EURUSD, GBPUSD, NZDUSD record new lows

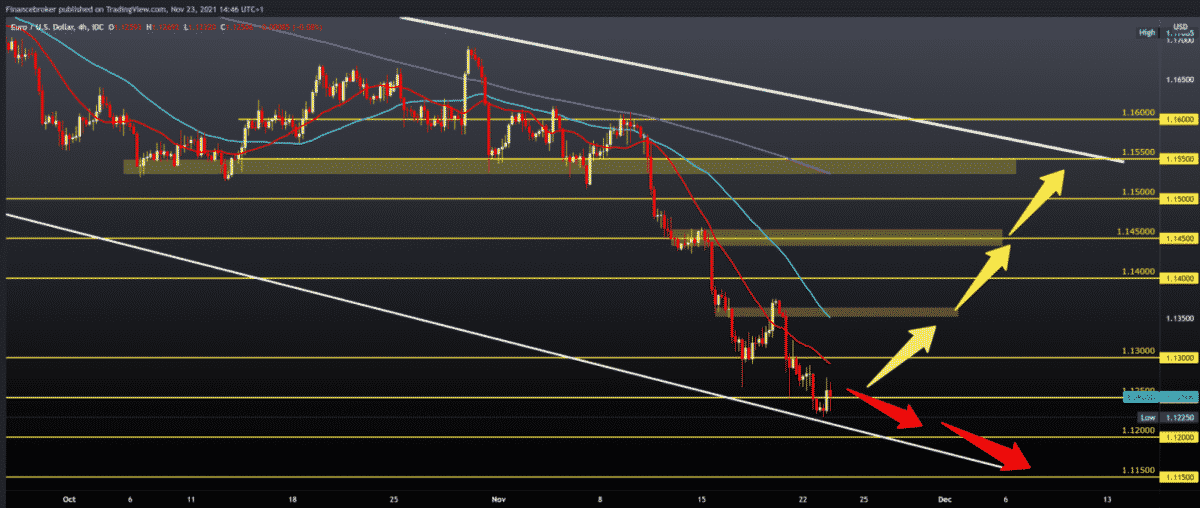

EURUSD chart analysis

Pair EURUSD finds current support at 1.12250, making a smaller gain to 1.25300. Now we need to pay attention to what kind of consolidation will be positive or negative. The loose monetary policy of the EU and European countries’ lockdown actions have caused the EURUSD to fall to new lows this year.

Bullish scenario:

- We need further positive consolidation and growth of EURUSD above 1.12500.

- The next resistance is at 1.13000, where the MA20 moving average awaits us.

- If EURUSD makes a break above, the next higher resistance is at 1.13500, place of the previous bullish attempt, and additional resistance awaits us in the MA50 moving average.

Bearish scenario:

- We need continued negative consolidation and new testing of the previous low at 1.12250.

- The breakthrough below leads us to the next support at 1.12000. Additional potential support is our lower trend line.

- The broader picture is that the pair is EURUSD in a bigger bearish trend in the coming period.

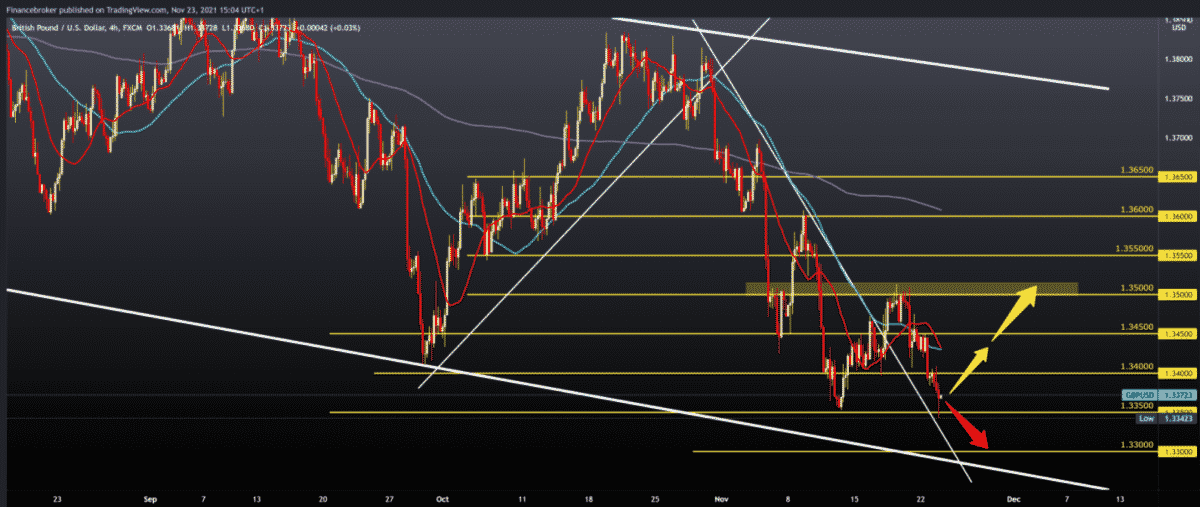

GBPUSD chart analysis

Pair made a new low this year at 1.33423 today. The previous lower low at 1.33550 did not last, and GBPUSD is making a break below. It is very important for us now to see how consolidation will go at this level. The strengthening dollar continues to have a major impact on other major currencies.

