vanuatu Financial Services Commission (VFSC), CySEC is reserved for institutional traders |

| Address: | Room 12, First Floor, Kingsgate House, Victoria, Mahe, Seychelles |

| Broker status: | Active |

| Customer Service | |

| Phone: | N/A |

| Email: | [email protected] |

| Languages: | EN, JP, AR, TR, VN, ID, MY, TH and many more |

| Availability: | 24/7 |

| Trading | |

| The Trading platforms: | MetaTrader 4, MetaTrader 5 |

| Trading platform Time zone: | N/A |

| Demo account: | Yes |

| Mobile trading: | Yes |

| Web-based trading: | Yes |

| Bonuses: | Yes |

| Other trading instruments: | Yes |

| Account | |

| Minimum deposit: | $5 |

| Maximal leverage: | 1:1000 |

| Spread: | Floating From 0.0 Pips |

| Scalping allowed: | Yes |

General Information & First Impressions

Our FXGT.com review, like our other content, has the primary goal of helping you thrive while trading. However, this one was a bit difficult for us.

Not to be afraid, though, as the difficulty stems from the broker’s brilliance. It has such an all-encompassing and deep service that it takes time to find a starting point.

FXGT.com is a true all-in-one broker. And when we say that, we don’t mean it offers bits of everything. It’s a monumental company that provides a complete and varied service no matter your preferences. Whether you prefer forex or cryptocurrency trading or search for regulation & licensing or sophisticated trading tools, it has you covered.

In this part of our FXGT.com review, we will offer an extremely condensed rundown of its features. However, we will note that we are barely scratching the surface here.

Let’s start with some general facts; it’s a CFD broker that started operating in 2019 and operates from multiple jurisdictions. The company is a global brokerage that puts trader needs first and is diligent in crafting the best user experience. Lastly, it has been operating for four years, generating a fantastic reputation. That ensures its conditions hold up in practice as well as they do in theory.

Another notable thing for our FXGT.com review is that it offers multiple specialised account types. They all come at a mere $5 deposit requirement and even a demo account. That simplifies service access and lets you choose between practising with a permanent demo account or accessing the live service with a minuscule deposit.

On top of that come the phenomenal trading conditions, with a maximum leverage of 1:1000, a top-tier online trading platform via MT4 and MT5, various bonuses and promotions and much more.

If this introductory section has captured your interest, we encourage you to continue reading our FXGT.com broker review, as there is much more to discover.

FXGT.com Review: Fund and Account Security

Now, lets move deeper into fxgt.com broker review. Traditionally, security has been a pain point for most brokerages, especially newer ones. Most companies want to strike a balance where they give users some security without putting in too much effort. However, as you’ll see from this part of our FXGT.com review, the broker pulled out all the stops and has taken a completely different approach.

We’ll start with the general safety features before moving on to each jurisdiction’s specifics. Right from the start, it’s clear that the broker wants to provide you with the optimal trading experience. One of the things it does to secure that is ensure that you can trade without concern for your safety.

That starts right from registration. Putting down your information and registering for an account is a simple task. However, the broker diligently keeps a clean community with Know Your Customer (KYC) AI-assisted checks.

That covers Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) verification, among general identity confirmation. In other words, we are confident that the broker prevents any suspicious activity, running exclusively as a trading service provider.

Having said that, in our FXGT.com analysis, it is not surprising that it also employs popular account and data prevention methods. It has advanced encryption technology, secure servers and strong firewalls, as well as authenticators for accounts. That ensures safety-conscious users will have no trouble with cyberattacks.

The broker cooperates with top-tier institutions, including tier 1 banks, to secure user funds entirely. Naturally, it also employs fund segregation, keeping its own funds separate from users. Furthermore, it uses top-notch liquidity providers and payment service facilitators as a backbone for its operations. Lastly, it maintains a capital adequacy ratio of 40%, quadrupling regulator requirements.

Regulation and Insurance at FXGT.com

Even the things that we’ve gone over so far in our FXGT.com review are enough to score it top grades in our security rating. However, we haven’t even touched on the regulatory compliance that the broker displays across the board.

