Feeling the Growing Heat and Tensions in Stocks?

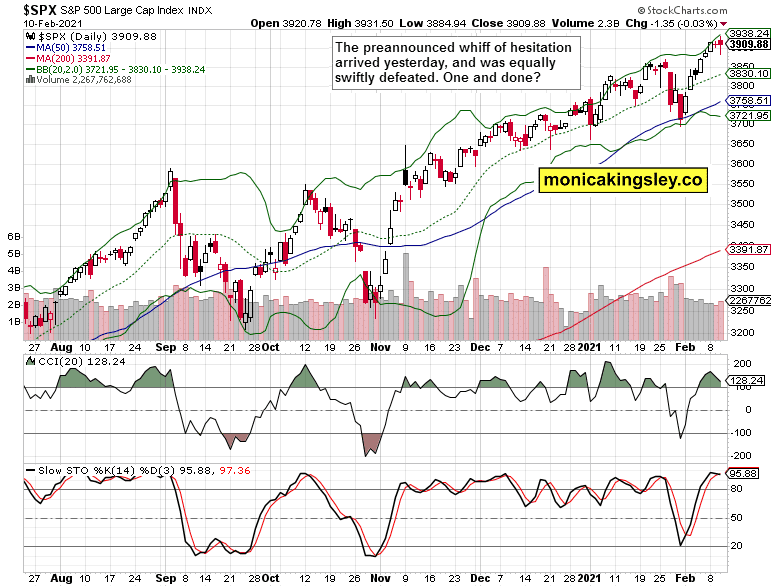

Yesterday was a prelude, a little preview of things to come. We better get used to brief and shallow corrections again, after being lulled by the many preceding sessions. It appears that we‘re now going to get the consolidation period even as the overall S&P 500 metrics remain in healthy territory.

This is the (print-and-spend-happy) world we live in, and we better not fixate on the premature bubble pop talk too closely. I have been stating repeatedly that things have to get really ridiculous first, and this doesn‘t qualify yet in my view. So, for all the tech bashers, we‘re going higher – like it or not.

Let‘s get right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Its Internals

A second day of hesitation, this time with a thrust to the downside. Comfortably repelled, but still. Is it just one of a kind, or more would follow over the coming sessions? I think this corrective span has a bit further to run in time really. Remember my yesterday‘s words though – the bears are just rocking the boat, that‘s all.

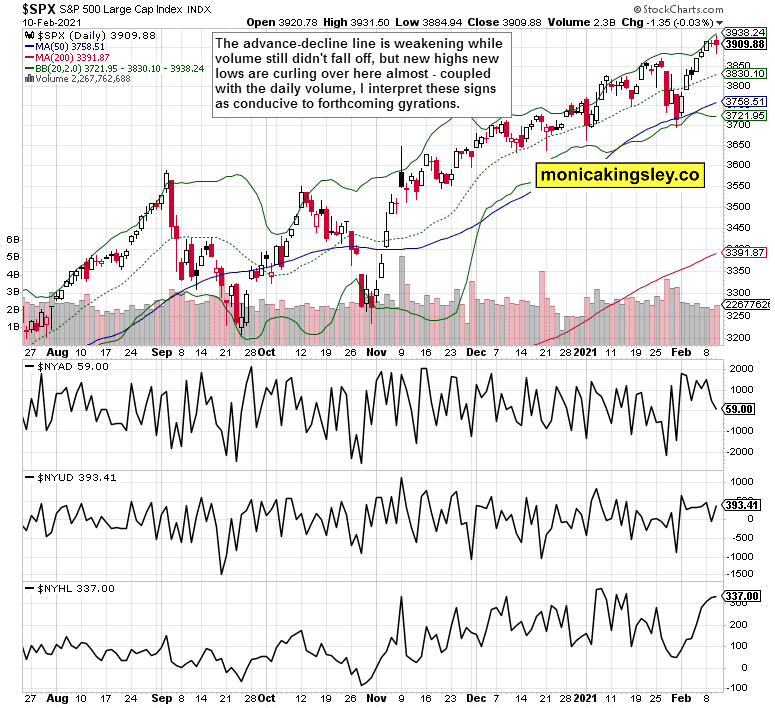

The caption describes nicely the mixed momentary situation in market breadth. I am looking especially at new highs-new lows right now for whether they would be able to keep the relative high ground, or not, and what would accompany that. Now, it‘s amber light.

