EURUSD and GBPUSD: EURUSD falls to 1.10650 this morning

- During the Asian trading session, EURUSD hovered around 1.11200 levels.

- During the Asian trading session, GBPUSD held above the 1.28500 level.

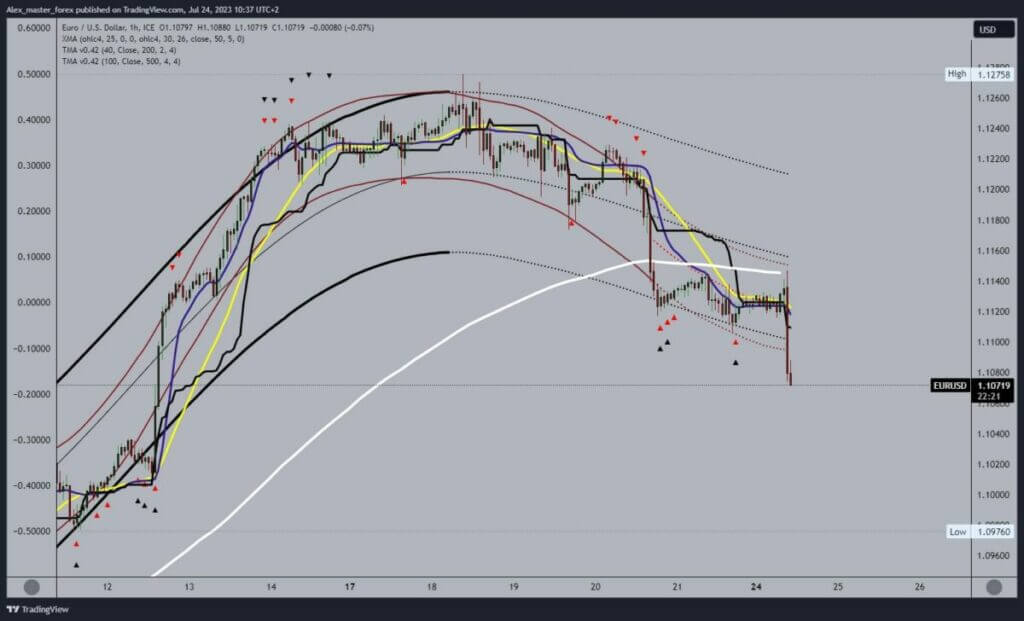

EURUSD chart analysis

During the Asian trading session, EURUSD hovered around 1.11200 levels. At the start of the EU session, we had some important news for the Euro: The German Manufacturing Purchasing Managers’ Index, which showed that the German economy is increasingly slow. This morning’s data showed that the index fell to 38.8 points, only 3.9 points from the minimum at the beginning of the Corona crisis when the index fell to 34.5 levels.

This news caused EURUSD to fall from 1.11400 to 1.10750 level. Currently, we see that the euro has stopped at that level and is trying to consolidate. For a bearish option, we need a continuation of the negative consolidation. Potential lower targets are 1.10700 and 1.10600 levels. For the bullish option, we need positive consolidation and growth of EURUSD to the 1.11000 level. After that, we could expect to see further recovery of the euro. Potential higher targets are 1.11200 and 1.11400 today’s high.

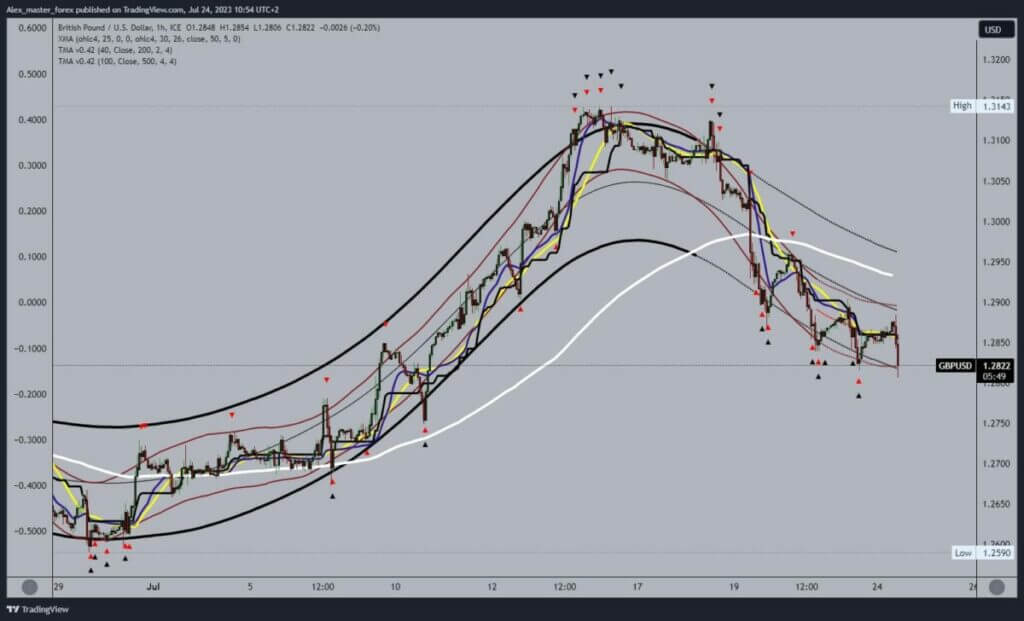

GBPUSD chart analysis

During the Asian trading session, GBPUSD held above the 1.28500 level. The pair managed to climb at one point to the 1.28850 level and form today’s high there. After that, we see a pullback at the start of the EU session. In the next hour, additional pressure was exerted by the bad data on the GBP Manufacturing PMI index.

The index showed a slowdown in production, leading to the pound’s fall to the 1.28000 level. We formed a two-week lower low there and are now trying to consolidate above it. Potential higher targets are 1.28500 and 1.29000 levels.

We need a negative consolidation and a new drop below the 1.28000 level for a bearish option. This would mean forming a new low and continuing to the bearish side. Potential lower targets are 1.27750 and 1.27500 levels.