Bitcoin and potential optimism

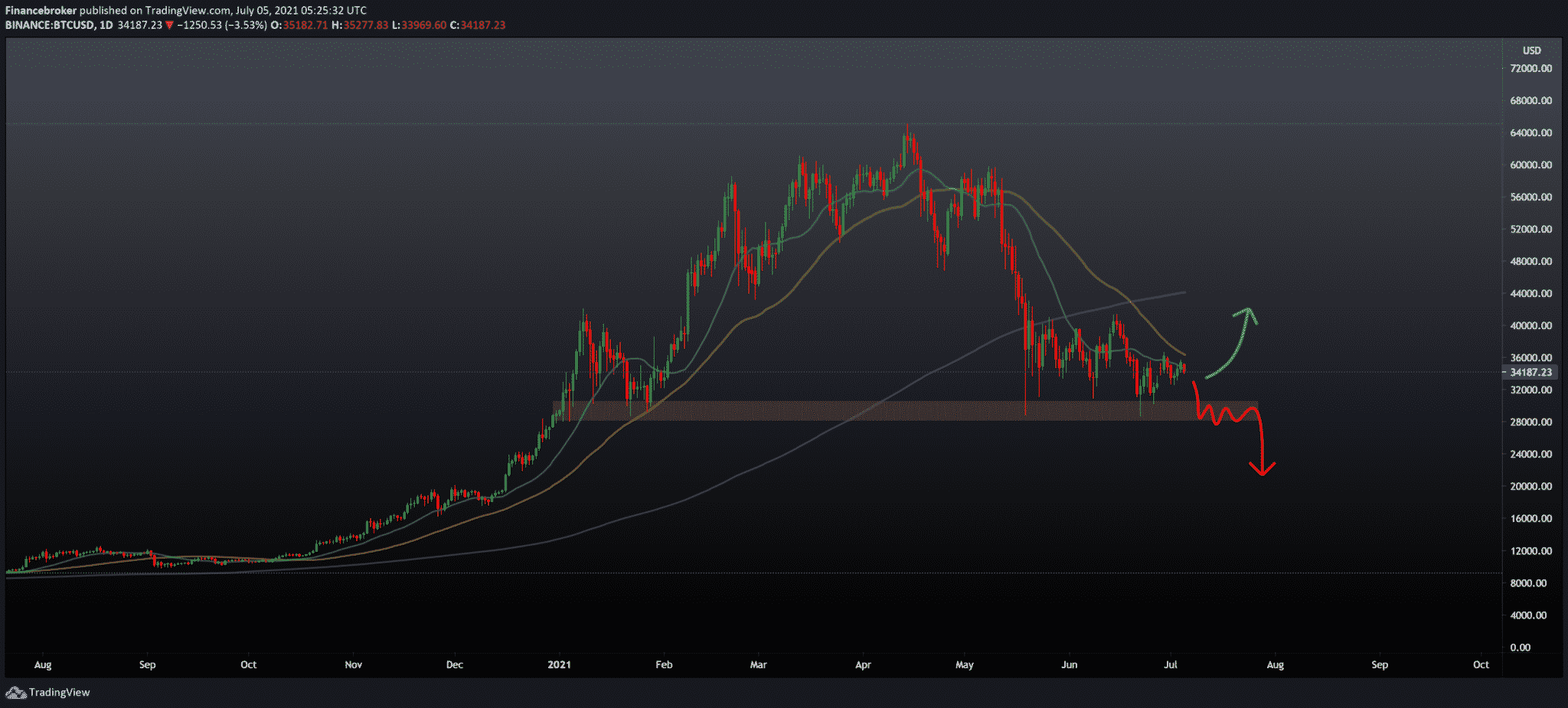

The last correction of the fall of Bitcoin I have similarities in stock prices in June-December 2019. Bitcoin faces the prospect of reaching 47,500-50,000 USD based on the similarity of its current trend with that in June to December 2019.

Bitcoin reached about $ 14,000 on June 26, 2019, before it went lower for the rest of the year due to earnings, as well as FUD caused by hardfork Bitcoin Cash, Facebook’s stalemate with regulators over crypto project Libra, and then US President Donald Trump and the threatening tone of Finance Minister Stephen Mnuchin on Bitcoin.

The main cryptocurrency collapsed to close to 6,500 US dollars in December 2019. This prompted its 50-day simple moving average (SMA) to turn below its 200-day SMA, a phenomenon that technical cartologists call the “cross of death,” and see its formation as a sign of the prolonged sale that follows.

But at the same time, Bitcoin bulls kept the price above the 50-week SMA. The one-day cryptocurrency chart showed the bear’s attempts to bring the price below the 50-week SMA. But the bulls bought those falls every time.

In 2021, Bitcoin halfway reconstructed the scenario for 2019. At first, the correction of the cryptocurrency from a record high of almost 65,000 US dollars landed BTC/USD on the same 50-week SMA support, around 30,000 US dollars. At the same time, his lower move made it possible to place the cross of death.

Demand for Bitcoin also fell after the Federal Reserve’s optimistic tone. The US Federal Reserve has announced that it may raise reference interest rates by the end of 2023 to curb inflationary pressures, coinciding with the fall in the BTC/USD rate on June 16 and beyond.

Bitcoin has crossed $ 30,000, the level of psychological support, and is currently above $ 34,000. However, an equally strong resistance level of $ 40,000 keeps the cryptocurrency’s short-term bearish bias intact. It is expected that the longer we remain without the handle of 40,000 dollars, in the end, the support will collapse and give way to a sudden movement towards 20,000 dollars.