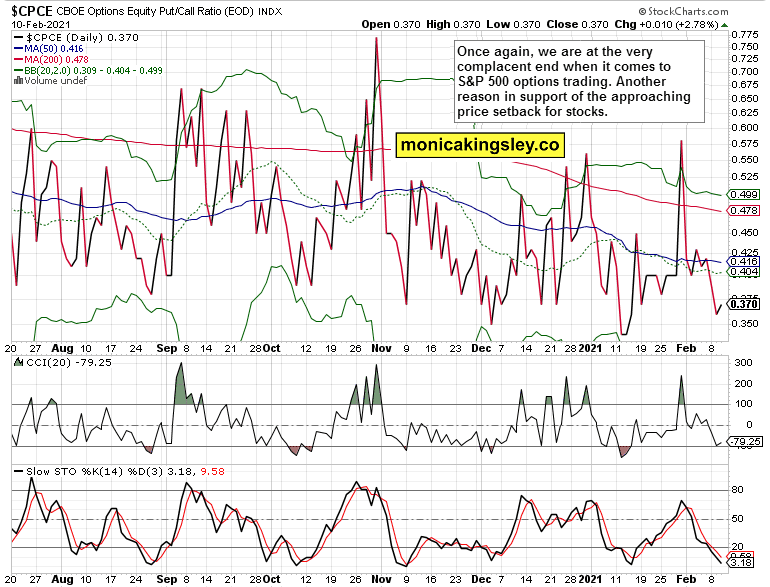

A supportive warning sign comes from the put/call ratio – we‘re getting a bit too complacent here again. Well worth watching.

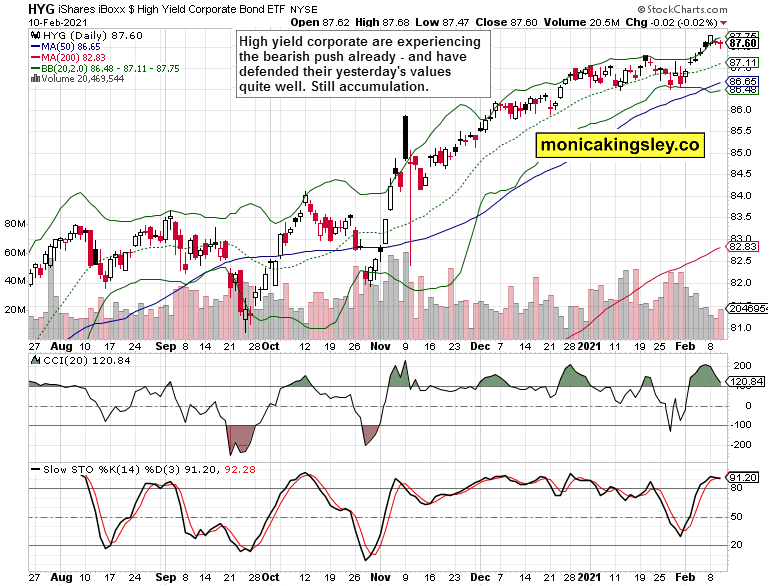

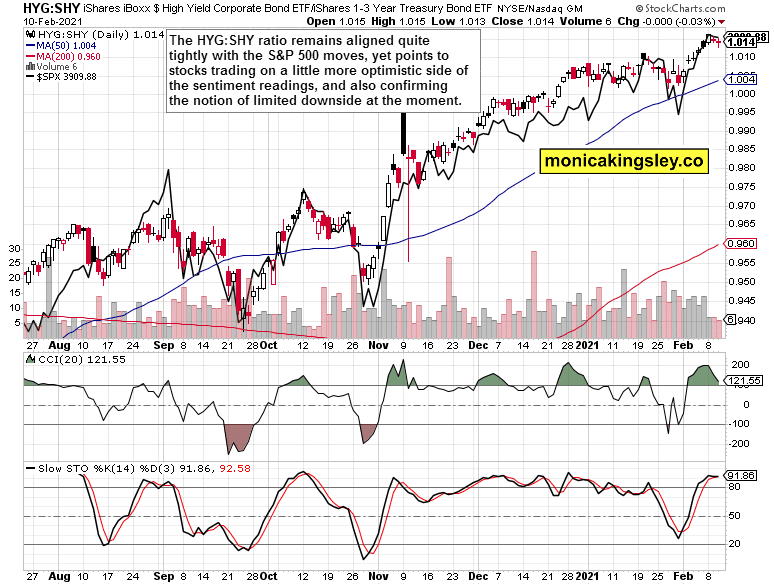

Credit Markets

High yield corporate bonds (HYG: ETF) wavered yesterday as well, yet bottom fishers appeared, pushing up the volume. The bond markets are clearly buying the dip here.

High yield corporate bonds to short-term Treasuries (HYG: SHY) ratio is still lining up closely with the S&P 500 index. Pulling in tandem, these aren‘t showing any momentary divergence.

