Bitcoin, Ethereum, and Dogecoin in the sideways consolidation

Bitcoin chart analysis

Looking at the chart of Bitcoin on the daily time frame, we see that the price continues to consolidate above the 200 daily moving average from the bottom to $ 45,000 and 50.0% Fibonacci level to $ 47,000 from the top. The situation is still undecided, but today’s bullish option is on the table, and we have to wait for the price to make one stronger move on the chart. To continue the bullish trend, we need a break above the 50.0% Fibonacci level and a jump to $ 48,000. The price has room to consolidate above the 50.0% level and continue further towards the 61.8% Fibonacci level to $ 51,250. For the bearish trend, we need a drop below the 200-day moving average to increase bearish pressure and direct the price towards 38.2% Fibonacci level to $ 42,660. If that Fibonacci level doesn’t hold up, we go down to 23.6% Fibonacci level to $ 37345.

Ethereum chart analysis

Looking at the daily time frame chart of Ethereum, we see that the price consolidates around $ 3225 and that our current obstacle is $ 3200, still in question because we need a stronger rejection from this zone. Consolidation is still above the 50.0% Fibonacci level at $ 3035, and he favors giving us some support. Further positive consolidation may raise the price to 61.8% Fibonacci level to $ 3353, where the next resistance awaits us if the price manages to rise to those levels. For the bearish scenario, we need a price withdrawal below 50.0% Fibonacci levels. A further drop brought us down to the lower Fibonacci level of 38.2% to $ 2720. Looking at moving averages, we see that if the price goes down to the 38.2% level, we will encounter a 20-day moving average that can be potential support.

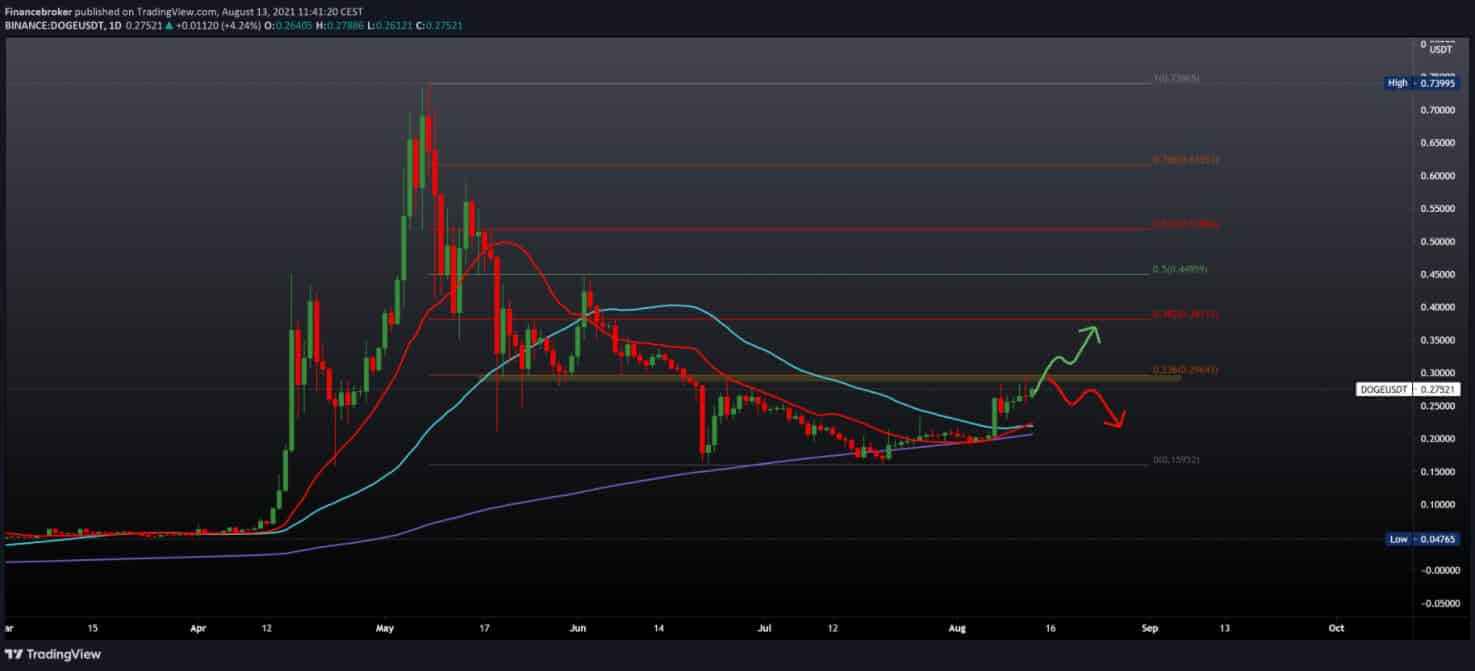

Dogecoin chart analysis

Looking at Dogecoin on a daily time frame, we see that we are still and today in a bullish trend in August, and soon we will be testing a zone around 0.30000. By setting the Fibonacci level, we see that we encountered resistance at the 23.6% first level at 0.29645. To continue bullish, we need to jump above this resistance zone towards the next Fibonacci level at 38.2% at 0.38110. Looking at moving averages, they are all bullish and give us extra support for a potential move to higher levels on the chart. For the bearish trend, we need a further weakening of the price below the resistance to 0.30000, where we then again turn to support at 0.25000, and we look for additional support in moving averages.

Market overview

Difficulties in Bitcoin mining plunged after China announced the suppression of mining operations, which at their peak contributed three-quarters of the global hashrat. The latest data from BTC.com shows a steady increase in difficulties in Bitcoin mining since June 17, 2021.

As miners from China have slowly moved to crypto-friendly geographic areas, the bitcoin ecosystem has experienced a 13.77% increase in mining difficulties in two consecutive jumps, exceeding 15 terahash (T) for the first time since week June 2. The next adjustment should start on August 27, and it is estimated that it will increase to 15.63 terahas.

Before the Chinese suppression of local miners, the difficulties in Bitcoin mining reached the peak of 25 terahash. The sharp drop in the number of Chinese miners has reduced competition in confirming blocks. This enabled the existing miners on the network to make higher profits. The data show that China’s contribution to Bitcoin mining fell to almost 46%, while the United States caught part of that deficit, hosting almost 17% of the global mining hashrate.

In a CNBC report on the issue, Quantum Economics crypto analyst Jason Deane pointed out that the latest mechanism for adjusting network difficulties has made 7.3% less profitable in Bitcoin mining.

Concluding the discussion, Mike Colier, CEO of the New York-based digital currency group, said: “A huge amount of machines are coming from China that need to find new homes.” Colier also believes that the new generation of mining platforms is more efficient and would “duplicate the hash power for the identical amount of electricity.”

China’s move against bitcoin mining has been attributed to energy problems due to electricity consumption in mining operations. After the crackdown, Canada, Kazakhstan, Russia, and the United States emerged as the best options for migrating Bitcoin miners.

-

Support

-

Platform

-

Spread

-

Trading Instrument