Market News and Charts for January 25, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

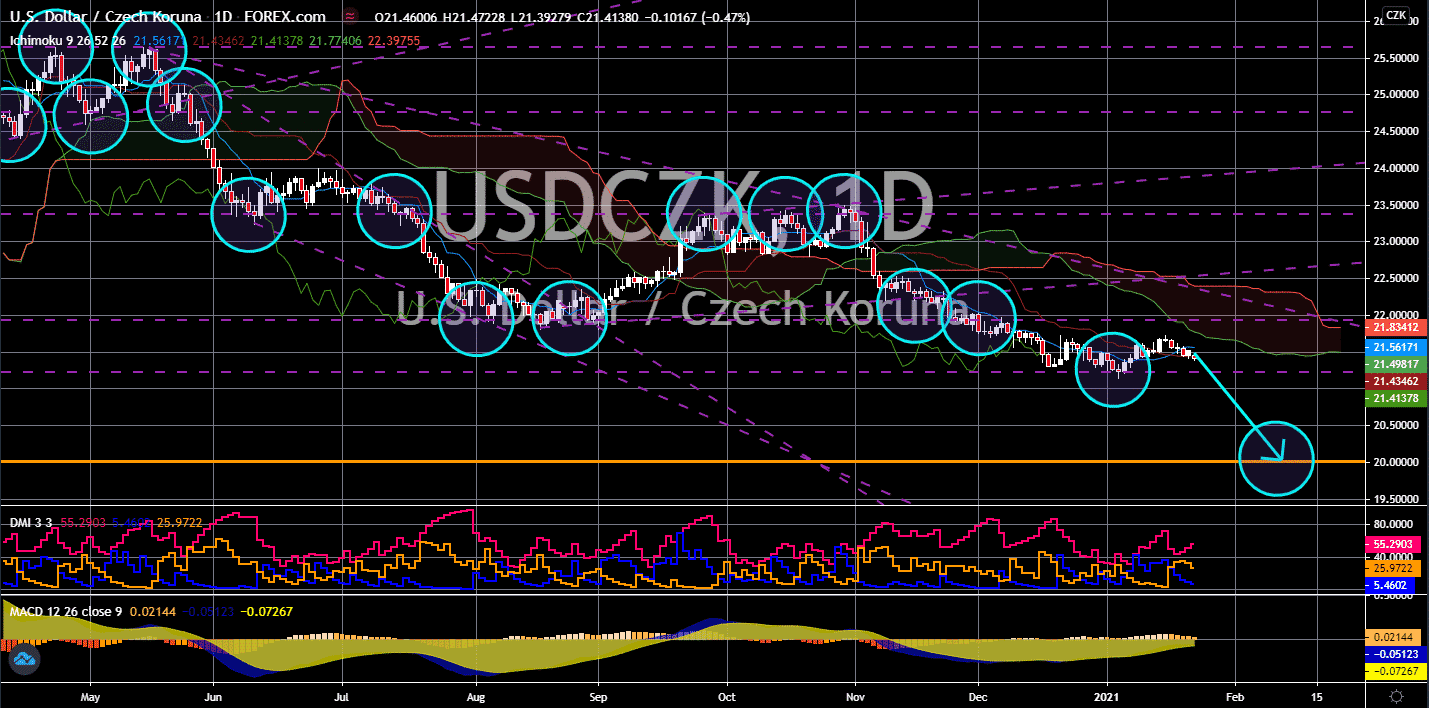

USD/CZK

The pair will break down from a key support line, sending the pair lower towards the 20.0000 price zone. Fitch Ratings retained Czechia’s Long-Term Foreign-Currency Issuer Default Rating (IDR) an AA- with a Stable Outlook. The credit rating agency expects debt ratio to go back to its previous levels in 2022 amid strong fiscal measures from the government. Fitch further added that it sees a 7.0% decline in Czech Republic’s gross domestic product (GDP) for fiscal 2020. Meanwhile, economic forecast for 2021 and 2022 were 4.1% and 4.9%, respectively. In addition to this, budget deficit is expected to be revised up to 6.6% of the country’s GDP from the 5.5% agreement by lawmakers or 320 billion koruna. The positive readings from Fitch Ratings are expected to shrug off optimism in the greenback. The main driver of the strength of the US dollar was Janet Yellen’s nomination as Treasury Secretary and her comments against cryptocurrencies.