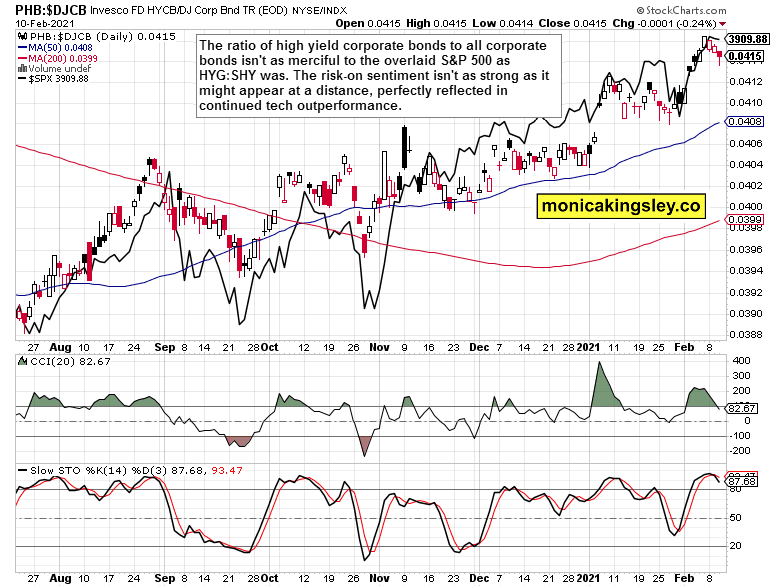

When it comes to the high yield corporate bonds to all corporate bonds (PHB:$DJCB) ratio, the picture gets different, as the riskier end of the corporate bond spectrum isn‘t firing on all cylinders. That‘s part of the watch out story justification.

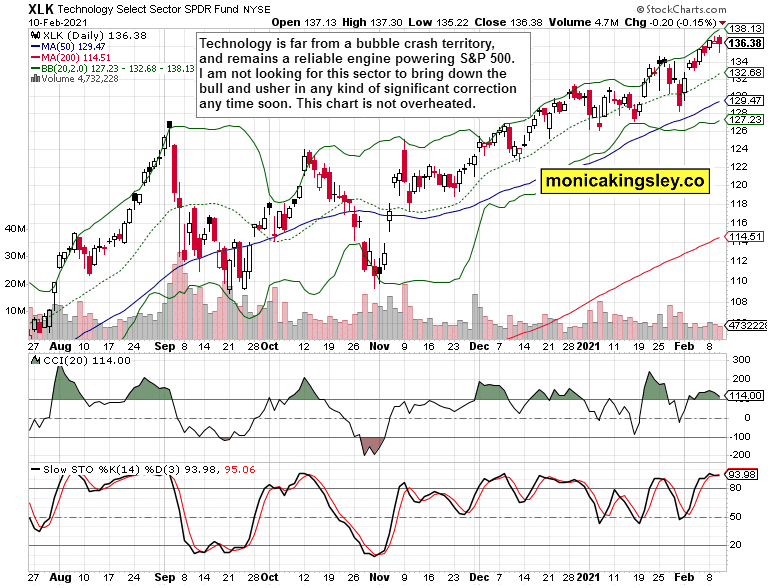

Technology, Value, and Growth

Technology (XLK ETF) hadn‘t suffered a profound setback really yesterday. The volume wasn‘t there, and half of the intraday losses were recouped – the bears weren‘t serious, and as the caption says, be wary of tech bubble callers constantly warning about significant corrections with unclear timings. Both tech and S&P 500 are primed to go to much higher levels before things get really ridiculous. Also, remember that since September, the sector has been not at its strongest really.

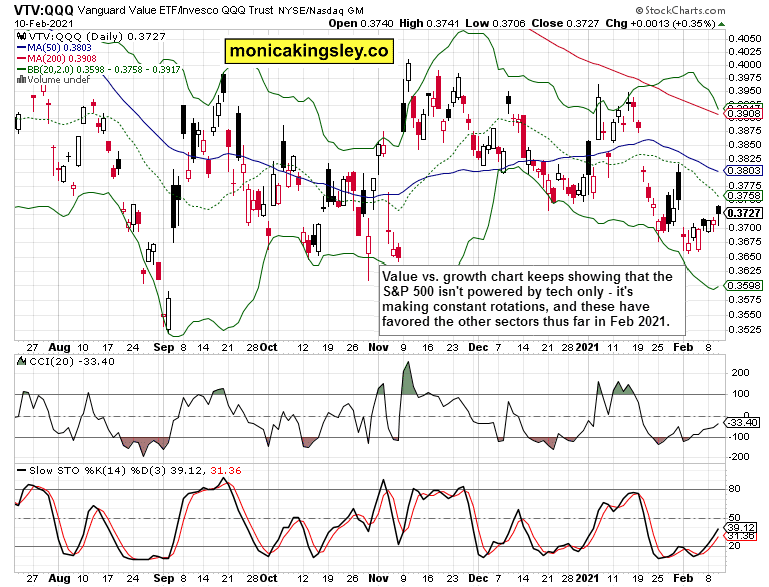

Here comes the rotation between value and growth – given the current status, tech has been underperforming. It‘s the other sectors that are now catching up since the start of Feb. All in all, the chart doesn‘t scream imbalance – the accompanying S&P 500 advance has been relatively orderly.

