What is cross-trade, and how does it work nowadays?

Do you know what cross-trade is and why traders talk about it more now? As an experienced trader and investor, why is it crucial that you understand concepts like cross-trade, international trade, import and export, trade agreements, and much more? As a trader and investor, knowing about cross-trade, international trade, import/export, and trade agreements is important.

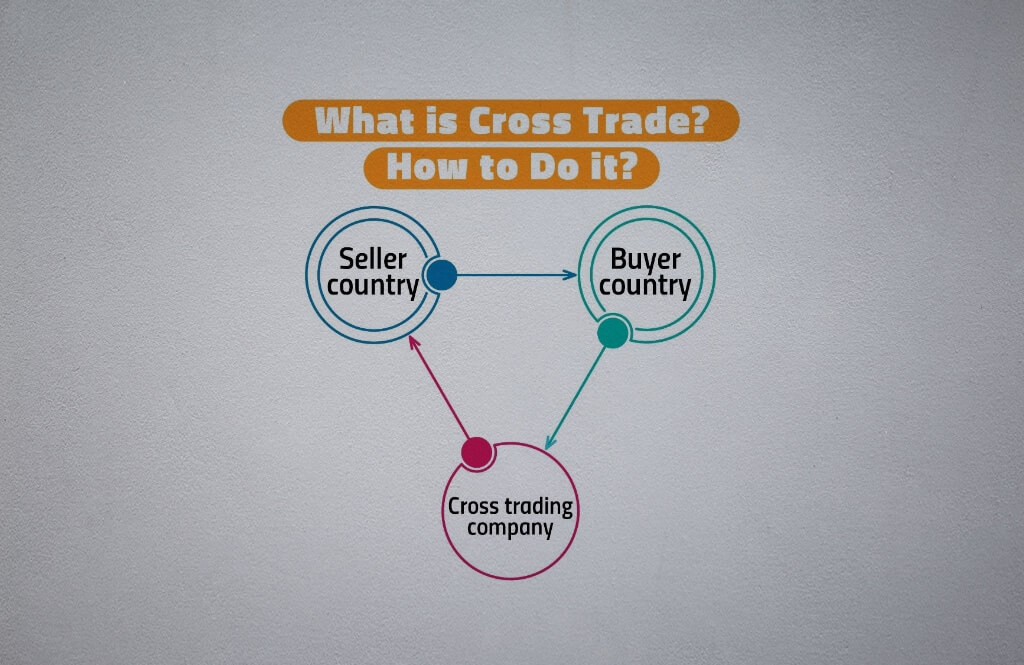

Cross trade is generally considered a situation where traders or investors buy or sell orders from the exact peer and are complemented by specific trading operations of an electric trade-off.

It may happen by accident once we witness price advances and decay orders; it’s generally forbidden according to market regulations and observed by ombudsmen and regulators who consider it a good example of “non-commercial trading” between two parties.

But, to learn more about cross-border and if it is a global trade where trading between countries takes place, or something else, let’s get familiar with the basics first, shall we?

What is the definition of cross-trade?

As mentioned earlier, a cross trade represents a particular practice where buy and sell orders of a single asset are considered in a counterbalance with no trade recording to the exchange. It’s a practice that is only allowed on a few well-known exchanges.

It’s essential to note that brokers match buy and sell orders for the same securities across client accounts, called cross trades. Instead of using the stock exchange, the broker facilitates these trades internally. The trade details, including time and price, are promptly reported.

Investors and traders should keep in mind that it’s vital to understand that trade occurs, or at least should be executed, at a fair market price. This process saves tim0, is according to trade regulations, and ensures transparency for clients.

Understanding how the cross-trade works

Those wondering “How does it work” should remember that Cross usually presents challenges due to their limited-time reporting. If these trades aren’t recorded through the exchange, one or both clients may miss out on the market price available to other participants.

Since these trades are not publicly listed, investors may need to know if a better price could have been obtained. Major exchanges typically do not allow cross-trades, as all orders must be sent to the exchange, and trades must be recorded.

However, there are certain situations where this kind of trading is permitted. One of these situations could be once both the buyer and the seller are clients of the same asset manager. In these select cases, as long as the price of the cross-trade is competitive at the time of the transaction, it is considered acceptable.

What is the main role of a portfolio manager?

A portfolio manager can productively pass a particular asset of one client to another that is eager to get it to minimize the spread in the trade. To successfully meet regulatory requirements, the broker and manager must demonstrate a fair market price for the transaction.

Once so, they must classify it as a cross-trade and provide evidence of its mutual benefit to both parties when reporting to the Securities and Exchange Commission (SEC).

What is the main advantage?

If you’re into trade transactions, you should keep in mind that, among other benefits, the key advantage is saving money. Cross trades are useful for transaction costs and fees avoiding since it’s a cost-effective option. Also, traders must remember that trading fees are sometimes different.

They vary depending on the country and financial instruments included in the process. Regarding transaction costs, it’s crucial to note that they include the following:

- Bid-ask spreads

- Commissions

- Market impact

- Taxes

- Missed trade opportunities

- Delays

Note that all these costs can reach 4% of the entire amount. For that reason, cross-trades are essential for offering valuable cost savings, making them a perfect choice for all market participants.

What is the controversy Surrounding Cross Trades?

Cross trades lack price specifications but occur when a broker receives matching buy and sell orders at the same price from different investors. These trades may be permitted depending on regulations as each investor shows interest in transacting at the given price. This is particularly relevant for highly volatile securities where values can swiftly change.

However, cross-trades raise concerns about trust in the market. While some are technically legal, other participants miss the chance to engage with these orders as they occur off the exchange.

Another worry is the potential use of cross-trades to engage in illegal market manipulation, known as “painting the tape.” Market players collude to create false trading activity, influencing security prices. The controversy stems from limited access, market manipulation risks, and eroding trust.

Bottom Line

Cross trades, leveraging trade finance, foster economic growth by facilitating goods and services exchange. Embracing free trade and comparative advantage, nations like the United States unlock the potential for mutually beneficial transactions.

Executed by brokers, cross trades yield gains, promoting balanced development and prosperity. Historically significant, they symbolize global cooperation after World War II while contributing to a favorable balance of payments.

Also, by enhancing export opportunities and fostering a robust trading ecosystem, cross trades empower nations to harness international trade’s full potential. The result is sustainable economic expansion and the realization of numerous benefits.