Stocks Ripe for a Breather As Gold and Silver Remain Strong

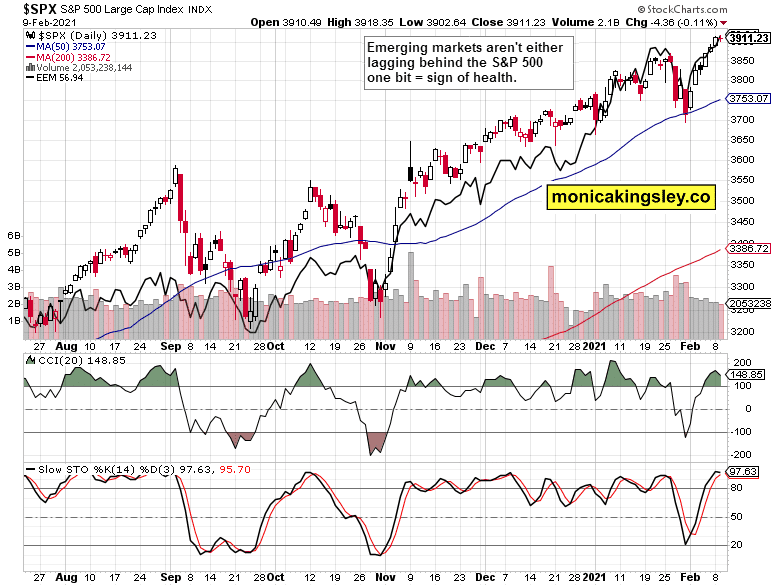

Both the upside and downside in stocks appears limited as these keep cooling off not far away from recent highs. Yesterday‘s session sent us a telling signal that the bears might wake up from their stupor briefly. Largely though, all remains well in the S&P 500 land.

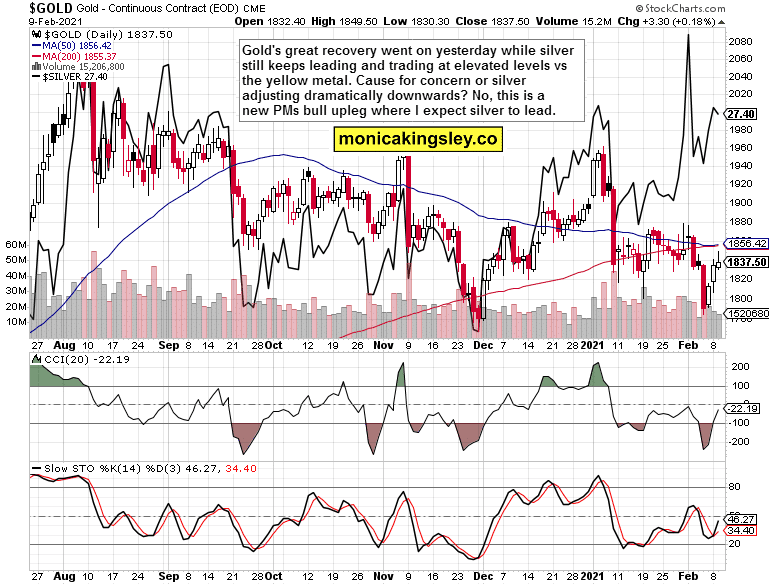

The anticipated gold rebound is underway, and the significant upper knot of yesterday‘s session isn‘t concerning – gold is not rolling over to the downside here. Let alone the silver. I view yesterday‘s trading as consistent with a daily pause within an unfolding uptrend.

My open long position is growingly profitable, and I‘ve covered the bullish case in detail both on Monday and Tuesday. Today‘s analysis will strengthen the story even more.

Observations

Given the dollar performance, I can‘t underline enough the importance of what we‘re witnessing – let‘s move to my Monday‘s dollar observations, which are silently marking the turning point I called for, directly relevant to precious metals:

(…) The weak non-farm employment data certainly helped, sending the dollar bulls packing. It‘s my view that we‘re on the way to making another dollar top. After which much lower greenback values would follow. Given the currently still prevailing negative correlation between the fiat currency and its shiny nemesis, that would also take the short-term pressure of the monetary metal(s).