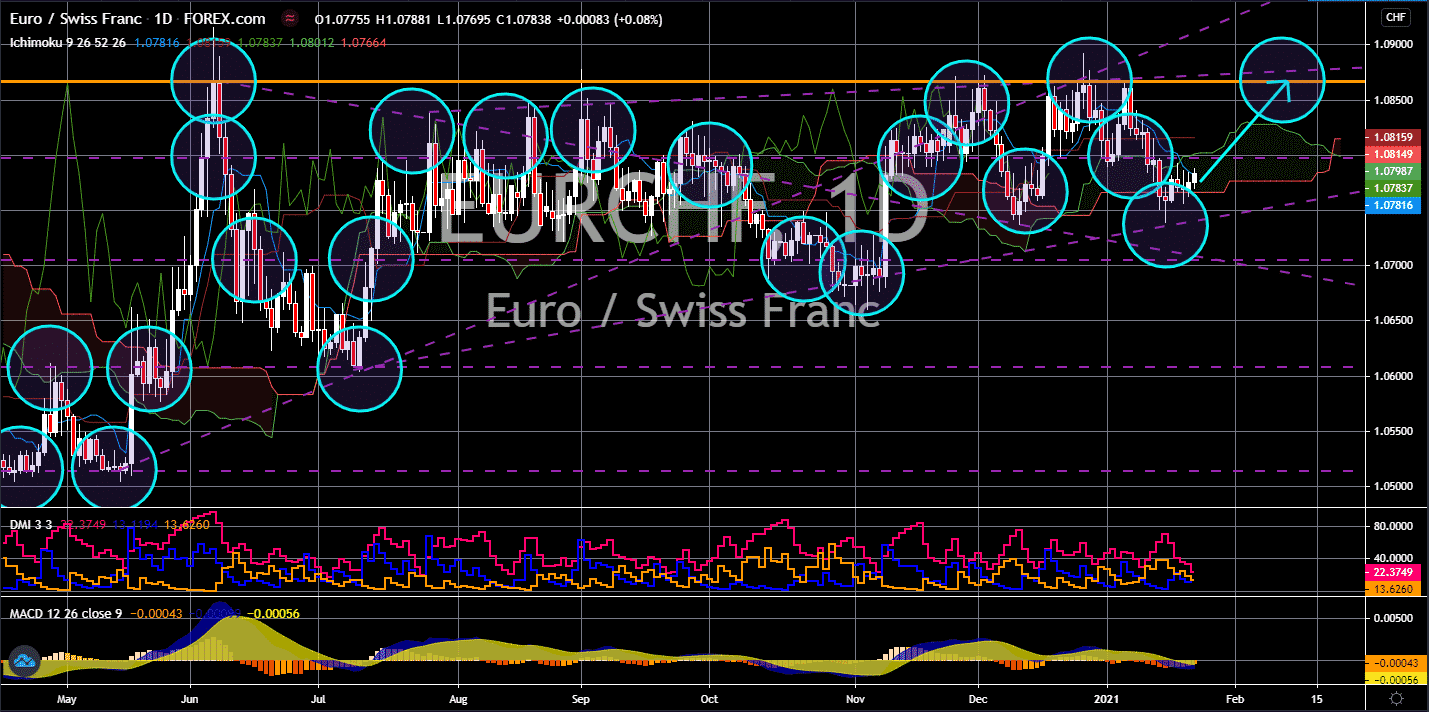

EUR/CHF

The pair will resume back its bullish movement after it bounced back from a key support line. The safe-haven appeal of the Swiss franc has been weaning off. This was due to the 509K total COVID-19 cases in the country of 8.545 million. This means that for every 18 citizens, 1 is infected by the deadly virus. As a matter of fact, Singapore emerged on the top list of countries that are possibly the next location of the World Economic Forum (WEF). Also, the EU and its member states had a poor performance on their Purchasing Managers Index (PMI) report on Friday, January 22. Only France’s Manufacturing PMI was able to beat its previous record along with analysts’ estimate among the nine (9) report from the EU, Germany and France. Meanwhile, Berlin and Brussels had 57.0 points and 54.7 points results. As for Services PMI, figures came in at 45.0 points, 46.8 points, and 46.5 points, respectively. The disappointing performance will drive the euro higher.