Unlike most of its peers, the broker sought to secure top-tier regulation and licensing for each of its jurisdictions. Here are the organisations looking over FXGT.com:

- CySEC is reserved for institutional traders

- Vanuatu – Vanuatu Financial Services Commission (VFSC): license number 700601

- South Africa – South African Financial Sector Conduct Authority (FSCA): license number 48896

- Seychelles – Seychelles Financial Services Authority (FSA): license number SD019

From this, it’s clear that the broker carries itself in nothing less than a stellar manner. The presence of so many regulators makes it entirely certain that you won’t ever feel threatened while trading with the broker.

The impressive thing we want to mention in this part of our FXGT.com review is that the company has taken things even further to guarantee your complete comfort. It offers liability insurance of up to a total of €1,000,000 for its users.

Of course, that’s on top of the existing insurance from regulators. So, even in the worst-case scenario of an error or misunderstanding, the broker will fully compensate you.

Even regarding cryptocurrency trading, the broker ensures maximum clarity for users. It explains that crypto is inherently unregulated and that the company doesn’t provide those services but rather a licensed third party.

When researching for this part of our FXGT.com review, it was clear to us that the broker put a ton of effort into addressing a huge pain point within the online finance industry. We’ve seldom seen such robust security setups, and we have nothing but praise for the broker for its structure.

Deposits, Withdrawals, and Accounts at FXGT.com

As we transfer to the more practical bit of our FXGT.com analysis, we should mention its deposit and withdrawal structure. A broker needs to have your preferred account funding method; this one has nearly all of them.

Without turning this into a list, we’ll note that there are options for cards, bank transfers, eWallets, EFTs, and crypto. That ensures that, no matter your preference, you can get your money in or out smoothly.

We will note that most methods do have a minimum deposit and withdrawal. However, the minimums don’t exceed 50 USD/EUR or their equivalent, barring bank wire transactions. Additionally, none of the methods charges commissions, again excluding the wire transfers.

While that is a bit unfortunate for those of you with bank wire transfers as your preferred method, we should keep in mind that those charges and minimums are under the bank’s control, and there’s little the broker can do.

Another important thing for our FXGT.com review is that card and wire transfers are only possible during bank operating hours on business days. That means they are available Monday-Friday 09:00-17:00. Card transfers are instant if banks are open, but you may have to wait until the next morning if they’ve closed.

You can access the list of methods and all the info on them on the broker’s website under deposits & withdrawals. Before we move on to the accounts section of our FXGT.com review, we also wanted to note that there is a deposit bonus (as well as various other promotions).

If you deposit money, you can get a 25% bonus on all transfers into your account. However, that only applies to holders of the Mini and Standard+ account. The bonus goes up to $10,000, presenting quite an alluring proposition.

Demo account and Minimum on FXGT.com

One feature we were particularly sad to see modern brokerages slowly phase out is the demo account. It is the best way to explore a new broker without committing funds, and invaluable as a practice tool. That’s why we were so glad when, during the research for our FXGT.com review, we discovered that it offered a free testing account.

The ironic thing is that the broker needs it much less than its competitors do. Since its minimum is only $5 without any fees & commissions, you can comfortably deposit that and explore the service. Still, a demo is a great option for those who are apprehensive about turning in their personal details. Additionally, traders who want some extra funds to practice with can get fantastic mileage out of it.

The biggest takeaway here is that the broker repeatedly shows customers that it wants them to shape their own experience. It does whatever it can to make you feel like you can take things at your own pace.

In the current brokerage landscape, that’s sadly a huge outlier. However, we are glad to use this part of our FXGT.com review to give huge props to the broker for organising such a fantastic service structure when most of its competitors have sunk into complacency.

Live accounts

We finally arrive at the live account options, where the broker offers four high-quality options. There is sort of a soft split, where Mini and Standard+ stand out as the options for new and intermediate traders, as well as those looking to use bonuses and promotions to enhance their trading experience. Meanwhile, the Pro and ECN accounts are for those with a bit more experience and developed preferences, and those that want the most cutting-edge trading conditions.