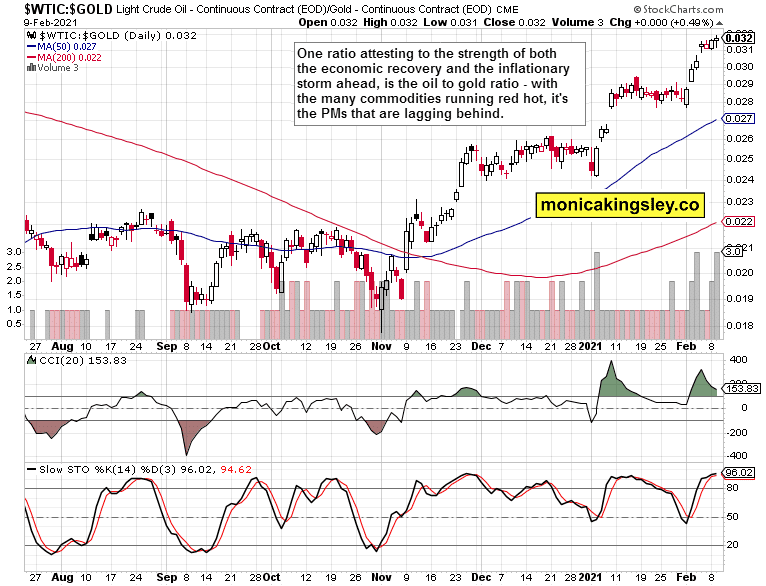

What would you expect given the $1.9T stimulus bill, infrastructure plans of similar price tag, and the 2020 debt to GDP oh so solidly over 108%? Inflation is roaring – red hot copper, base metals, corn, soybeans, lumber and oil, and Treasury holders are demanding higher yields especially on the long end (we‘re getting started here too). Apart from the key currency ingredient, I‘ll present today more than a few good reasons for the precious metals bull to come roaring back with vengeance before too long.

Finally, I‘ll bring you uranimum market analysis today as well. By popular demand, I‘ll dive into the commodity and its miners. You know already that my focus goes much further than the key topic of these analyses (stocks and precious metals). I am regularly covering oil, commodities and currencies too – just check out my trading story if you hadn‘t done so already.

So, let‘s dive into the charts (all courtesy of www.stockcharts.com).

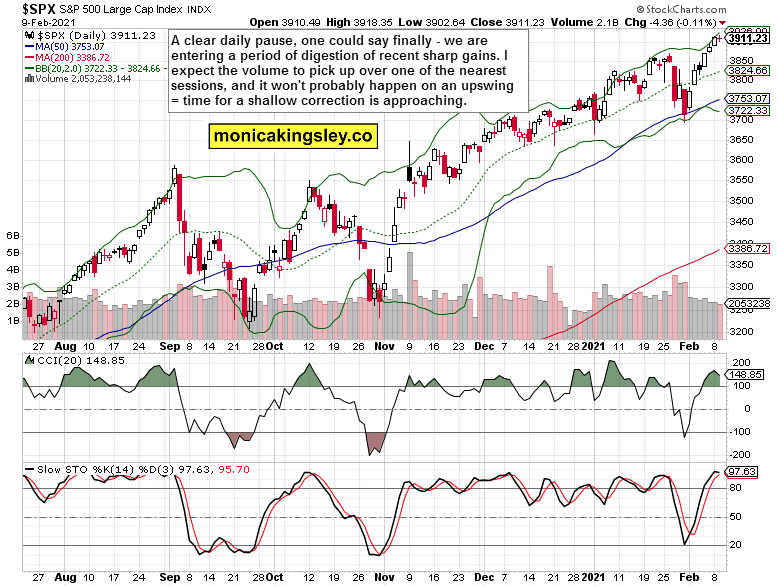

S&P 500 Outlook and Its Internals

A first day of hesitation into a very strong chart with non-stop gains recently, yet it‘s exactly these moments when the bears might try to raise their heads once again. Just to rock the boat, that‘s all.