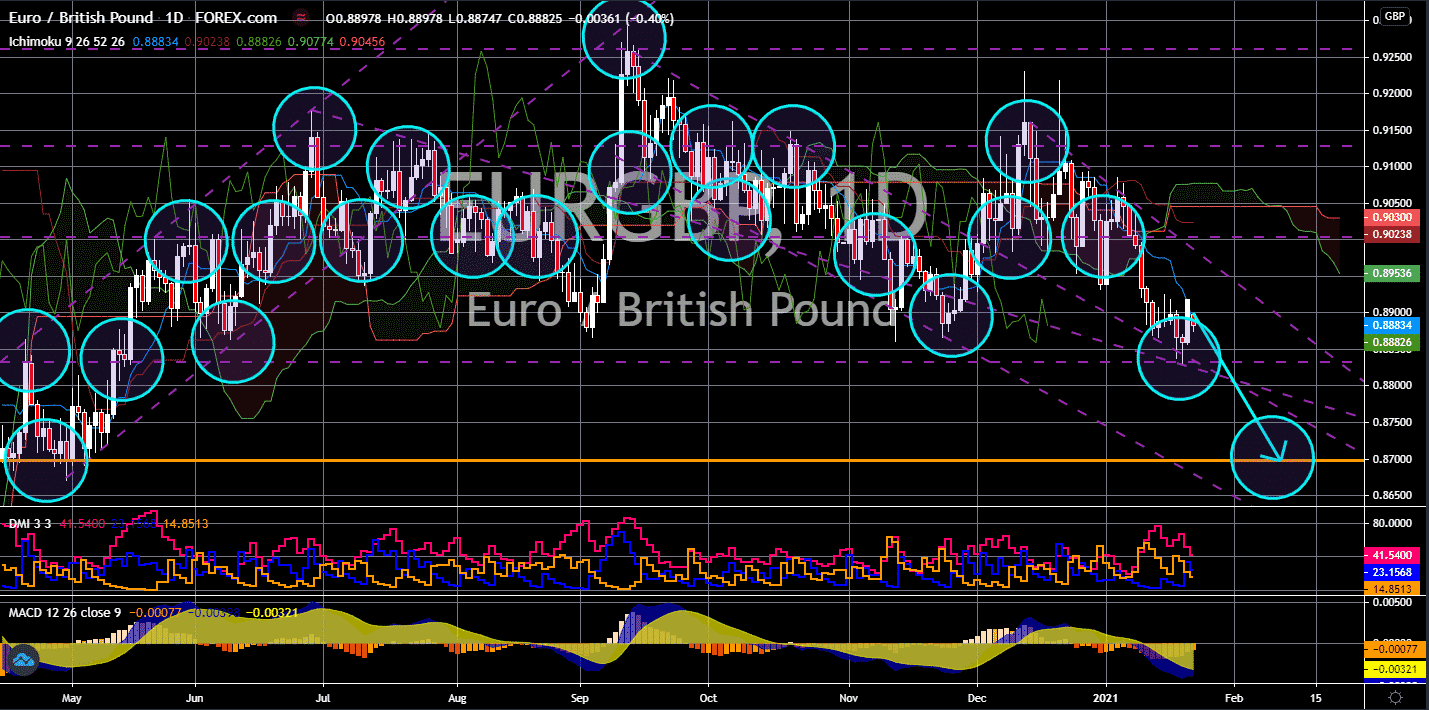

EUR/GBP

The pair will break down from its currency support line, sending the pair lower towards its May 2020 low. The UK ended the PMI report last week in red. The figures for the Composite, Manufacturing, and Services PMIs were 40.6 points, 52.9 points, and 38.8 points. The UK had the lowest Composite and Services PMIs compared to the EU, Germany, and France. In addition to this, Retail Sales reports all failed to beat consensus estimates. Retail Sales in December advanced by 0.3%. While it was comparatively better than the prior month’s -4.1% result, the figure is still way lower than the 1.2% reading. On an annual basis, the report grew by 2.9% against 4.0% expectations. Meanwhile, Core Retail Sales MoM and YoY published 0.4% and 6.4% results. The Public Sector Net Cash Requirement was also higher at 40.644 billion as they prepare for the impact of the Brexit. Public Sector Net Borrowing was up at 33.38 billion.