There is sort of a soft split, where Mini and Standard+ stand out as the options for new and intermediate traders. Meanwhile, the Pro and ECN accounts are for those with a bit more experience and developed preferences.

However, this part of our FXGT.com review doesn’t mean that a pro trader can’t enjoy the Mini account or a relative newcomer to the ECN. Each account is a powerful tool and an important tool for service personalisation.

Also, FXGT offers negative balance protection on each account. As such, we urge you to do your research and use the account best suited for your established habits.

As we already explained in our FXGT.com analysis, each account has its strengths and weaknesses. For example, the Standard+ account offers a larger position size than Mini, but the latter has a higher max volume limit.

If you want to just choose an account without getting into the detailed features, you can just follow the broker’s suggestions. Mini is for newer traders, and Standard+ is the best generalist tool. Keep in mind that both are fantastic options for those aiming to utilise the broker’s various experience-enhancing promotions.

In the next section, we will present more details about the accounts to help you choose. However, we urge you to remember that you get additional benefits, like educational resources, risk management tools, and much more.

Without further delay, here’s the part of our FXGT.com review where you can inspect its accounts in detail:

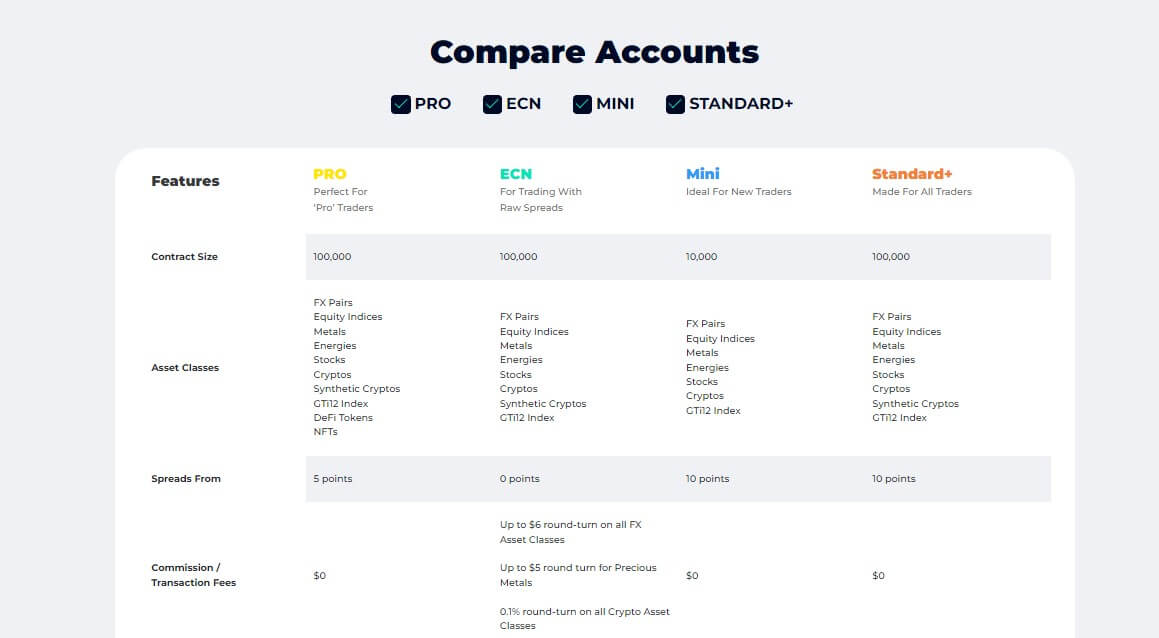

Mini

- Contract Size: 10,000

- Asset Classes: FX Pairs, Equity Indices, Metals, Energies, Stocks, Cryptos, GTi12 Index

