EURUSD and GBPUSD: One-month high

- During the Asian session, the euro formed its new one-month high at the 1.02960 level.

- Yesterday, the pair GBPUSD failed to climb above the 1.23000 level.

- UK house price inflation.

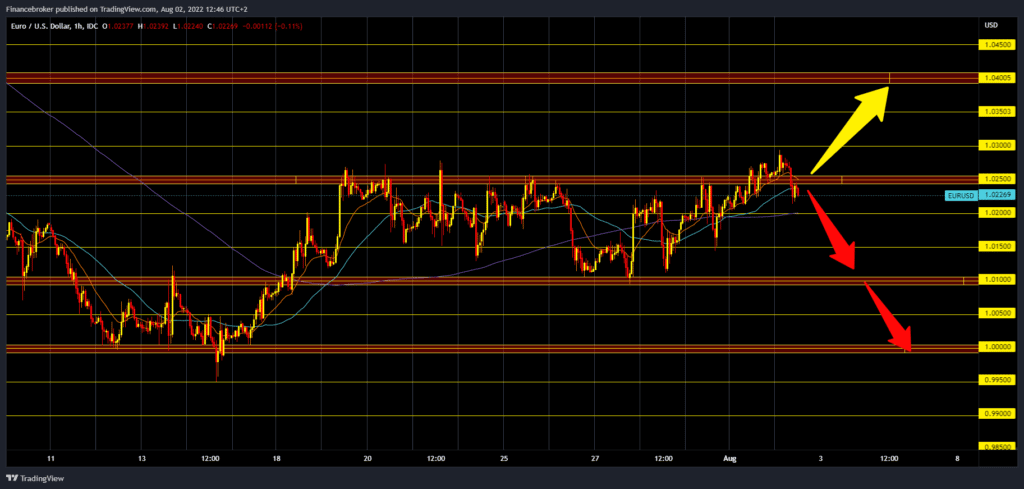

EURUSD chart analysis

During the Asian session, the euro formed its new one-month high at the 1.02960 level. A pullback soon followed, and the euro fell to 1.02150. We are now turning bearish again and could see a new test of support at the 1.02000 level. Additional support at that level is in the MA200 moving average. If a break below occurs, EURUSD could drop to support at the 1.01000 level. Increased pressure on the euro and the flight of investors to the safe dollar could once again lower this pair to the psychological 1.00000 level. For a bullish option, we need a return above the 1.02500 level. After that, we need to hold on to that level to try to continue towards 1.03000, the next resistance zone.

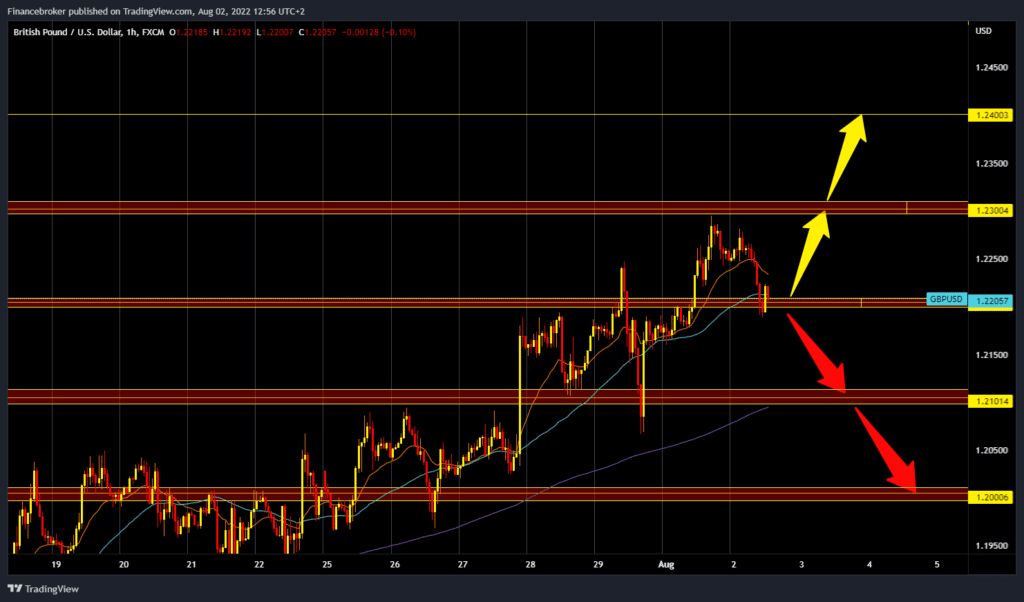

GBPUSD chart analysis

Yesterday, the pair GBPUSD failed to climb above the 1.23000 level and was soon followed by a pullback during the Asian trading session to the 1.22000 support zone. MA20 and MA50 are now on the bearish side and intensifying negative pressure. If we fail to hold on to the current level, a break below and a drop to the 1.21000 level could occur. Additional support at that level is in the MA200 moving average. We need a positive consolidation and a return to the 1.23000 resistance zone for a bullish option. A break of the pound above would open up space for us towards the next 1.24000 level, and if the dollar starts to weaken, maybe we will climb up to the 1.25000 level.

Market overview

UK house price inflation

UK house price inflation rose less than expected in July, after easing in the previous three months, Nationwide Building Society survey results showed on Tuesday. The house price index registered a double-digit annual growth of 11.0% in July, faster than the 10.7% increase in June. However, it was slower than economists’ forecast of 11.5%. On a monthly basis, house prices rose by 0.1 % in July, following a 0.2 % rise in the previous month. This was the twelfth consecutive monthly increase. The real estate market has maintained a surprising level of momentum despite rising inflation, which has already sent consumer confidence to an all-time low. Demand for real estate continued to be fueled by strong labor market conditions. At the same time, a limited supply of homes on the market has helped keep upward pressure on home prices.