CHF/JPY forecast for January 25, 2021

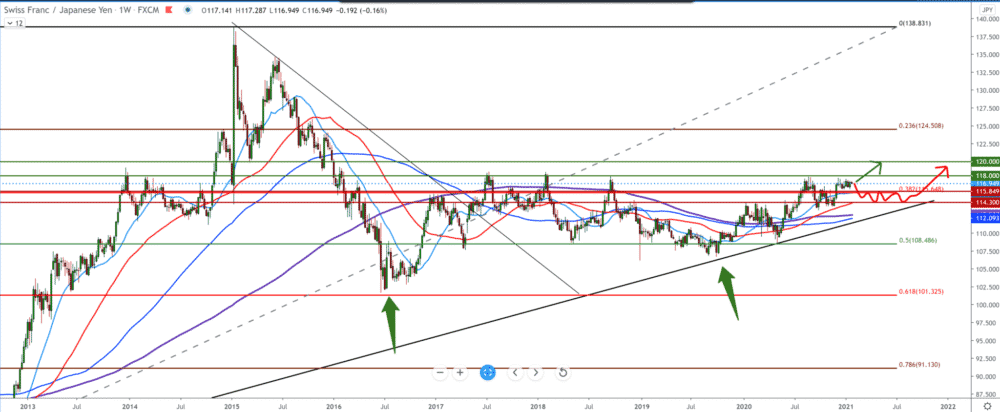

Looking at the chart on the weekly time frame, we see that the CHF/JPY pair has good resistance at 118.00, a zone that has resisted since July 2017. Now again, we can expect a smaller pullback to 116.00. on the underside, we have the support of all moving averages, and for now, we also have a big trend line on the bottom as support and rejection of the bearish scenario. By setting the Fibonacci retracement level, we see that the CHF/JPY pair is now at 38.2% level, that after the break, it now consolidates a little above that level. We can conclude that in the next period, we can see this pair close to 120.00 if we first see a break above 118.00.

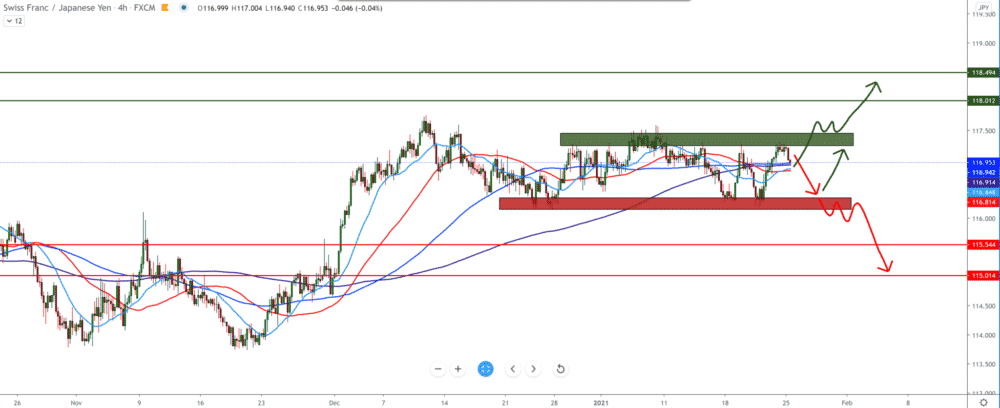

On the daily chart, we can see the CHF/JPY pair making all the lower highs making the expected pullback for the next turn up to the higher levels. That pullback can be seen up to support at 116.00. the movement is now around the moving average of the MA20, but the curve is tilting downward along with the current bearish candlestick earlier this week. It is generally still early, but for now, we have that sign on the chart. Buyers’ ideal position would be a pullback to the moving average MA200 (purple line), which would be a great support for rejection and moving on to higher levels.

We see the CHF/JPY pair moving sideways, alternating the two zones up and down on the four-hour time frame. The last is the bounce from the upper zone above 117.50 and the pullback, and if we see a break below the moving averages soon, we can expect the pair to drop to 116.00. Any jump outside these zones above or below can sign a potential continuation of the trend.

EUR/JPY forecast for January 25, 2021

-

Support

-

Platform

-

Spread

-

Trading Instrument