- Spreads From: 10 points

- Commission/Transaction Fees: $0

- Leverage: Up to 1:1000

- First Transfer-in to MT4/MT5 Trading Account: $5

- Promotions/Bonuses: Yes

- Minimum Trade Size: 0.01

- Maximum Trade Size: 200 lots

- Maximum Volume Limit: 500 lots

- Account Currency: BTC, ETH, USDT, ADA, XRP, EUR, USD

- Trading Platforms: MT5/MT4 Desktop, Web, Mobile

- Order Execution: Market

- Margin Call: 70%

- Stop Out: 40%

- Swap-free days allowance: All assets: 0 days

- Swap Free account (on request): Yes

- Limit & Stop Levels: Yes

- Maximum Number of Positions: 150

- Maximum Number of Pending Orders: 150

- Negative Balance Protection: Yes

Standard+

- Contract Size: 100,000

- Asset Classes: FX Pairs, Equity Indices, Metals, Energies, Stocks, Cryptos, Synthetic Cryptos, GTi12 Index

- Spreads From: 10 points

- Commission/Transaction Fees: $0

- Leverage: Up to 1:1000

- First Transfer-in to MT4/MT5 Trading Account: $5

- Promotions/Bonuses: Yes

- Minimum Trade Size: 0.01

- Maximum Trade Size: 100 lots

- Maximum Volume Limit: 200 lots

- Account Currency: BTC, ETH, USDT, ADA, XRP, EUR, USD

- Trading Platforms: MT5/MT4 Desktop, Web, Mobile

- Order Execution: Market

- Margin Call: 70%

- Stop Out: 40%

- Swap-free days allowance: FX, Metals, Equity Indices, Stocks, Cryptos, GTi12: 0 days/Synthetic Crypto Pairs: completely swap-free

- Swap Free account (on request): Yes

- Limit & Stop Levels: Yes

- Maximum Number of Positions: 100

- Maximum Number of Pending Orders: 100

- Negative Balance Protection: Yes

ECN

- Contract Size: 100,000

- Asset Classes: FX Pairs, Equity Indices, Metals, Energies, Stocks, Cryptos, Synthetic Cryptos, GTi12 Index

- Spreads From: 0 points

- Commission/Transaction Fees: Up to $6 round-turn on all FX Asset Classes/Up to $5 round turn for Precious Metals/0.1% round-turn on all Crypto Asset Classes

- Leverage: Up to 1:1000

- First Transfer-in to MT4/MT5 Trading Account: $5

- Promotions/Bonuses: Yes

- Minimum Trade Size: 0.01

- Maximum Trade Size: 200 lots

- Maximum Volume Limit: 200 lots

- Account Currency: BTC, ETH, USDT, ADA, XRP, EUR, USD

- Trading Platforms: MT5/MT4 Desktop, Web, Mobile

- Order Execution: Market

- Margin Call: 70%

- Stop Out: 40%

- Swap-free days allowance: Cryptos (including GTi12 & Synthetic Crypto Pairs): completely swap-free/Gold, Equity Indices: 3 days/FX, Energies, Stocks: 0 days

- Swap Free account (on request): Yes

- Limit & Stop Levels: Yes

- Maximum Number of Positions: 200

- Maximum Number of Pending Orders: 200

- Negative Balance Protection: Yes

Pro

- Contract Size: 100,000

- Asset Classes: FX Pairs, Equity Indices, Metals, Energies, Stocks, Cryptos, Synthetic Cryptos, GTi12 Index, DeFi Tokens, NFTs

- Spreads From: 5 points

- Commission/Transaction Fees: $0

- Leverage: Up to 1:1000

- First Transfer-in to MT4/MT5 Trading Account: $5

- Promotions/Bonuses: Yes

- Minimum Trade Size: 0.01

- Maximum Trade Size: 200 lots

- Maximum Volume Limit: 200 lots

- Account Currency: BTC, ETH, USDT, ADA, XRP, EUR, USD

- Trading Platforms: MT5/MT4 Desktop, Web, Mobile

- Order Execution: Market

- Margin Call: 50%

- Stop Out: 20%

- Swap-free days allowance: Cryptos (including GTi12 & Synthetic Crypto Pairs): completely swap-free/FX, Metals, Equity Indices, Energies: 6 days/Stocks, DeFi Tokens, NFTs: 0 days

- Swap Free account (on request): Yes

- Limit & Stop Levels: Yes

- Maximum Number of Positions: 200

- Maximum Number of Pending Orders: 200

- Negative Balance Protection: Yes

FXGT.com’s Trading Platform

As we’ve established earlier in our FXGT.com review, the broker offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). And if you’ve been trading for a while, these platforms need little introduction. They have been the leading trading solutions globally for years, and they don’t seem to be letting up.

