EURUSD and GBPUSD: New October High

- During the Asian trading session, the euro continued its bullish consolidation from yesterday and formed a new October high at the 0.98970 level.

- During the Asian trading session, the pound continues to advance against the US dollar, with today’s high at the 1.14300 level.

- Eurozone producer price inflation accelerated more than expected to a new record high in August.

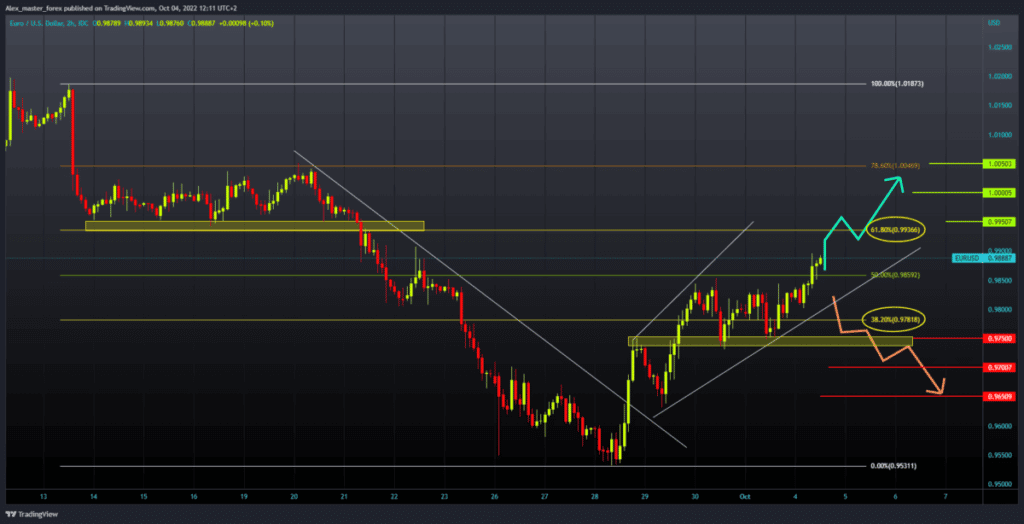

EURUSD chart analysis

During the Asian trading session, the euro continued its bullish consolidation from yesterday and crossed above the 50.0% Fibonacci, forming a new October high at the 0.98970 level. Chances are high that we will see today’s continuation of the euro recovery against the dollar, and the next target is the 61.8% Fibonacci level at 0.99360. For a bearish option, we need a new negative consolidation and a return below 50.0% Fibonacci. Then, the euro would likely pull back to the lower support at the 0.97500 level at the 38.2% Fibonacci. If the weak euro continues, a break below is inevitable. Potential lower targets are 0.97000 and 0.96500, the previous low of September 29.

GBPUSD chart analysis

During the Asian trading session, the pound continues to advance against the US dollar, with today’s high at the 1.14300 level. Yesterday, the pound managed to make a break above the 61.8% Fibonacci at the 1.12000 level, which further instilled optimism for further recovery. We are now looking at the 78.6% Fibonacci retracement at the 1.14620 level and could test the 1.15000 level. We need a pound return below 61.8% Fibonacci for a bearish option. First, we need a negative consolidation that would take us down to the 1.12000 level. We then need to hold below there, which would increase the bearish pressure, and we could see the pound continue to fall. The next support is around 38.2% Fibonacci zone at the 1.10560 level. A potential lower target is the 1.10000 level.

Market Overview

Eurozone producer price inflation accelerated more than expected to a new record high in August. Producer prices rose by 43.3% year-on-year in August. On a monthly basis, producer prices rose by 5.0% in August, following a 4.0% rise in the previous month.