EURUSD and GBPUSD: Euro Reviving Above The 1.00000 level

- The European session added strength to the euro, which we are reviving with a jump above the 1.00000 level.

- Pair GBPUSD formed a new October high today, breaking the 1.15000 level.

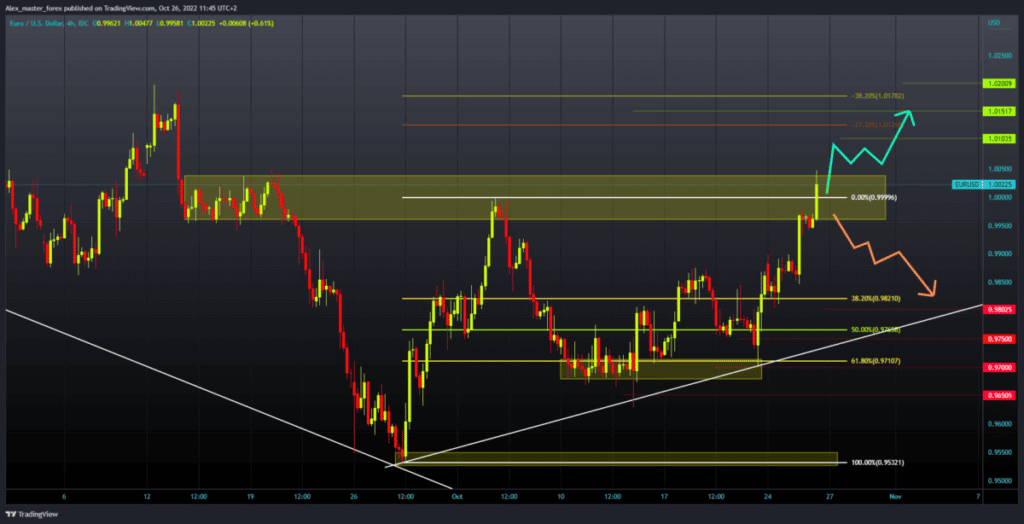

EURUSD chart analysis

During the Asian session, the pair EURUSD consolidated around the 0.99500 level in the zone. The European session added strength to the euro, which we are reviving with a jump above the 1.00000 level. The new October high is at the 1.00500 level. For a bullish option, we need a continuation of this positive consolidation.

First of all, we need to stay above the 1.00000 psychological level for the euro. If we succeed in this, we could expect a further recovery of the euro. Potential higher targets are 1.01000 and 1.01500 levels. For a bearish option, we need a negative consolidation and a return below the 1.0000 level.

After that, we would retest the previous breakout zone at the 0.99500 level. The fall of the euro below this zone could extend the bearish option to the next support at the 0.99000 level. Potential lower targets are 0.98500 and 0.98000 levels.

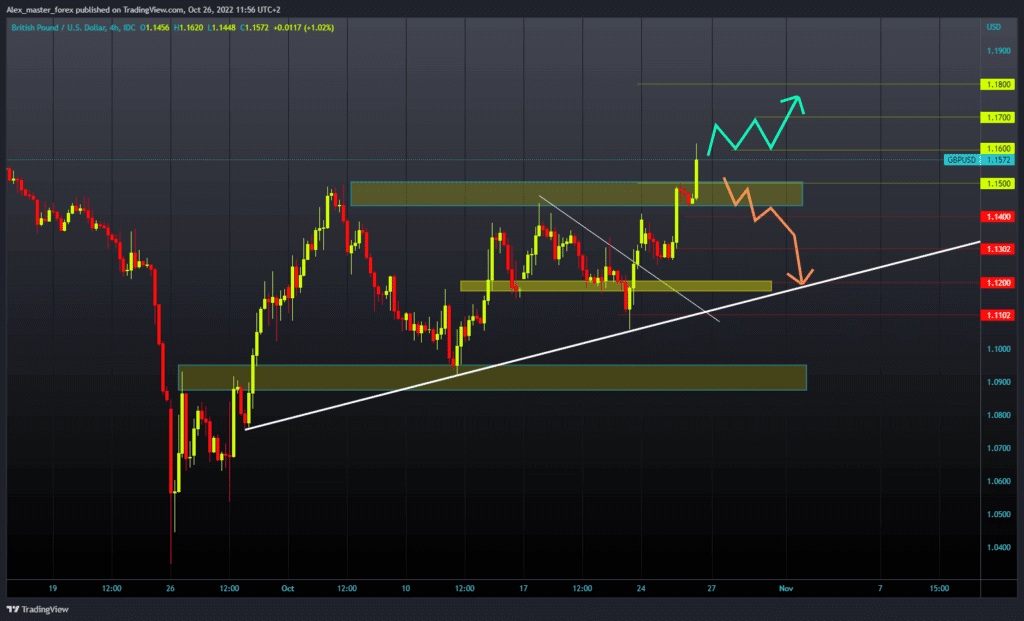

GBPUSD chart analysis

The GBPUSD pair formed a new October high today, breaking the 1.15000 level. Today’s high is the 1.16200 level, and we now see consolidation taking the pound down to the 1.15750 level. The pound must maintain above the 1.15000 level if it intends to continue with the bullish trend. To continue the bullish option, we need further positive consolidation and a new move above the 1.16000 level.

Then we need to try to stay there and continue the recovery with a new bullish impulse. Potential higher targets are 1.17000 and 1.18000 levels. For a bearish option, we need a pullback below the 1.15000 level. We could then expect a negative consolidation pushing the pound to lower levels on the chart.

Potential lower targets are 1.14000, 1.13000, and 1.12000 levels. We have additional support at the 1.12000 level in the lower trend line.