EThereum positive moments

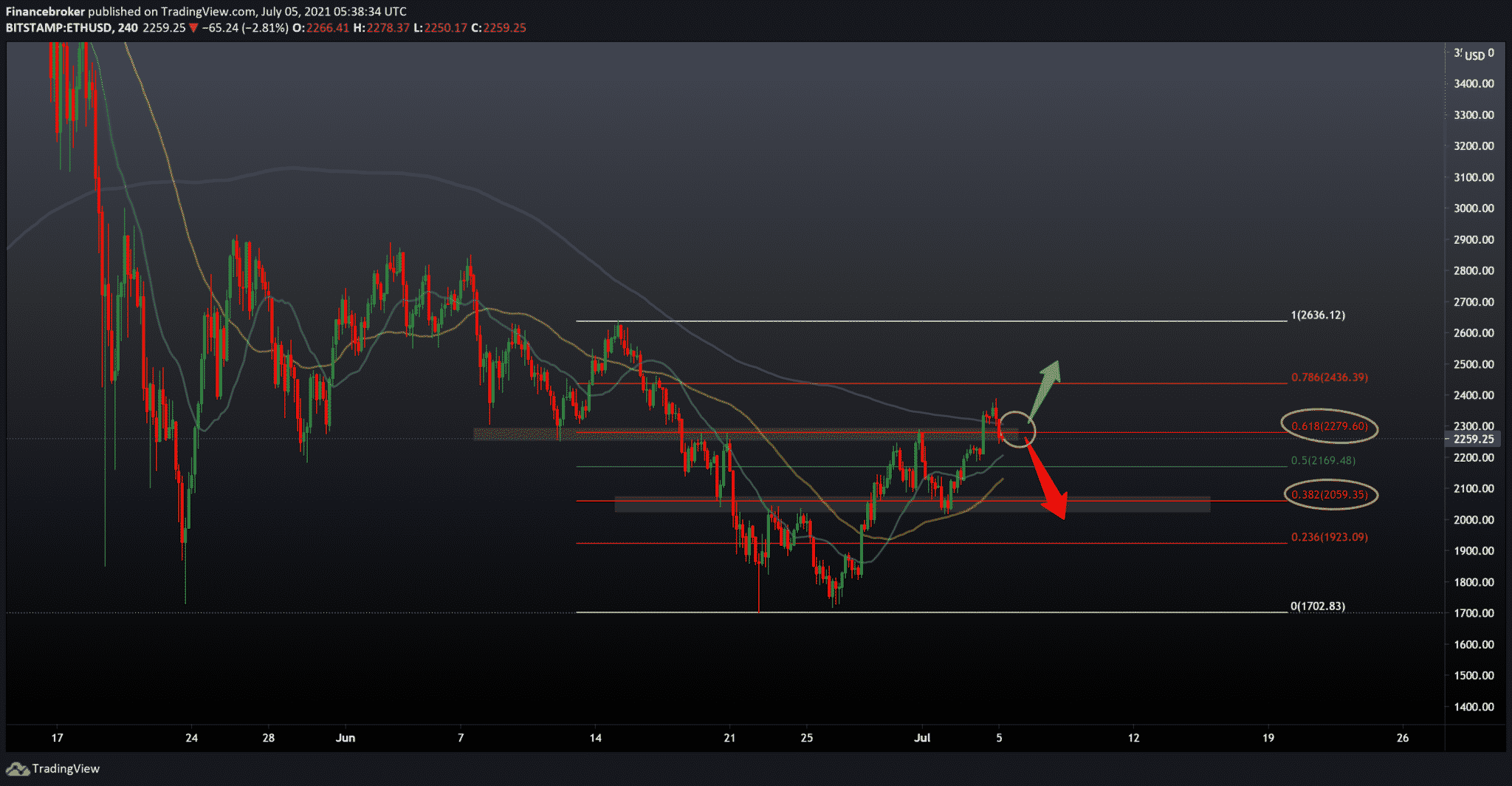

The stability of bitcoin prices and the prediction of major protocol upgrades stimulate investors’ appetite for ETH. The second-largest cryptocurrency by market capitalization reached its new high of $ 2,390 on Sunday. This is its highest reading since June 18. Ether’s $ 230 million option on Friday seems to have changed the mood in the market in favor of the bulls, at least for now. At the same time, investors remain cautiously optimistic about the upcoming London hard fork. Additionally, Bitcoin seems to have established a solid bottom.

ETH rose more than 6.5% on Sunday to $ 2,390, the highest in two weeks, according to Cointelegraph Markets Pro. The volume of trade during the weekend remained characteristically low and amounted to slightly more than 18 billion dollars. Ethereum a total market capitalization of $ 274.8 billion.

The DeFi market, mostly built on top of Ethereum, recorded a cumulative gain of 9% on Sunday

According to Coingecko, the total market value of DeFi coins is $ 67.3 billion.

The battle between the bulls and the bear was shown in the options market last month. Both camps were expecting extreme price fluctuations for Ether, which led to the expiration of options on Friday. As Cointelegraph reported, the price level of 2,200 dollars is where the bulls are starting to increase their advantage, as evidenced by the ratio of call options and options.

Ethereum’s London hard fork, which contains the long-awaited EIP 1559, was launched on Ropsten testnet on June 24, setting the stage for the full implementation of the home network later in July.

The hard fork is likely to positively impact Ether’s value thanks to several upgrades, including a move to an environmentally friendly consensus on proving stakes and a new feature that will reduce the number of tokens in circulation.

Analysts expect investors to increase exposure to ETH, leading to a hard fork. Data on the chain suggests that this is already happening because Ethereum registered over 750,000 active addresses last week, which significantly exceeded Bitcoin. Analytical firm Santiment, which provided this data, described the relocation of the active address as a very important event.