EURUSD and GBPUSD: Are You Ready For New Bullish Impulse?

- During the Asian trading session, the euro slightly retreat to the 0.99800 level.

- During the Asian trading session, GBPUSD managed to hold above the 1.15000 level.

- The European Central Bank is expected to raise its benchmark rates later in the European trading session, given record high inflation and a tightening stance by its global peers.

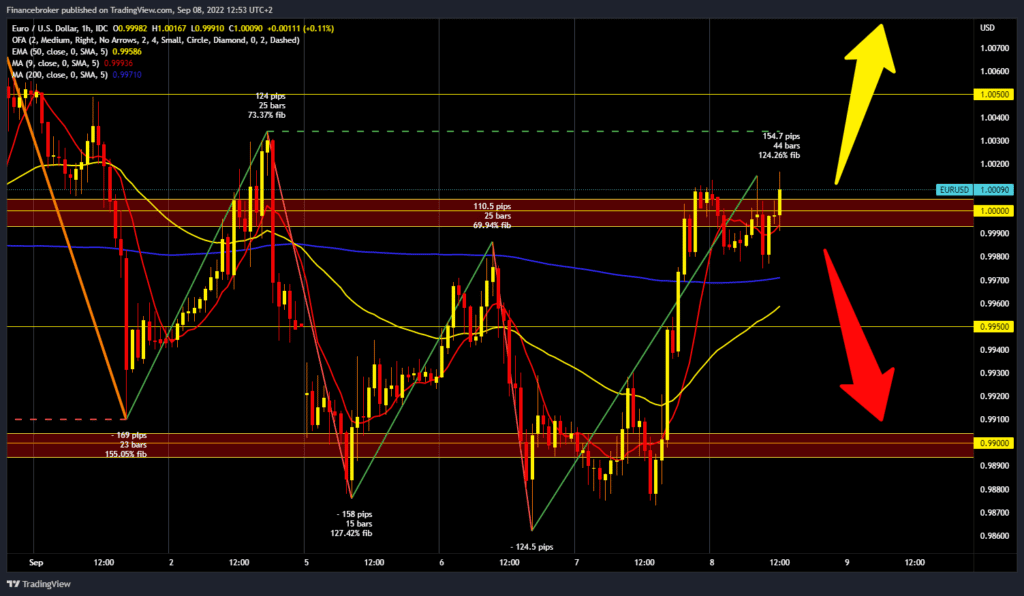

EURUSD chart analysis

During the Asian trading session, the euro slightly retreat to the 0.99800 level. Soon we were back above the 1.00000 level again, and now we are looking towards the previous high at the 1.00340 level. We need a continuation of this positive consolidation as we move towards last week’s high from Friday. If the bullish impulse continues, the next target is the 1.00500 level. A potential higher target is the 1.01000 level. We need negative consolidation and pullback to the 0.99500 level for the bearish option. Then we would get additional resistance in the MA50 and MA200 moving averages. And our potential lower target is yesterday’s support zone around 0.99000.

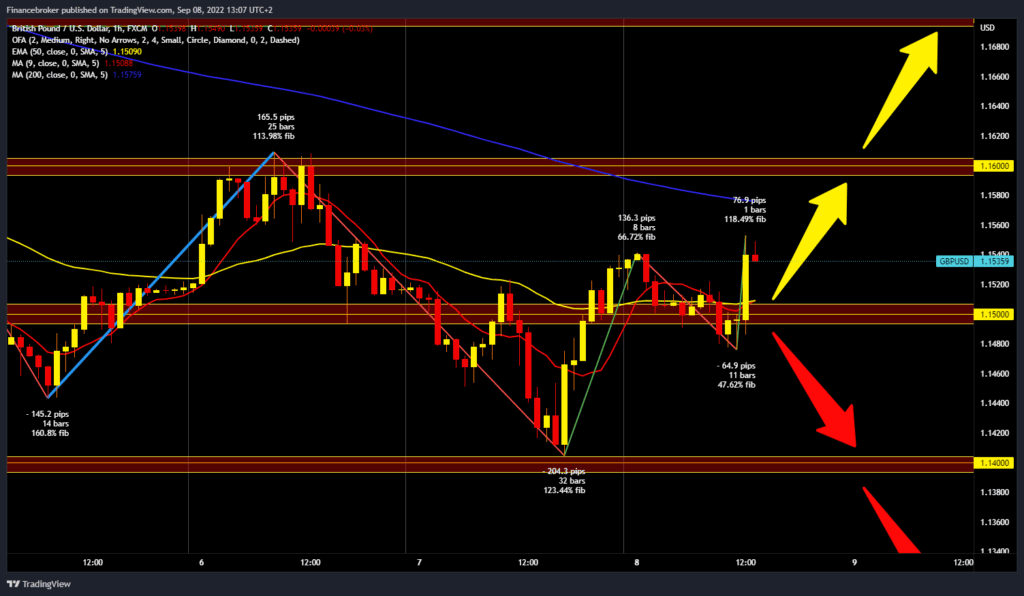

GBPUSD chart analysis

During the Asian trading session, GBPUSD managed to hold above the 1.15000 level. We have a new bullish impulse which has lifted the pound to 1.15500. A break was formed above this morning’s maximum, and we could expect further strengthening of the pound. For a bullish option, we need a continuation of the positive consolidation up to the 1.16000 level. Additional resistance is called MA200 in the zone around 1.15800 levels. A break of the pound above both resistances would be very helpful and facilitate the continuation of the pound’s recovery. Potential higher targets are 1.16500 and 1.17000 levels. We need a negative consolidation and a return to the 1.15000 support level for a bearish option. A break below would signify that we are returning to negative territory and that we could expect a further weakening of the pound. Potential lower targets are 1.14500 and 1.14000 levels.

Market Overview

The European Central Bank is expected to raise its benchmark rates later in the European trading session, given record high inflation and a tightening stance by its global peers.

Japan’s gross domestic product rose 3.5% year-on-year in the second quarter of 2022, beating expectations for a 2.9% increase from 0.1% in the previous three months. At the quarterly level, GDP increased by 0.9%.