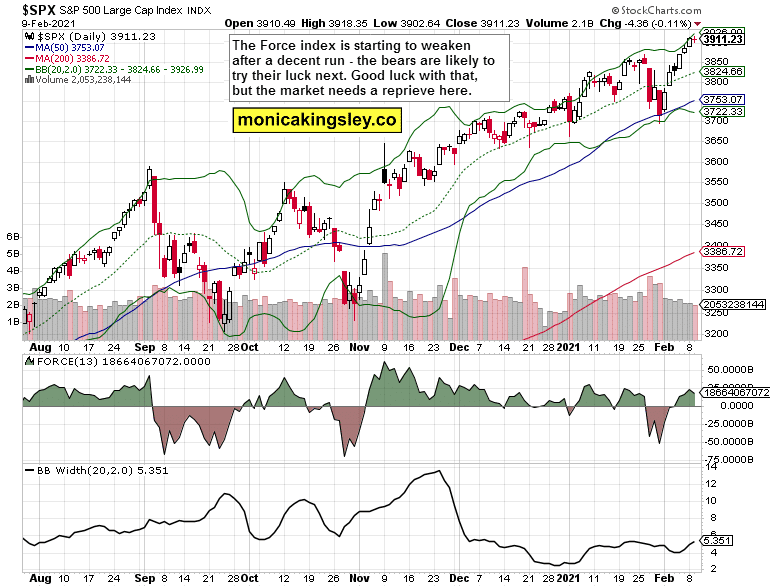

The Force index is warning that its solid upswing is due to a reprieve here in what I perceive to be initial signs of selling into strength. Not too much, but distribution had an upper hand yesterday over accumulation.

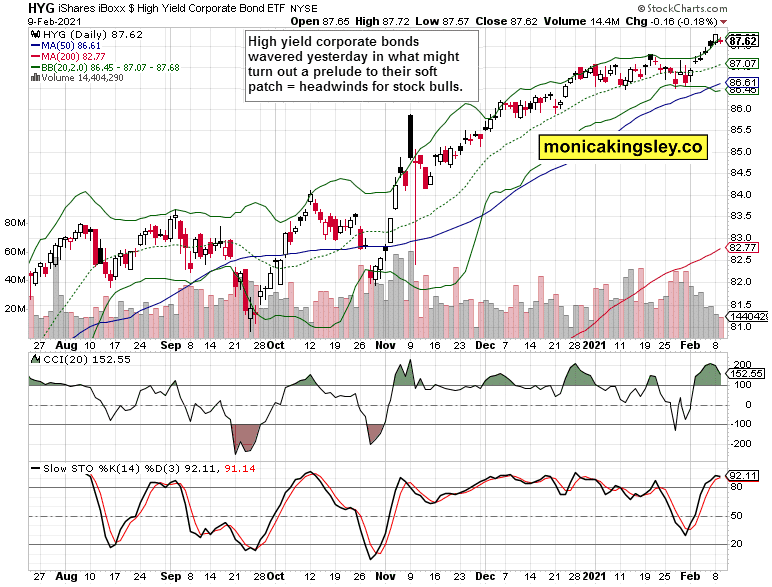

Credit Markets

High yield corporate bonds (HYG ETF) didn‘t perform fine yesterday at all. On declining volume, the bulls couldn‘t close above Monday‘s opening prices. Thus, the post-Jan 20 performance, doesn‘t bode well for the short term. The steep uptrend simply appears in need of a rest.

