ECB in the spotlight this week

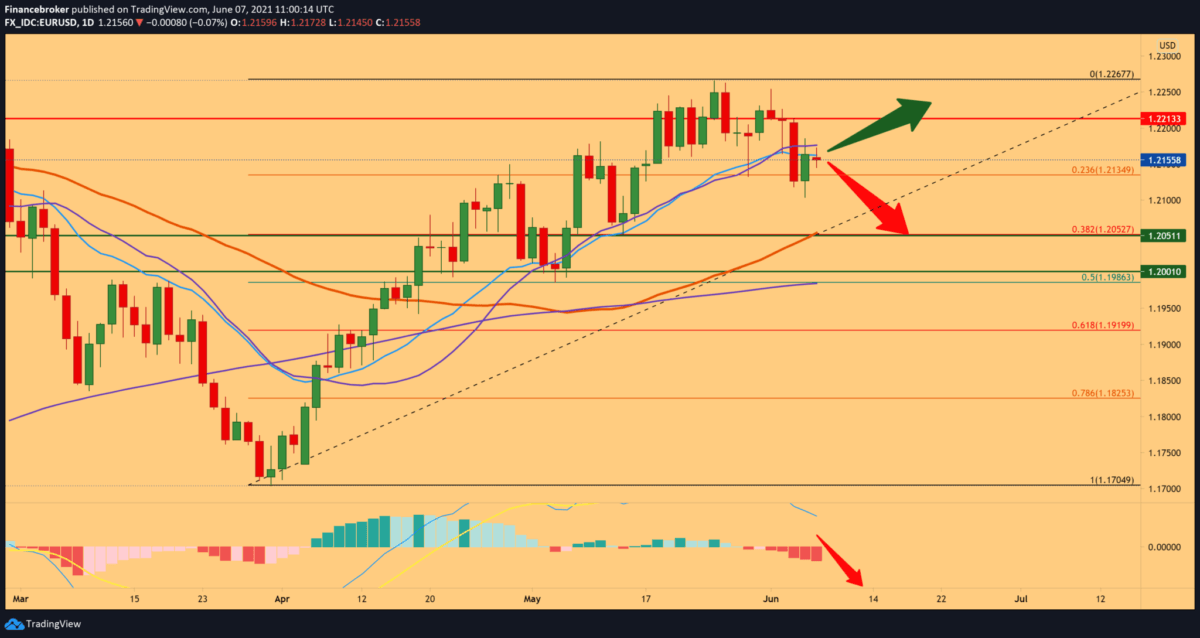

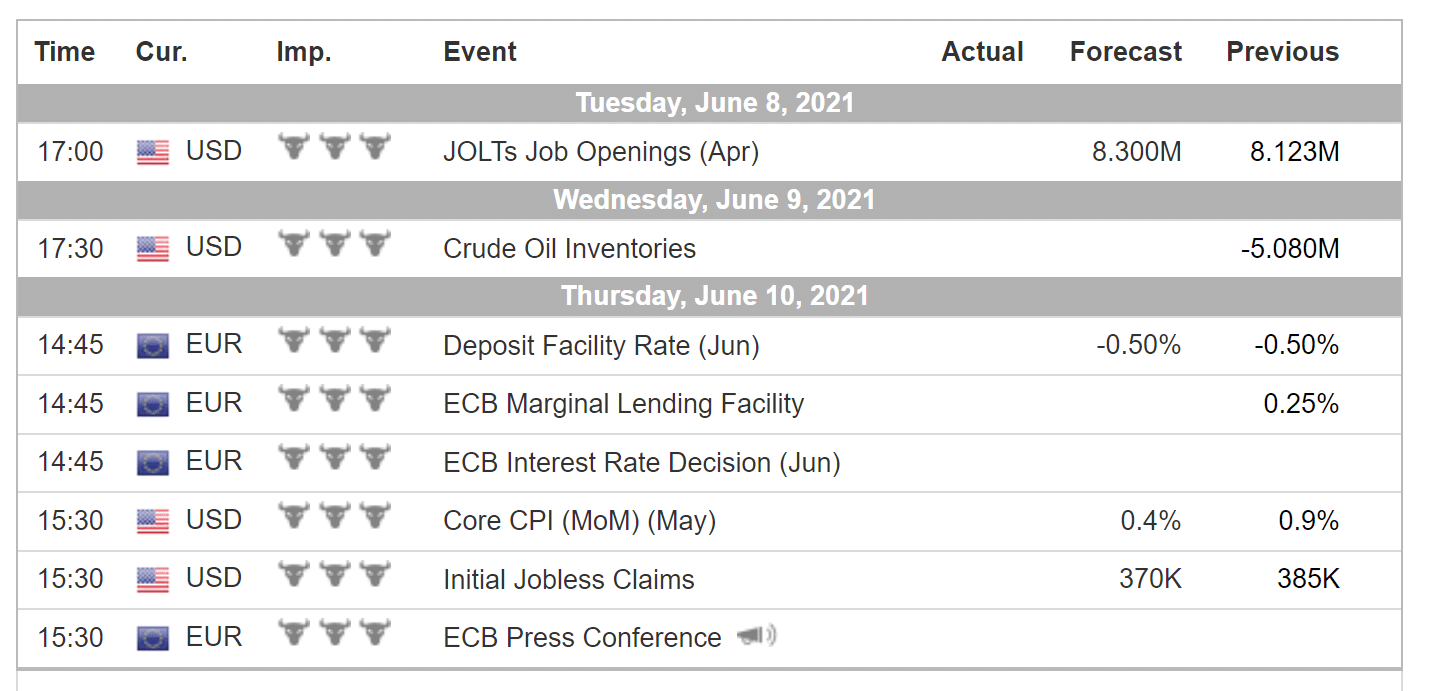

The euro made a pullback against the US dollar last week. The main risk from this week’s events will be the last meeting of the European Central Bank on Thursday. The various discussions on the ECB and the Fed on the policy should direct the pair to the short side of EUR/USD, but within a controlled pullback, not as a reversal of the trend. The improved growth outlook is unlikely to prompt the ECB to announce a slowdown in the pace of QE (government bond) purchases. Recent comments by ECB officials have dismissed premature expectations of a reduction in QE. Most economists now only expect the ECB to announce a reduction in QE purchases in September.

The ECB is also expected to release conclusions from its review of the monetary policy strategy only in September, translating into a higher risk of events. The ECB is reluctant to slow purchases so quickly it reflects concerns about the risk that financial conditions could tighten prematurely and undermine the recovery.

The ECB is expected to signal that “QE purchases will be maintained at approximately the current pace next week. The market reaction needs to be limited, and eurozone yields have already been adjusted and lower in recent weeks. A difference was opened between the ECB and the Fed, which indicated their readiness to discuss the narrowing of the QE at the upcoming meetings. It will help the upward momentum for EUR/USD. However, developments are not enough to change our bullish outlook.

German factory orders fell in April as a drop in domestic demand slowed the growth of foreign orders, Destatis data revealed on Monday. Production orders fell 0.2 percent on a monthly basis in April, in contrast to the 3.9 percent increase recorded in March and economists’ forecasts of +1.0 percent. Annual growth in new orders rose to 78.9 percent from 29.2 percent in the previous month.

The data showed that the turnover in production in April fell by 2.6 percent compared to the previous month when it increased by 3.1 percent. Data on industrial orders from April indicate a temporary halt in the industry’s recovery, said Carsten Brzeski, an economist at ING. It is just a delay, not a derailment, Brzeski added.

-

Support

-

Platform

-

Spread

-

Trading Instrument