Oil and Natural Gas: The bearish trend for the fifth day

- The price of oil dropped from $98.40 to $92.40.

- Yesterday, the price of natural gas managed to recover to $8.40.

- Russian oil exports appear to have stabilized, with Bloomberg data released on Monday showing a steady level of 500,000 barrels a day below the peak reached before the February invasion of Ukraine.

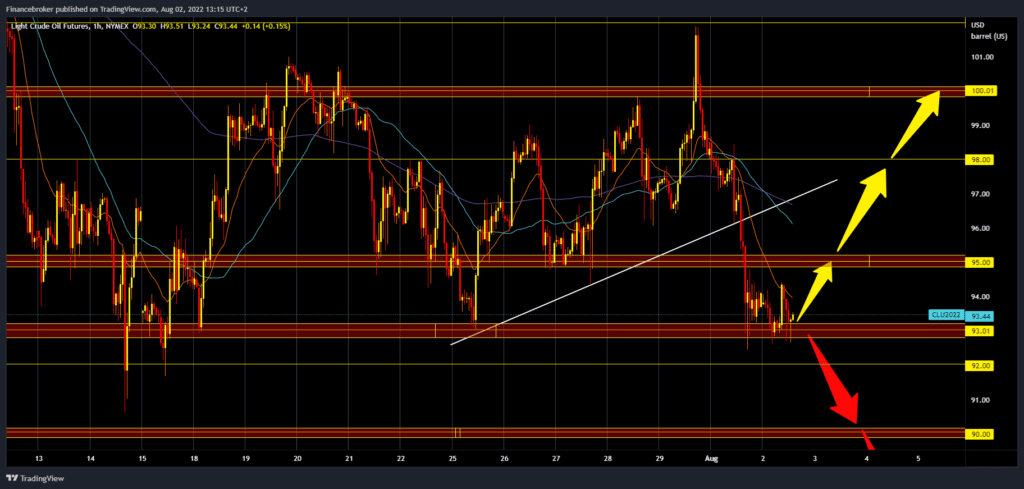

Oil chart analysis

The price of oil yesterday did not withstand the pressure of the increase in Covid-19 newly infected and new lockdowns in China, as well as announcements in other countries. From $98.40, the price dropped to $92.40. During the Asian trading session, the price managed to stay above $93.00, and we are holding at that level for now. Bearish pressure is evident on the chart, and we could expect a further drop in the price towards the $90.00 level. For a bullish option, we need a new positive consolidation and a return above the $95.00 level. In this way, the price of oil would form a new bottom and could continue towards the following resistance levels. Potential higher targets are $98.00 and $100.00, as well as last week’s high at $102.00.

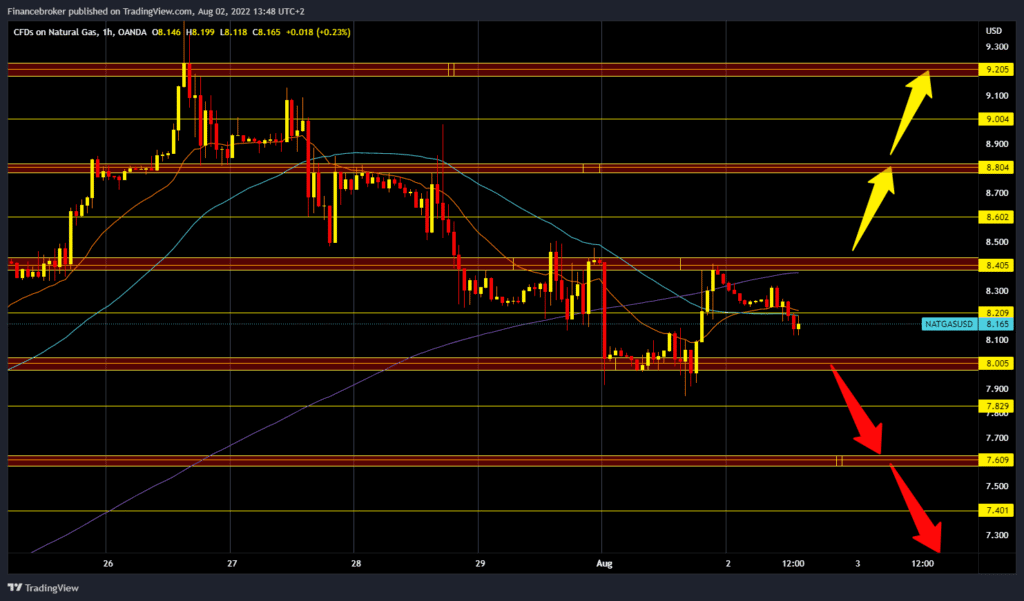

Natural gas chart analysis

Yesterday, the price of natural gas managed to recover to $8.40. It did not stay there for long, and during the Asian session, a pullback towards the $8.20 level followed. Subsequently, the price dropped below this support zone and continues towards $8.00. We are already in a bearish trend for the fifth day, and if the gas price does not break the $8.40 level, we could see a further retreat below the $8.00 level. Potential lower targets are $7.80 and $7.60 for gas prices. Our potential higher targets are $8.60 and $8.80 levels.

Market overview

Russian oil exports appear to have stabilized, with Bloomberg data released on Monday showing a steady level of 500,000 barrels a day below the peak reached before the February invasion of Ukraine.

According to Bloomberg, Russian offshore crude oil exports reached 3.5 million bpd in the week to July 29, while the four-week average is around 3.2 million bpd – a figure that suggests stabilization.

Specifically, while Bloomberg reported last week that there are indications that Chinese and Indian buyers have slightly backed off their purchases of Russian oil, Russian crude flows to Asia remain steady after the invasion.

The result is that Moscow continues collecting significant oil revenues for its war coffers.

Moscow has already said it will not comply and will not sell to any country that agrees to cap prices, and China, which has refused to condemn Russia’s invasion of Ukraine, is unlikely to go along with the West’s plans.