EUR/CAD forecast for February 5, 2021

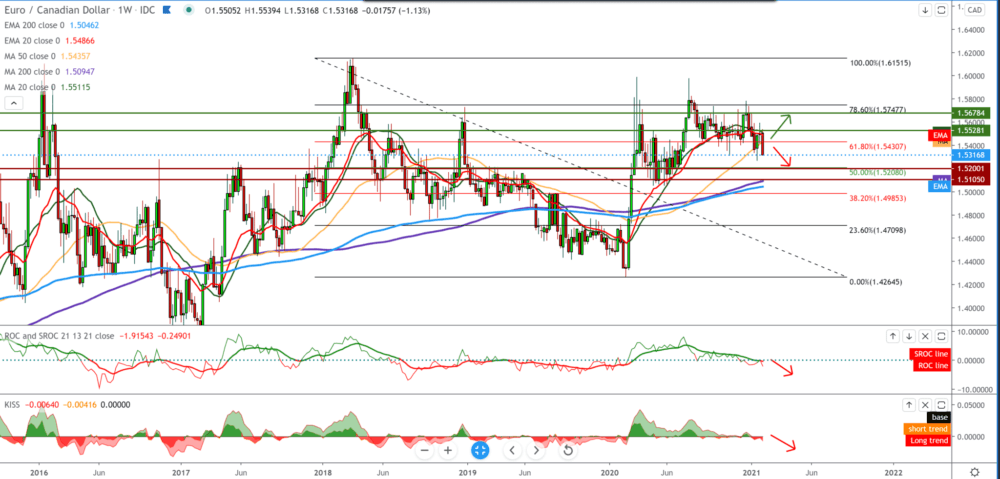

Looking at the weekly time frame graph, we see a withdrawal from 1.60000 to the current 1.53250. By setting the Fibonacci retracement level, we see that the EUR/CAD pair has fallen below 61.8% and that it is now likely to drop to 50.0% level to 1.52000.

From the top, we see that the moving averages MA20, EMA20, and MA50 have moved to the bearish side, and based on that, we can expect a continuation to lower levels in the coming short term. We can look for target and potential support on moving averages MA200 and EMA200 in the range between 1.51000-1.52000.

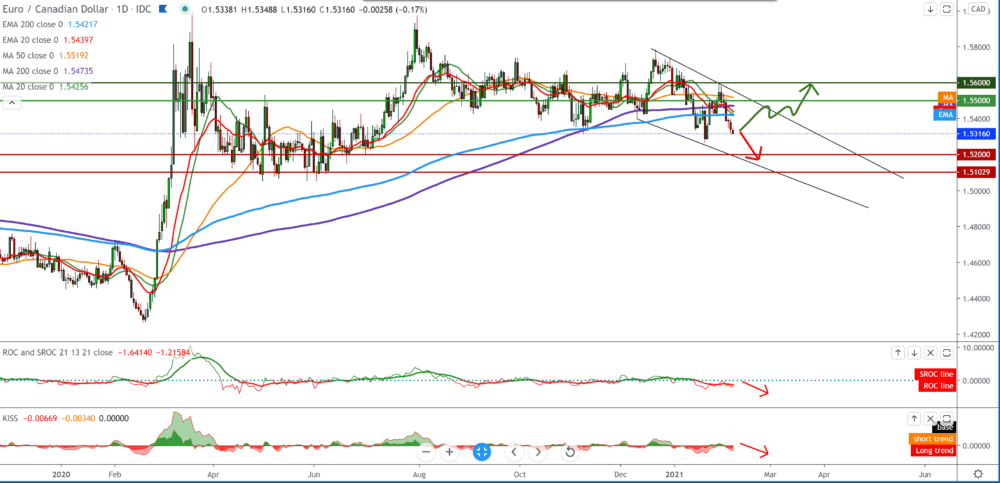

On the daily time frame, we see that as the EUR/CAD pair moved to the bearish side, it formed a falling channel, and we can follow it as a parameter to determine the chart’s future movement.

All moving averages are on the bearish side on this time frame, creating resistance from above by pushing the EUR/CAD pair down.

We need to pay attention to the previous low at 1.52700, where there was a previous rejection, and now the EUR/CAD pair will probably test that level again.

The break below that drops us to 1.52000, approaching the psychological zone to 1.50000.

Check-out Financebrokerage’s Comprehensive review on Fundiza

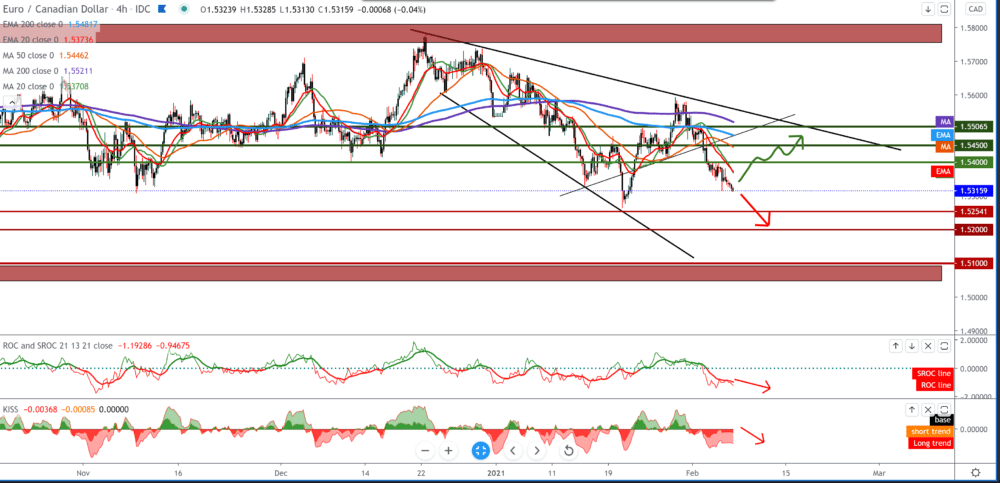

On the four-hour time frame, we see a falling channel with a certain pullback with moving averages from the top confirming the current bearish scenario. as on the daily chart, so here too, we need to pay attention to the previous low at 1.52700.

Potential reversal and turn to the bullish side, we have no signs on the chart for something like that. From the news for these two currencies, we could single out the following: German factory orders fell more than expected in December, Destatis data revealed on Friday.

Orders fell 1.9 percent a month, reversing the growth of 2.7 percent in November, and were also higher than economists ’forecast of -1 percent. Domestic orders fell 0.9 percent in December, while foreign orders fell 2.6 percent.

Excluding major orders, actual new orders in production were 2.0 percent lower than the previous month. On an annualized basis, industrial order growth declined to 6.4 percent from 6.7 percent the previous month.

We will have Employment Change measures and The Ivey Purchasing Managers’ Index (PMI) this afternoon for the Canadian dollar.

-

Support

-

Platform

-

Spread

-

Trading Instrument