| General Information | |

|---|---|

| Crypto Exchange Name: | Coinfield |

| Country: | Canada |

| Operating since year: | 2018 |

| Address: | - |

| Exchange Status: | Active |

| Crypto Exchange | |

| Online Wallet: | YES |

| Account Minimum ($): | / |

| Web-based trading: | YES |

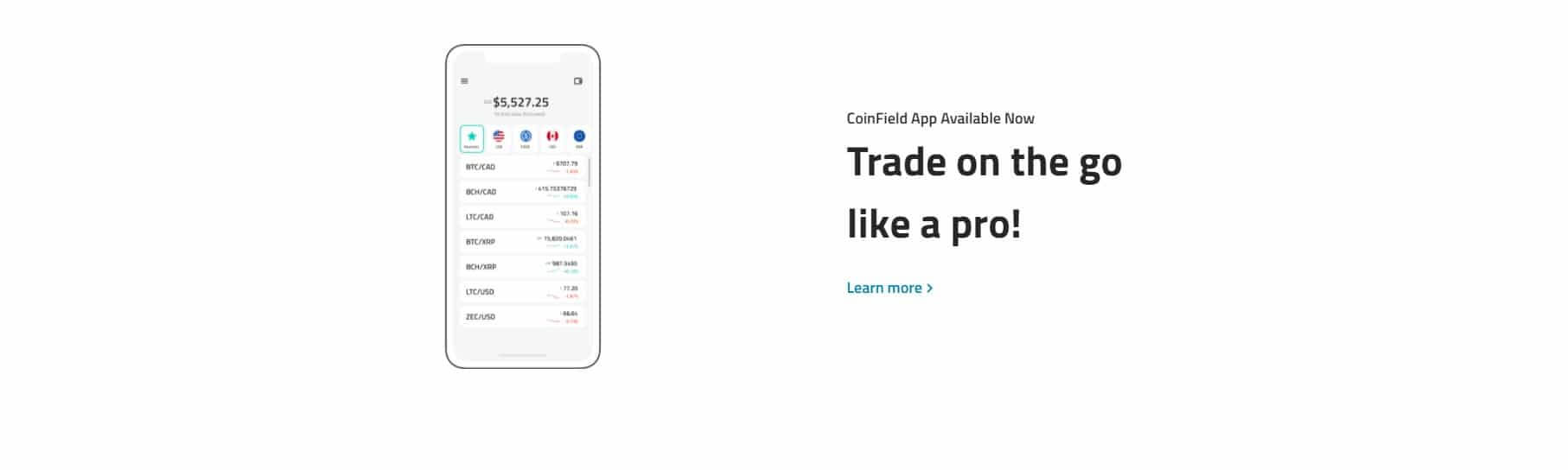

| Mobile App: | YES |

| Fees: | 0.15%-0.25% |

| Transfer Types: | Credit Card, Bank Wire Transfer, Crypto Transfer |

| Supported fiat: | USD, CAD, EUR, GBP, JPY, AED |

| Supported pairs: | 23 |

| Has token: | - |

| Customer Service | |

| Phone: | N/A |

| Email: | N/A |

| Languages: | N/A |

| Availability: | 24/7 |

-

Support

-

Platform

-

Spread

-

Trading Instrument

Comments Rating

( reviews)

They didn’t want to let me withdraw and wouldn’t respond for a long time via their customer service outlets. Wouldn’t recommend the exchange to anyone.

Did you find this review helpful? Yes (2) No

Not bad

Overall, it’s not a bad crypto exchange.

Did you find this review helpful? Yes No