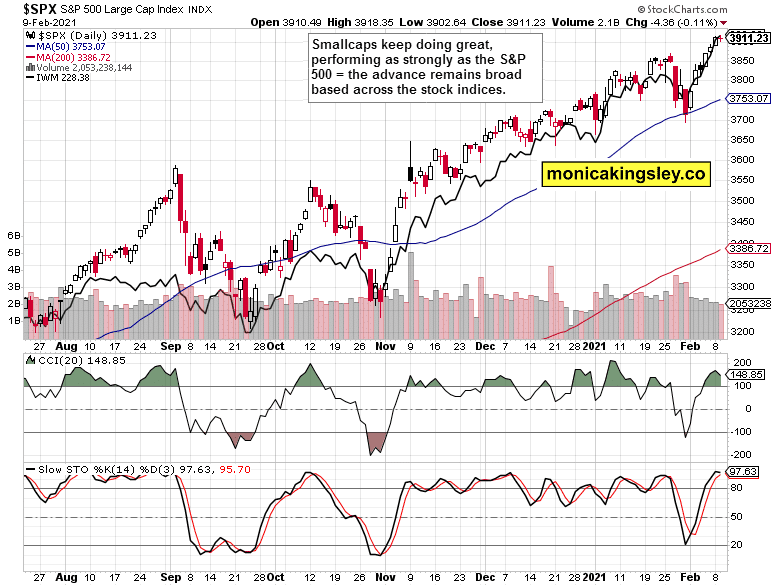

Smallcaps, Emerging Markets, and Oil

S&P 500 vs. the overlaid Russell 2000 (black line) isn‘t sending any warning signs of internal weakness when the two are compared. The rising tide is lifting all (stock) boats.

Gold & Silver

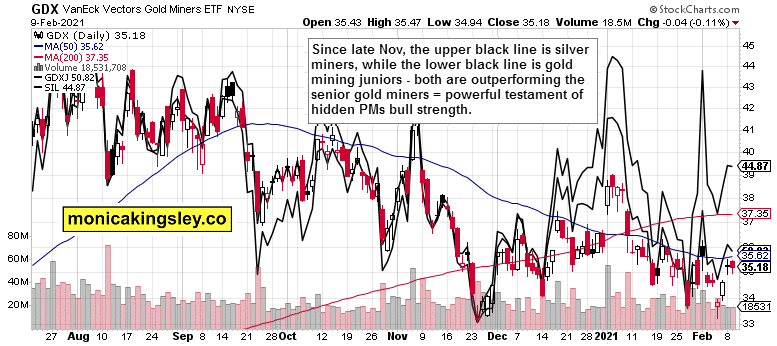

Let‘s overlay the gold chart with silver (black line). My yesterday‘s words are a good fit also today – the disconnect since the Nov low should be pretty obvious and interpreted the silver bullish way I‘ve been hammering for weeks already. Please note that the white metal has been outperforming well before any silver squeeze caught everyone‘s attention.

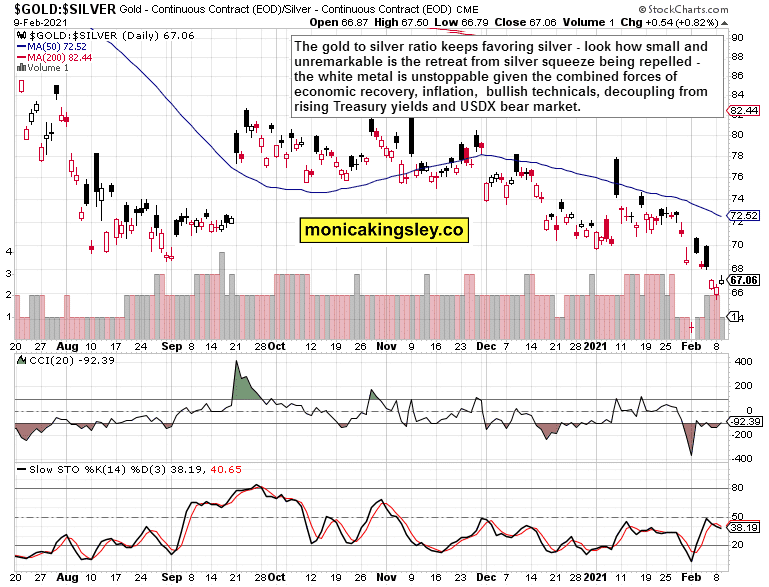

The gold to silver ratio sends a similarly clear message. The coming precious metals upleg will be characterized by silver outperforming gold for various reasons beyond the industrial demand and versatility ones. Silver‘s above ground stockpile isn‘t being added to at the same pace as gold. Moreover, it is recycling is less feasible, practically speaking. Solar panels are but one of the ever hungry industrial applications, making heavy demands on silver reserves.

