EURUSD and GBPUSD – Highest Level in The Last Two Weeks

- During the Asian session, the euro consolidated against the dollar.

- During the Asian session, the British pound confirmed yesterday’s gains against the dollar.

- Retail sales in the UK rose unexpectedly in April.

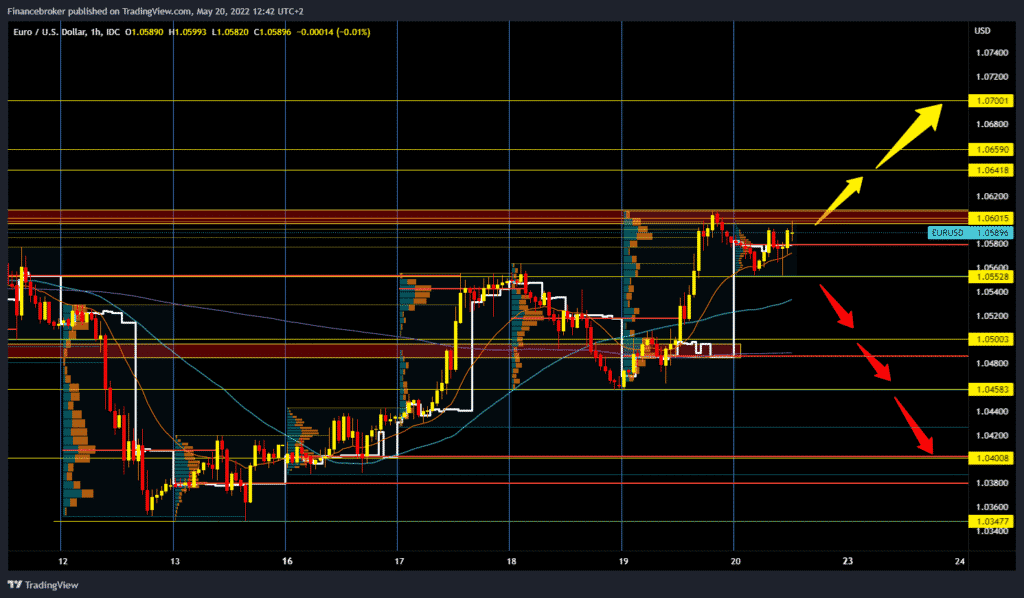

EURUSD chart analysis

During the Asian session, the euro consolidated against the dollar. The US currency is in retreat along with falling yields on US Treasury bonds. The euro used the pressure of sales on the dollar and climbed yesterday to the highest level in the last two weeks, to 1.06000. For now, that is an obstacle for us for the euro. The EU has not yet made a decision on the embargo on the import of Russian oil, and the episode about the obligation to pay for Russian gas in rubles, it seems that this gives vent to the common European currency. The euro is exchanged for 1.05930 dollars, representing the strengthening of the common European currency by 0.08% since the beginning of trading tonight. For the bullish option, we need a break above 1.06000 levels. Potential bullish targets are 1.06250, 1.065000, and 1.07000 levels. For the bearish option, we need a pullback below 1.05600 levels. After that, we can expect a continuation of the retreat toward previous levels of support. Our potential bearish targets are 1.05000, 1.04800 and 1.04600 levels.

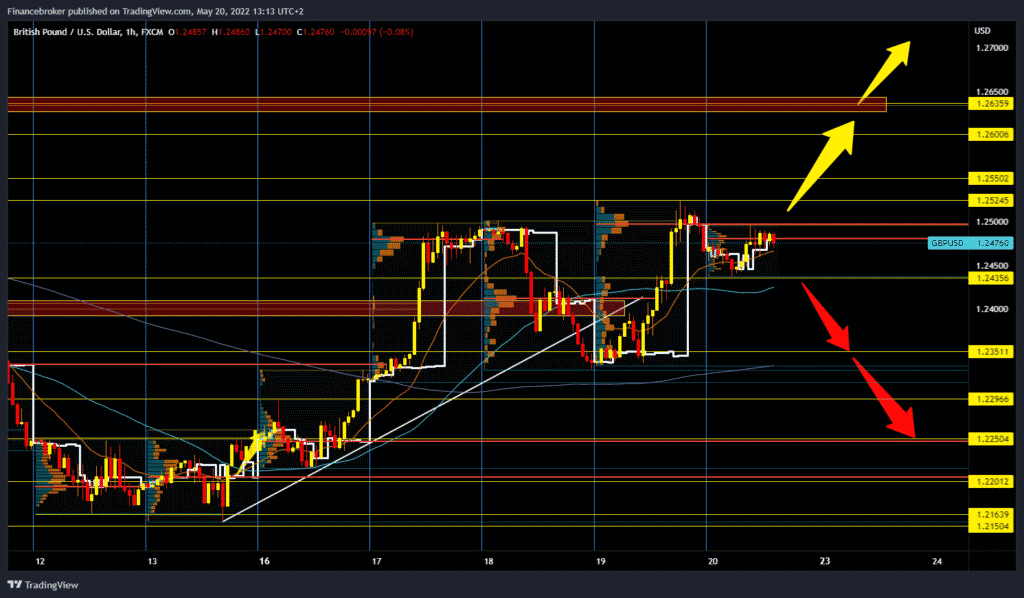

GBPUSD chart analysis

During the Asian session, the British pound confirmed yesterday’s gains against the dollar. Data on retail sales in the UK in April were above expectations, which gave an additional boost to the pound. The US currency is in retreat, along with falling yields on US Treasury bonds. Tensions over post-Brexit relations between the EU and the UK continue to be exerted on the British currency. As of this morning, a drop in ten-year US bond yields is helping the pound’s recovery. The pound is exchanged for 1.24800 dollars, representing the British currency’s strengthening by 0.11% since the beginning of trading tonight. We need a break and consolidation above 1.25000 levels to continue the bullish option. Yesterday’s maximum was at 1.25245 level. After that, the pound fell this morning to the 1.24356 level. Since then, we have had a bullish consolidation that is slowly pushing the pound towards yesterday’s maximum. The break above opened the way for us to the following targets: 1.25500, 1.26000, 1.26500, etc. For the bearish option, we need a return below the 1.24300 level. Potential lower targets are 1.24000, 1.23500 and 1.23000 levels.

Market overview

UK retail sales

Retail sales in the UK rose unexpectedly in April despite consumer confidence falling to a record low as rising inflation further increased the cost of living.

According to data released by the Office for National Statistics on Friday, retail sales rose 1.4 % a month, reversing a 1.2 % drop in March.

Year on year, retail sales fell 4.9 % after rising 1.3 % in March. However, the pace of the decline was slower than the economists’ forecast of -7.2 %.

While things are likely to become more difficult for consumers as the pressure on real household incomes increases due to higher inflation, signs of resilience in economic activity in retail data are encouraging, said Nicholas Farr, an economist at Capital Economics.

The fall in consumer confidence has not led to a collapse in consumer spending and adds weight to the view that the Bank of England will have to raise rates further to bring inflation back to the 2.0 per cent target, Farr added.