Bullish scenario:

- We need a positive consolidation that will push GBPUSD above 1.34000.

- Additional support we can make if the pair climbs above 1.34500.

- Further growth encounters resistance at 1.35000 psychological level.

Bearish scenario:

- We need further negative consolidation and a break below the previous lower low.

- A break below 1.33500 opens new this year’s lows, and the first next support is 1.33000.

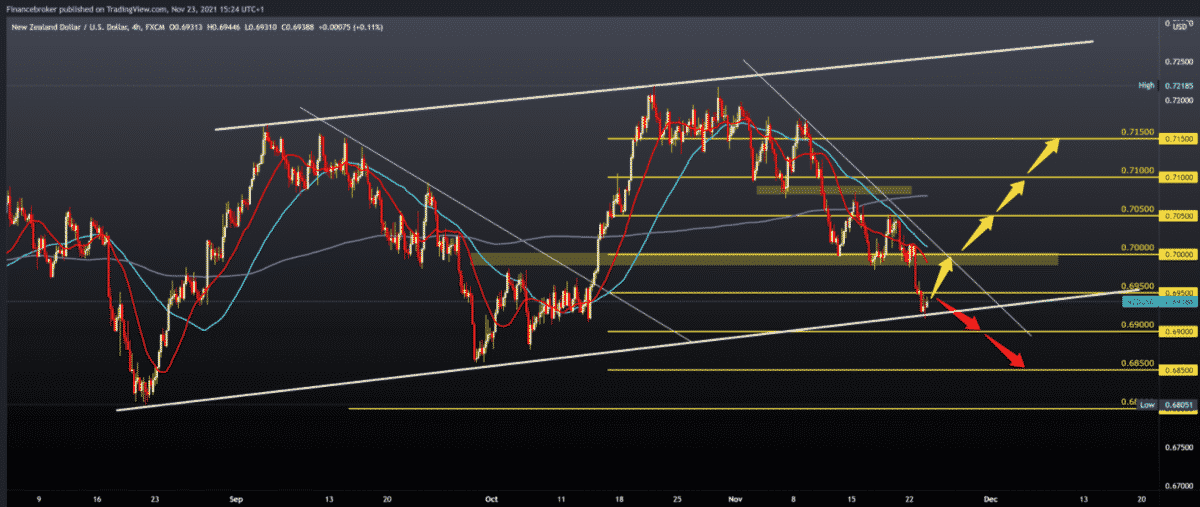

NZDUSD chart analysis

Pair NZDUSD fell to a new November lower low at 0.69250 to the bottom line of the rising channel. And now we expect the pair to embark on a new bullish trend with positive consolidation. The New Zealand Reserve Bank’s report on a possible interest rate increase may be positive for the NZD.

Bullish scenario:

- We need positive consolidation and growth to 0.70000 psychological level. Upstairs we are waiting for additional resistance in MA20 and MA50 moving averages.

- We can also draw a falling trend line as resistance on the chart, and the break above can drag us into a stronger bullish trend.

- A significant zone of resistance is in our area 0.70500-0.71000.

Bearish scenario:

- We need negative consolidation and a fall below the bottom trend line.

- The break below us drops to support at 0.69000, and the next support is at 0.68500, the previous lower low from September.

- The maximum drop on this time frame is the lower point of the channel and the August minimum at 0.68000

Market overview

British news

On Tuesday, Bank of England policymaker Jonathan Haskell said that British interest rates would be raised if the labor market remained tight.

“Although most of the current inflation is due to external forces such as energy prices, the labor market is tight, and we must be careful,” the banker said. If the labor market remains strong, the interest rate will have to rise, he said.

Markets generally expect the BoE to increase its rate in December as inflation remains high and the labor market continues to strengthen.

EU news

In November, private sector growth in the eurozone rose unexpectedly after falling to a six-month low in October, data from a rapid survey by IHS Markit showed on Tuesday.

The composite production index rose to 55.8 in November from 54.2 in October. The forecast is to drop 53.2.

Stronger private sector expansion is unlikely to prevent the eurozone from experiencing slower growth in the fourth quarter. Especially as more and more virus cases appear to cause new economic disruptions in December, said Chris Williamson, a chief business economist at IHS Markit.

-

Support

-

Platform

-

Spread

-

Trading Instrument