Let‘s overlay the senior gold miner’s chart with both junior mining stocks (also gold) and silver mining stocks. See the late Nov turning point, where silver miners started outperforming both the gold juniors and gold seniors. That‘s another proof of the precious metals bull waking up.

From the Readers‘ Mailbag – Uranium

Q:

Hi Monica, despite all the dire warnings of $1500 on gold, you seem to be spot on so far. Where do you think uranium might be headed. It looks risky, but some say nowhere but up, others nowhere but down!

A:

Thank you very much! That‘s honest analysis, free from fearmongering. I have been very vocal in writing here, on Twitter, and within comments everywhere that hypothetical technical targets divorced from reality (nonsensical) are dangerous to those who take them without a pinch of salt or two.

Whenever I turn from a precious metals (or stock market) bull to a more cautious tone, you all my dear readers, will be the first ones to know. Just as now, the technical signs supporting the bullish (PMs) case are appearing increasingly forcefully (hello, dollar), the same way I‘ll present to you the weakening bullish factors whenever their time comes. We are far away from that in both markets and in oil, too (you‘ll hear me cover that one more often as well).

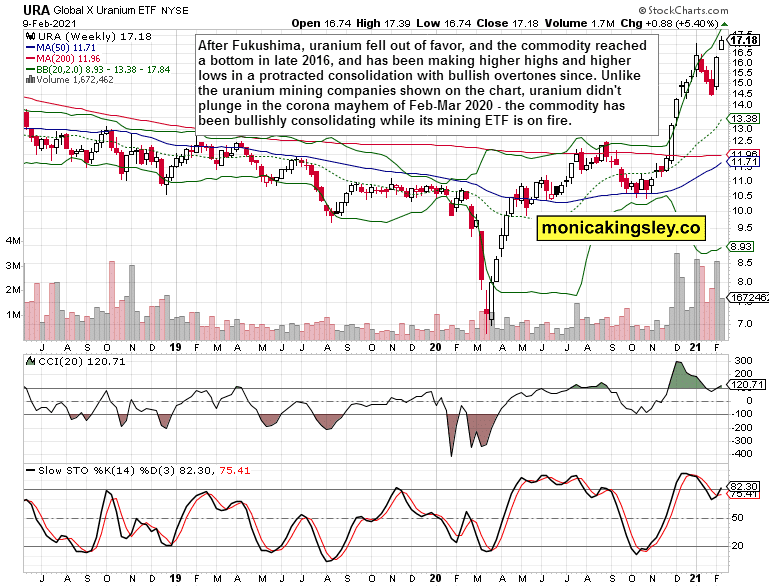

Uranium was hit pretty hard with the Fukushima disaster of 2011 that brought about a prolonged bear market. In 2016, a bottom was reached, and the commodity is slowly but surely on the mend. No spectacular gains, but modest positive returns that not even coronavirus managed to bring down.

The same couldn‘t be said about uranium miners, as the below chart shows. Having taken a plunge, they‘ve recovered with the veracity of Bitcoin (called right in my first 2021 analysis), outperforming uranium as a commodity significantly. Still, these remain considerably below their 2011 highs (over $105). And given the energy mix and policies, I am clearly on the bullish side of the uranium opinion spectrum.

Summary

The stock market keeps holding gained ground. But regardless of the rather clear skies ahead, a bit of short-term caution is called for given the weakening credit markets, which may prove to be very temporary indeed. Expect any correction to be relatively shallow – and new highs to follow, for we‘re far away from a top.

The gold and silver bulls are consolidating gains amid their return, and the bullish case for precious metals is growing stronger day by day. Crucially, it‘s not about the dollar here, but about the sectoral internals and decoupling from rising Treasury yields. The new upleg is knocking on the door, and patience will be rewarded with stellar gains.

Thank you for having read today‘s free analysis, which is available in full at my personal site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information, represent analyses and opinions of Monica Kingsley that are based on availability and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor.

Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. She may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument