EURUSD and GBPUSD: The New Lower Low Level

- During the Asian trading session, the Euro continued to weaken against the US dollar.

- During the Asian session, the pound continues to consolidate in the area of yesterday’s low.

- UK employment rose at the slowest rate in September, a year and a half.

EURUSD chart analysis

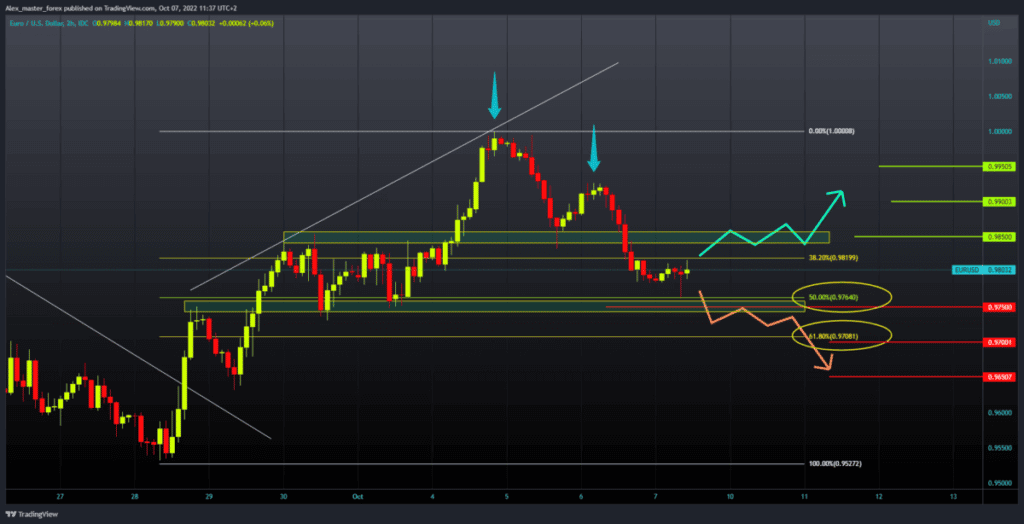

During the Asian trading session, the Euro continued to weaken against the US dollar. Pair EURUSD fell to 0.97335, thus forming a new three-day lower low. This pullback was to the 50.0% Fibonacci level and the support zone around the 0.97500 level. For now, the Euro finds support here and makes a minor recovery to the 38.2% Fibonacci level. We need a jump to the 0.98500 level and consolidation in that zone in order to gather strength for the next bullish impulse. Otherwise, the Euro will continue this bearish pullback, probably breaking the October low and forming a new lower low. Potential lower targets are 0.97000 and 0.96500 levels.

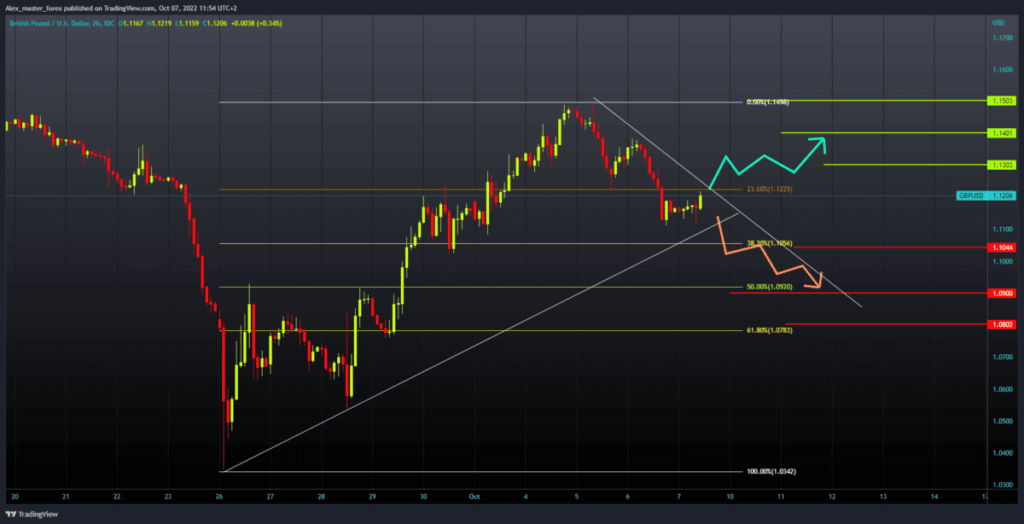

GBPUSD chart analysis

During the Asian session, the pound continues to consolidate in the area of yesterday’s low. For now, our obstacle is the 1.12000 level at 23.6% Fibonacci. We need to move above if we want to see a continuation of the pound’s recovery. Our first target is the 1.14000 level, the zone of the previous high, then the October high in the zone around the 1.15000 level. For a bearish option, we need a negative consolidation and a further pullback of the pound to the 1.10500 level. Thus, we would test the previous low at 1.10250. If the pound fails to find support there, we are expected to see a continuation of the bearish trend. Potential lower targets are 1.09000 and 1.08000 levels.

Market Overview

UK employment rose at the slowest rate in September, a year and a half. Although strong demand for staff and efforts to increase capacity fueled further increases in hiring activity, the pace of growth weakened due to a subdued economic climate.

German industrial production fell more than expected in August as raw material shortages and supply chain bottlenecks continued to hamper the functioning of many industries. In August, industrial production fell by 0.8% on a monthly basis. On an annual basis, industrial production rose 2.1%, reversing a 0.8% decline in July.