As far as online trading platforms go, there’s no going wrong with these two. They both offer a user-friendly interface and access to numerous sophisticated trading tools. However, it is important to note that MetaTrader 5, as the later instalment, is more feature-rich than its predecessor.

MetaTrader 4 Highlights

MetaTrader 4 has managed to maintain relevance as a powerful tool, even though a later version has superseded it. To simplify it for this part of our FXGT.com review, that’s because it’s a powerful tool on its own.

It has numerous multifunctional elements that allow users to analyse assets and navigate markets. On top of that, it has trading automation, allowing you to conduct your trades even if you’re away from your platform. You can also access over 30 graphing objects and three time frames.

The primary benefit is the platform’s relative straightforwardness when put against its younger brother. There’s also the fact that the platform has been around longer, meaning you may feel it’s more familiar.

And considering the software’s strength, even after so many years in circulation, there’s nothing wrong with choosing it over MT5. MetaTrader 4 is still a workhorse and allows you to achieve success in markets, provided you make sound trading decisions.

MetaTrader 5 on FXGT.com Highlights

As we noted earlier in our FXGT.com review, MetaTrader 5 is the more feature-rich of the two. It builds on the features already available on MT4 and improves upon them.

As such, it offers increased execution speed, extra indicators and analytical tools, and further market depth. That all allows for more precise trades and the creation of more precise trading strategies.

However, there is also the additional fact that the broker takes MT5 even further than its base model. Namely, if you’re a customer at FXGT.com, you can access the Advanced Trader Toolkit. It’s a special MT5 trading toolkit that expands the platform’s analytical capabilities.

Since this is the broker’s in-house solution, it scales off of your account deposit. Still, you don’t need to worry since even a relatively meagre $500 deposit will unlock the full functionality. Having any money in your account unlocks most of the features, cementing that the broker treats its customers with respect.

Here are some interesting features in the expanded toolkit:

- Trend strength – employs technical analysis to help you predict market direction.

- Volatility forecaster – uses historical data from the past 5 years to present periods of increased market activity.

- RSI extremes – analyses market speed and price changes to identify overbought and oversold assets due for a correction.

- Expanded EMA tool – analyses trends based on exponential moving averages to provide a simple visual representation.

There are many more toolkit options present. We also want to highlight that the MT5 trading toolkit that FXGT.com offers also comes with expanded execution features. Here, we can mention the one-click close tool, which allows for the quick closing of multiple positions, and the FX basket tool, which lets you open multiple positions from a premade set (basket) of forex pairs.

Which To Choose

From the things we already mentioned above in our FXGT.com analysis, it’s clear that MetaTrader 5 is the more potent solution. However, that doesn’t mean it’s right for every trader.

We suggest MT4 for those who don’t get deep into the technical features of a platform and rather use it simply as a tool to conduct their trading. That also applies to people who use third-party software to conduct their analysis.

Lastly, since MetaTrader 4 is powerful individually, those who choose it because it’s more comfortable aren’t wrong. It’s important to remember that trading is a mental process, and choosing a comfortable platform can go a long way toward helping you keep your cool during prolonged trading sessions.

On the other hand, we feel that MetaTrader 5 is the choice for those eager to optimise their trading experience. It offers more detailed market insights and is an invaluable tool for research, as well as fundamental and technical analysis. It’s an all-in-one solution, further improved by the broker’s expanded toolkit, which addresses common complaints about the platform.

As such, we’d say it’s more of a universal tool. It shows fantastic performance if you want a unified trading experience that doesn’t require managing numerous programs.

FXGT.com Analysis of Trading Instruments

Before we wrap up our FXGT.com review, there are a few more things to cover. As noted, the broker’s service scale is something you can seldom see in the brokerage world.

As far as its assets go, the broker offers the standard set. You’ll find forex, crypto, stocks, indices, and commodities such as precious metals and energies. We won’t bore you by listing every asset available, but there are many choices in each sub-section. If you don’t want to take our word for it, there’s a full list of assets available on FXGT.com. The list also specifies the accounts that can access it. Again, we have to praise the broker since that level of clarity isn’t something we often see nowadays.

