Bitcoin still undecided

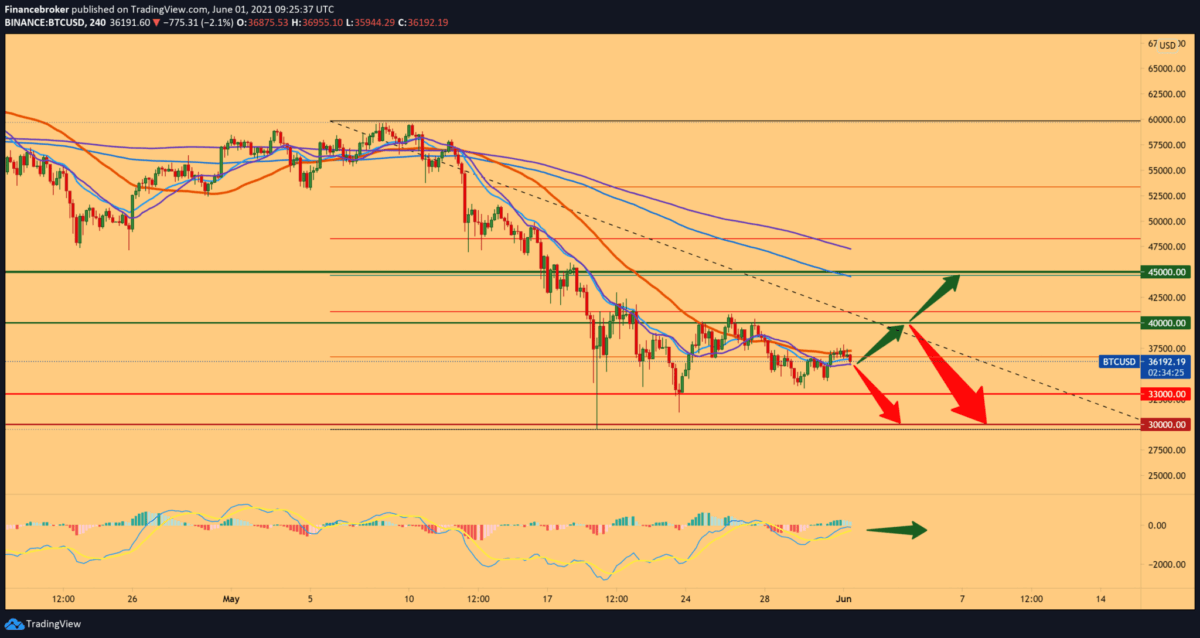

Crypto markets have partially recovered this week after falling by over $ 1 trillion in total market capitalization. As the negative news surrounding Elon Musk and China with its regulations, Iran with a mining ban until September, the crypto market has consolidated. Bitcoins are still trading in, ranging between $ 32,000 and $ 42,000.

By drawing data on the chain and derivatives on the market, we were able to gain critical insights to assess the near future of Bitcoin.

The profitability of addresses directly affects the purchase and sale orders placed by investors. Using the data on the chain, IntoTheBlock In / Out of the Money Around Price, groups of addresses are formed depending on whether they are profitable or losing money, at least on paper.

The largest address clusters represent at what price the largest volume of Bitcoin was previously purchased and directly affect the short-term level of support and resistance.

IOMAP reveals that 760,000 addresses were previously purchased with about 480,000 bitcoins at a price of about 38,000 US dollars. Due to the large purchasing activity in this area, as well as just under $ 36,500 to $ 38,000, strong support from new buyers and current owners at this level is expected. If this level fails, it will probably fall into the $ 30,000-34,000 zone.

On the other hand, there is strong resistance of $ 40,000. It is expected that the large amount that was previously bought there will create sales pressure because many owners tend to sell their positions to extract their money. If buyers manage to surpass this range of Bitcoin, moving above $ 43,000 seems likely. Comparing Bitcoin compared to a week ago when trading was at a similar level, we can notice the following. First, the number of addresses in the money is 800,000 higher, although the price is approximately the same. This indicates that a large number of owners bought a drop to 30,000 US dollars as an opportunity to buy and reduce their average costs, making them profitable as prices recover.

Second, the number of user addresses decreased by over a million. It is also likely that many panickers sold by accepting their losses.

Signs of panic and continued sales were also shown in the derivatives markets. For the first time during the whole year, the financing rate of permanent swaps reached negative levels on the three largest derivatives exchanges.

Bitcoin has recovered from a serious correction as the panic from the fall decreases and the purchase increases and is now at the current $ 36,000. The data on the chart indicate bitcoin trading between two points of high support, 30,000 and resistance 42,000. To restart the upward move, bitcoin traders will first have to overcome strong resistance in the $ 40,000-43,000 zone.

-

Support

-

Platform

-

Spread

-

Trading Instrument