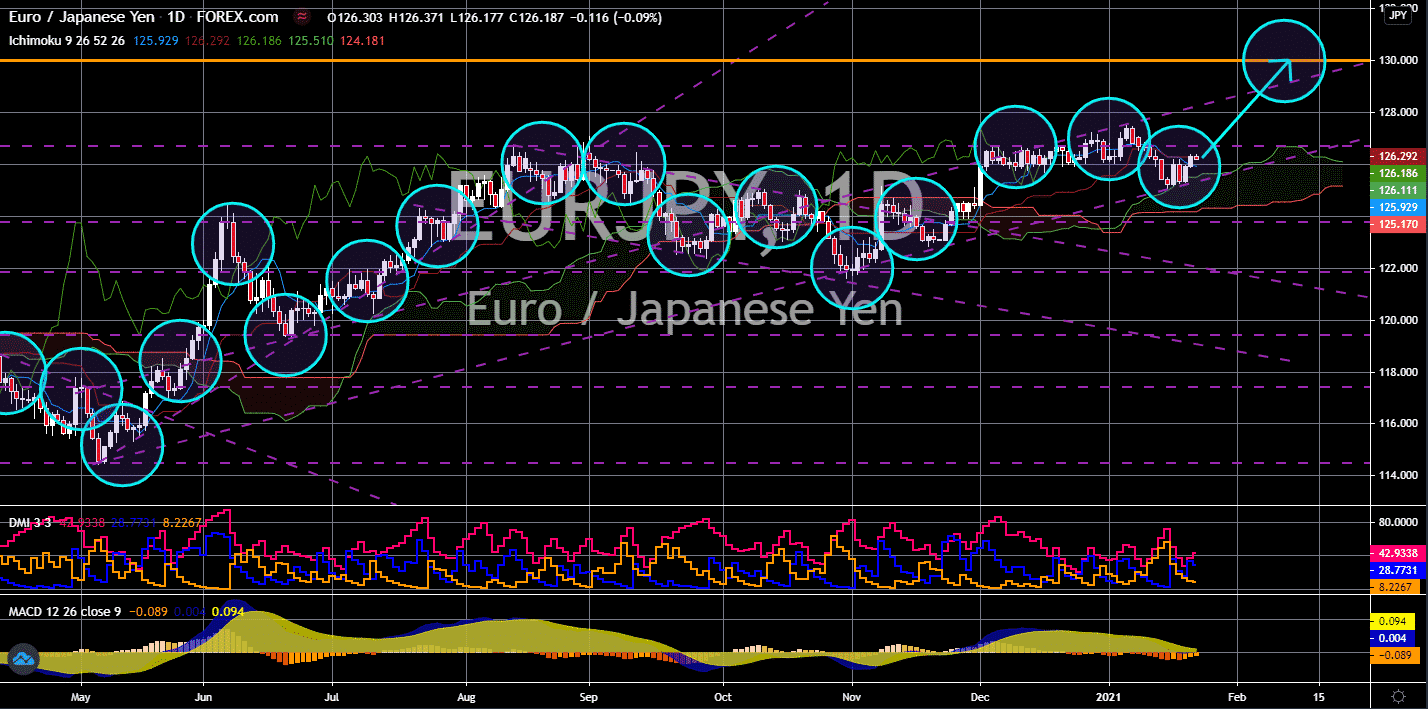

EUR/JPY

Bank of Japan (BOJ) raises its growth forecast for the next two (2) years in the world’s third-largest economy. 2021 GDP expectations was now at 3.9% against 3.6% projection back in October. Meanwhile, 2020 growth was seen at 1.8%, which is comparatively higher than the 1.6% forecast prior. The central bank cited Japan’s ultra-loose monetary policy along with record-breaking stimulus packages. However, the efforts to revive the economy was at the expense of the yen. Governor Haruhiko Kuroda added that recovery might take some time following the threats of the new COVID-19 strain. Another key report adding pressure to the local currency was the massive decline in Consumer Price Index (CPI). CPI shrunk by 1.0% on a yearly basis, the fastest drop in consumer price index for the past decade. Investors feared the if the succeeding reports will continue to decline, this might lead to a deflation on which prices are going down.