However, the company doesn’t stop at providing the standard set of trading instruments. It splits cryptos into regular pairs, which it sets against various fiat currencies, and synthetic cryptos, which pair up digital currencies with various assets, such as gold, oil, and even companies like Meta.

Furthermore, it offers access to the GTi12 index, which is a compendium of the crypto market. It uses 12 leading cryptocurrencies to allow you to use a single asset to speculate on a unified digital currency market.

The last two things we want to emphasise for this part of our FXGT.com analysis are DeFi tokens and NFTs. Both are present in the broker’s service if you choose the Pro account.

And while DeFi still hasn’t gained traction and NFTs have lost it, it’s still fantastic that the broker offers them. It proves that the broker isn’t complacent and that it constantly changes to reflect the market. That promises that you’ll always have access to the latest and most refined tools on FXGT.com.

Supplementary Services on FXGT.com

Before we give our final thoughts, we also need to touch on the broker’s additional services. Basically, we will cover everything that didn’t feel right to put in other parts of our FXGT.com review here.

And we will start with the bonuses. Now, we did mention that the broker offered a deposit-based bonus, but that’s not the end of it. It also offers other promotions, such as the loyalty reset bonus.

Once you spend the 25% loyalty bonus, you can attain it again after you meet trading volume and deposit requirements. That allows you to continuously bolster your trading funds, provided you maintain a stable success rate.

- If you want to learn more about the conditions to activate the bonus, visit this link!

The broker also offers VPS hosting, which lets you connect your MT5 platform to a virtual private server. That way, you can optimise execution speed and cut out potential connectivity issues, ensuring your peace of mind.

We also want to cover additional assistance and education features. The broker offers a MQL5 Trading Signal subscription, letting you get alerts that free you from constantly overseeing your assets. It also has a trader insights tab, which lets you see what your peers’ opinion is on certain assets.

Finally, we would be remiss to mention the extensive education library that FXGT.com offers for free. It has numerous eBooks, a full-term glossary, and numerous calendars that help you stay on top of asset opening hours. You can access most materials before signing up, again proving that the broker cares about fostering a capable trading community.

FXGT.com Review Conclusion

If we were to call the broker impressive, we would be putting it lightly. During our FXGT.com review, the broker has continuously impressed us by providing a broad, versatile service with features of such high quality that it almost sounds unreal.

The broker is open to a degree unseen in the online finance industry. Before you go in, you can see the full asset list, a detailed funding structure, and a transparent and complete fee and commission list.

That creates a baseline for trust, and the company cements it. It is a regulated broker with multiple licenses, an insurance plan, high capital adequacy and more. It leaves absolutely no room for doubt regarding its integrity, backing up technical conditions by a history of honest operating.

And we haven’t even gotten to the service – just when you think you’ve exhausted it, something new pops up. If you prefer to look around or practice, you can access FXGT.com with an unlimited demo or a simple $ deposit.

When you open an account, there’s a simple but secure registration process supported by KYC verification. The broker also helps develop its users with extensive education and beginner tools. All four accounts it offers are specialised but powerful, making each a solid choice.

The broker also organized an asset list that’s both broad and deep. There are tons of choices in standard categories such as forex and stocks and some rare additions like its GTi12 index. All that comes powered by the prominent MT4 and MT5 platforms, with the broker even including some proprietary additions.

As you can see from our FXGT.com review, the broker has set a benchmark few other companies can hope to reach. It has propelled itself among industry leaders, and we wholeheartedly suggest you try its service.

-

Support

-

Platform

-

Spread

-

Trading Instrument

Good broker

Always maintain good connection with me. Trading results are favorable and I am happy with customer service.

Did you find this review helpful? Yes No

Prompt withdrawals

Withdrawals are always on time. Customer service attend to trading needs promptly, too.

Did you find this review helpful? Yes No

Good customer service

The best customer service, they are willing to help me anytime. They are resourceful and efficient.

Did you find this review helpful? Yes No