Gold & Silver

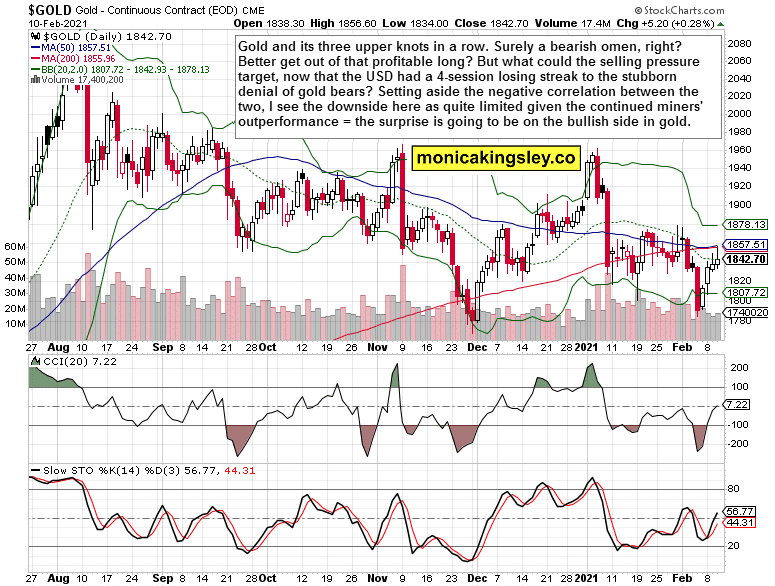

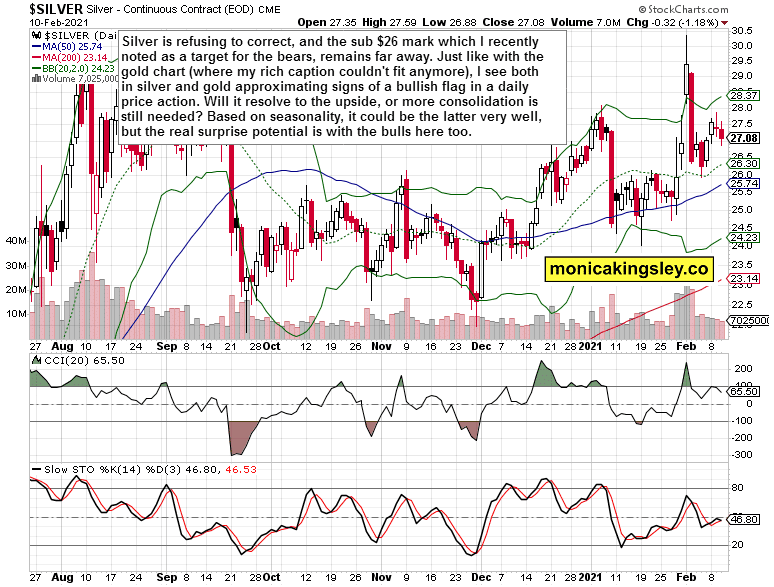

Today‘s precious metals section will be shorter than usual1, because the many bullish factors discussed throughout the week, remain in place. Just check out the metals & miners ratios, or yet another timely call of the dollar top.

Let‘s dive into the gold and silver price action that I tweeted about earlier today.

My open long position remains profitable, and the very short-term question remains what‘s next. Regardless of the upper knots, I don‘t see the short-term uptrend is exhausted, and you all know pretty well my medium- and long-term bullish case (stronger for silver than for gold in 2021 really).

Despite being quite hot in the short run, silver isn‘t willing to correct to any kind of reasonable target. I view the current indecision as part of an ongoing consolidation and don‘t discount the bullish implications. The key takeaway however is, how much would have to happen to flip this (and gold‘s) chart bearish. I remain cautiously optimistic in the short run, and very optimistic as regards the medium- and long-term.

Summary

The stock market keeps holding gained ground, having defended yesterday‘s values largely. Given the signs of creeping deterioration, which is however not strong enough to break the bull‘s back, let alone jeopardize it, the short-term caution in the 3,900 vicinity is still warranted.

The gold and silver bulls are consolidating gains, and the bullish case for precious metals remains strong. Crucially, it‘s not about the dollar here, but about the sectoral internals, decoupling from rising Treasury yields, and holding firm against corporate ones. The new upleg is knocking on the door, and patience will be richly rewarded.

Thank you for having read today‘s free analysis, which is available in full on my personal website. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on availability and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor.

Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument