EURUSD, GBPUSD, AUDUSD against a stable dollar

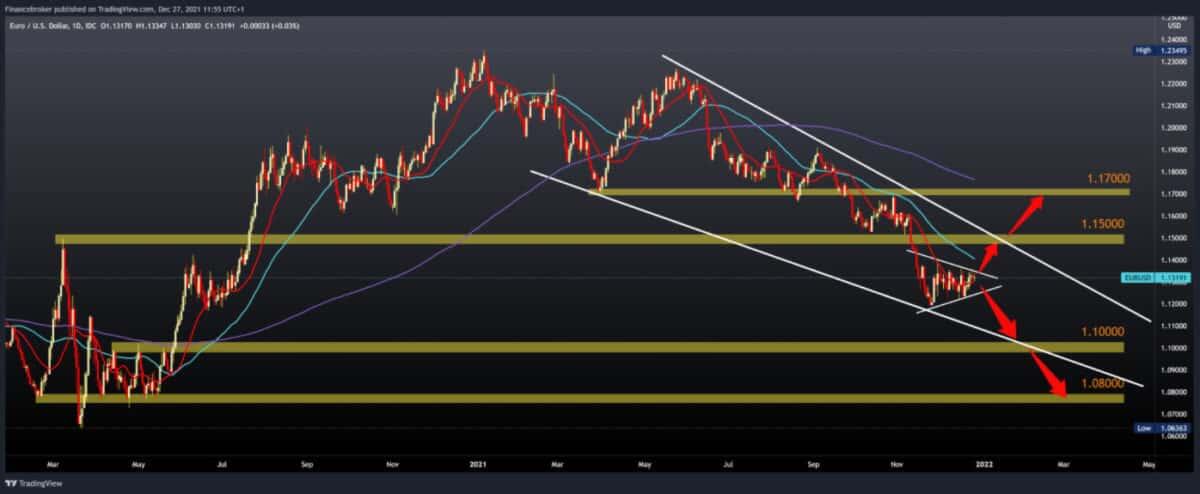

EURUSD chart analysis

During Asian trade, the euro weakened slightly against the dollar. In France, the number of newly infected has exceeded an alarming 100,000 on a daily basis. The euro consolidated somewhat last week because “risk on” sentiment prevailed in the financial market. However, the Bundesbank recently announced that the German economy could slow down this quarter. The number of newly infected with covid-19 introduces new restrictions and keeps consumers at home, which is holding back the economy. Currently, the euro is exchanged for 1.1318 dollars, representing a slight increase of the common European currency by 0.01% since the beginning of trading tonight.

Bullish scenario:

- We need to continue this positive consolidation with the support of the MA20 moving average.

- We see that EURUSD is moving in one triangle, and we need a break above the top line to continue.

- We see the next resistance zone at 1.14000, where we come to the MA50 moving average.

- The main target and stronger resistance await us at 1.15000, the place where we meet the upper line of resistance this year.

- Just a break above this line can heighten bullish optimism.

Bearish scenario:

- We need a new negative consolidation and a break below the bottom line of the triangle.

- Then we come across support at 1.12000, where we test this year’s minimum.

- Further bearish pressure may bring us EURUSD to the support zone at 1.10000.

GBPUSD chart analysis

During Asian trading, the British pound strengthened last week’s gains against the dollar. Currently, the pound was exchanged for 1.34010 dollars, representing a strengthening of the British currency by 0.14% since the beginning of trading tonight. Prime Minister Boris Johnson rejected the introduction of Great Britain in the new “lockdown” until the end of the New Year’s holidays, which was positively welcomed. However, the number of newly infected on the island on December 26 was 122,000. Today is a non-working (Christmas) day in the UK.

Bullish scenario:

- We need a further continuation of this positive consolidation, and we need a break above the MA50 moving average.

- In the following, we encounter psychological resistance at the 1.35000 level.

- A break above 1.35000 levels supports us to continue towards the upper resistance line around 1.36000.

Bearish scenario:

- We need a new negative consolidation and a rejection of the MA50 running average.

- We then descend to support at 1.33000 with additional support in the MA20 moving average.

- A larger zone of support awaits us at 1.32000, the place of the December minimum.

AUDUSD chart analysis

Risk-on sentiment prevails in the financial market. Pfizer received approval for its covid pill last week. In addition, the US Consumer sentiment indicator for the December Conference Board showed a much more optimistic view of consumers for the coming period last week. During the holiday weekend, thousands of flights to the United States were canceled due to the spread of the “omicron” coronavirus. During Asian trading, the Australian dollar has largely kept gains (since last week) against the US. Currently, the Australian dollar is exchanged for 0.7239 US dollars, which represents weakening the Aussie by 0.10% since the beginning of trading tonight.

Bullish scenario:

- We need new positive consolidation and support at the 38.2% Fibonacci level.

- We have support in MA20 and MA50 moving averages.

- Further positive consolidation can take us up to 50.0% Fibonacci level to 0.72715.

- In that zone, the additional resistance is the MA200 moving average.

Bearish scenario:

- We need continued negative consolidation below 38.2% Fibonacci levels.

- In zone 0.71500, we are waiting for MA20 and MA50 moving averages.

- The next lower support awaits us in the 0.71000 zone at 23.6% Fibonacci level.

- Our maximum pullback is up to 0.70000, the December and this year’s minimum.

-

Support

-

Platform

-

Spread

-

Trading Instrument