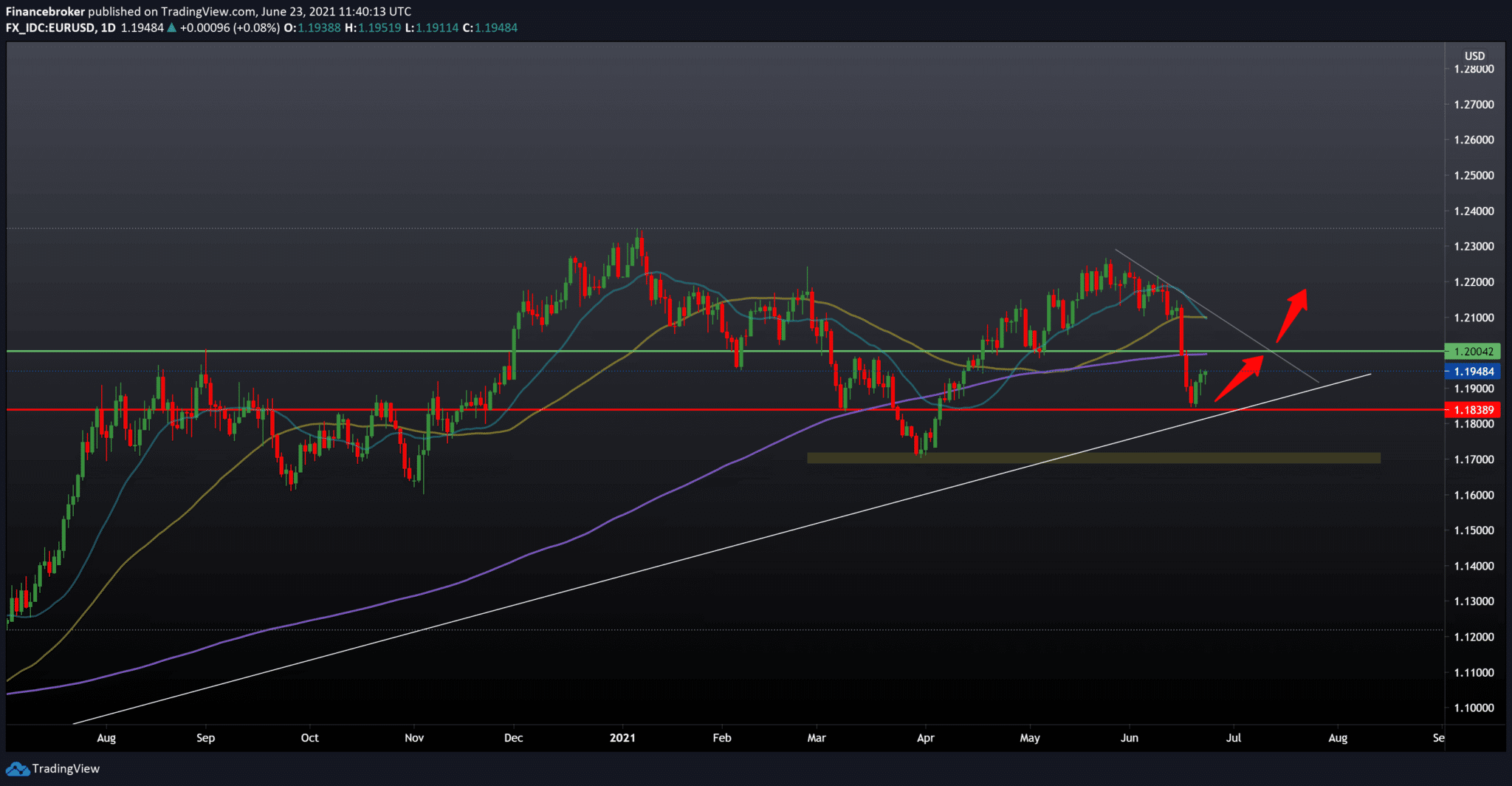

EUR/USD Forecast: The Pair is Progressing Towards 1.200000

On the daily time frame, we see that the EUR/USD pair has found support on the bottom line at 1.18300. Now we are progressing towards 1.20000 and a moving average of MA200, potential resistance. Towards a more specific bullish option, we need a break above 1.21000 and a lower upper resistance line, which would be a solid indicator that we are continuing up towards higher values on the chart.

Economic News in European Session

The day is full of economic news and a wealth of data released in the European session:

The private sector in the eurozone grew at the fastest pace in 15 years in June. Particularly as the economy reopened beyond restrictions in the fight against the virus, data from a quick survey by IHS Markit showed on Wednesday. At 59.2, the composite flash output index reached its highest level since June 2006, at 57.1 in May. The reading was also above the economists’ forecast of 58.8.

Production continued to grow, reporting the twelfth consecutive month of production. Nevertheless, the service sector again recorded the largest performance improvement.

At the same time, manufacturing PMI remained stable at 63.1 in June, while it was forecast to fall to 62.1. “The data sets the stage for an impressive expansion of GDP in the second quarter, followed by even stronger growth in the third quarter,” said Chris Williamson, a chief economic economist at IHS Markit.

Further improvement in demand was also recorded in June. Moreover, new order growth also accelerated to the fastest since June 2006.

Consumer confidence in the eurozone strengthened for the fifth month in a row in June to the highest level since the beginning of 2018. Preliminary data from the European Commission showed on Tuesday.

The Flash consumer confidence index rose to -3.3 from -5.1 in May. Economists forecast a result of -3.0. The latest reading was the highest since January 2018, when it was -3.0. The Confidence Index for the EU also improved for the fifth month in a row, rising by 1.5 points to -4.5. It was the highest reading since October 2018, when it was at the same level.

-

Support

-

Platform

-

Spread

-

Trading Instrument